Kioxia: Fiscal 3Q19 Financial Results

Planning IPO in October

This is a Press Release edited by StorageNewsletter.com on March 4, 2020 at 2:22 pm| (in ¥ million) | 1FQ19 | 2Q19 | 3FQ19 |

9 mo. 19 |

| Revenue | 214.2 | 239.0 | 254.4 | 707.6 |

| Growth | NA | 12% | 6% |

NA |

| Net income (loss) | (95.2) | (56.0) | (25.3) | (176.5) |

Kioxia Holdings Corporation reports financial results for the three months ended December 31, 2019.

It is gradually increasing sales and diminishing net losses since last 3 quarters.

Yokkaichi plant power outage in June 2019 is no longer impacting operations.

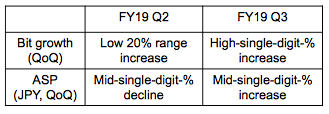

The firm was boosted by strength in memory for SSD and overall bit growth continues. ASPs trend moves positive on further improvement in supply and demand balance.

Despite global macroeconomic uncertainties, the industry is expecting memory demand to increase steadily, according to company, with the recovery of data center investment and the increasing penetration of 5G networks

Recent new products:

• 512GB automotive UFS (November 14, 2019)

• 3D semicircular flash memory cell structure Twin BiCS Flash (December 12, 2019)

• Developed fifth-gen 3D flash memory technology BiCS Flash (January 31, 2020)

Kioxia plans October IPO next October, market valuation reaching $32 billion to fill war chest for 5G era and to ramp up investment with eye on Samsung.

It will be the largest listing in terms of market capitalization since SoftBank Corp. went public in December 2018.

Read also:

Toshiba Memory Holdings Corporation (Kioxia): Fiscal 4Q18 Financial Results

Gigabyte shipments decreased due to reduction of 15nm NAND production, ASP continued to decline since late 2018

July 22, 2019 | Press Release

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter