Nutanix: Fiscal 2Q20 Financial Results

$218 million loss for revenue of $347 million up only 3% Y/Y

This is a Press Release edited by StorageNewsletter.com on February 27, 2020 at 2:29 pm| (in $ million) | 2Q19 | 2Q20 | 6 mo. 19 | 6 mo. 20 |

| Revenue | 335.4 | 346.8 | 648.6 | 661.5 |

| Growth | 3% | 2% | ||

| Net income (loss) | (122.8) | (217.6) | (217.0) | (446.9) |

- Delivers Record TCV Billings and Revenue as Company Continues Growth Amidst Faster Than Expected Subscription Transition

- Grows New Product Attach Rate to 31%, Up from 21% as of Q2 FY’19; Increases TCV Billings From New Products by 99% Y/Y

Nutanix, Inc. announced financial results for the second quarter of fiscal 2020 ended January 31, 2020.

2FQ20 Financial Highlights

• Revenue: $346.8 million, up from $335.4 million in 2FQ19 (1)

• Billings: $428.1 million, up from $413.4 million in 2FQ19 (1)

• Software and Support (TCV) (2) Revenue: $338.2 million, up 14% Y/Y from $297.4 million in 2FQ19 (1)

• Software and Support (TCV) (2) Billings: $419.5 million, up 12% Y/Y from $375.5 million in 2FQ19 (1)

• Gross Margin: GAAP gross margin of 78.3%, up from 74.4% in 2FQ19; Non-GAAP gross margin of 81.4%, up from 76.8% in 2FQ19

• Net Loss: GAAP net loss of $217.6 million, compared to a GAAP net loss of $122.8 million in 2FQ19; Non-GAAP net loss of $116.3 million, compared to a non-GAAP net loss of $40.4 million in 2FQ19

• Net Loss Per Share: GAAP net loss per share of $1.13, compared to a GAAP net loss per share of $0.68 in 2FQ19; Non-GAAP net loss per share of $0.60, compared to a non-GAAP net loss per share of $0.23 in 2FQ19

• Cash and Short-term Investments: $819.0 million, compared to $965.9 million in 2FQ19

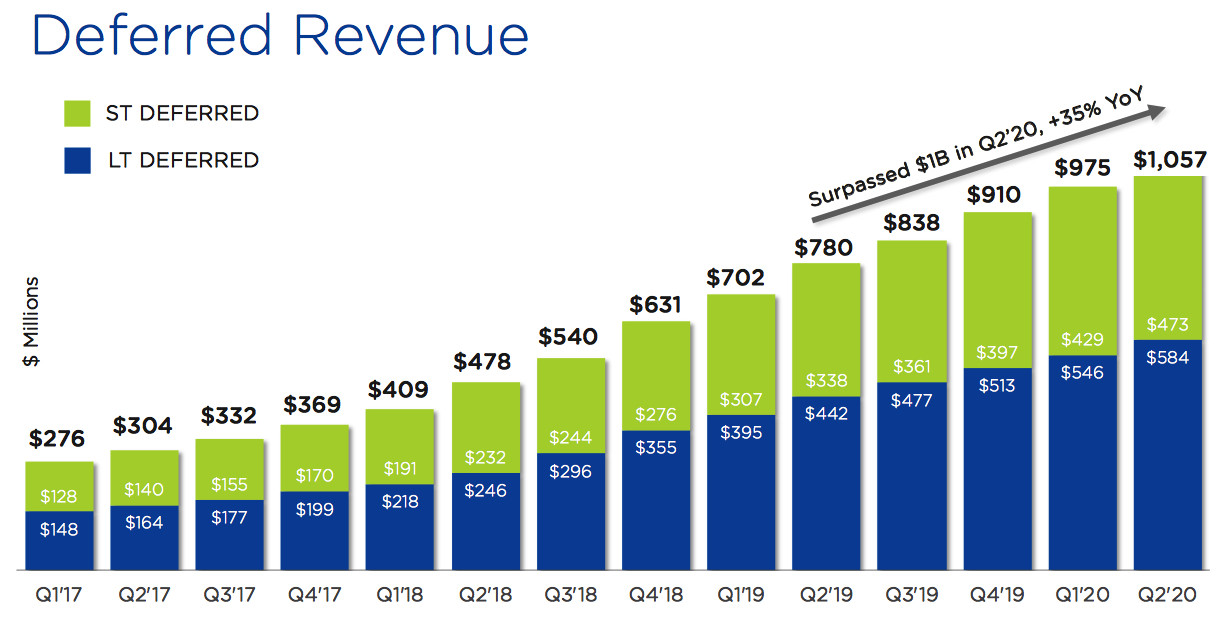

• Deferred Revenue: $1.06 billion, up 35% from 2FQ19

• Operating Cash Flow: Use of $52.5 million, compared to gen of $38.5 million in 2FQ19

• Free Cash Flow: Use of $73.7 million, compared to use of $4.1 million in 2FQ19

“Our solutions-based approach to our go-to-market strategy is helping customers realize the benefits and power of our new products in conjunction with our core software. As a result, we increased the attach rate of our new products to 31%, up from 21% as of 2FQ19,” said Dheeraj Pandey, chairman, co-founder and CEO. “We were also pleased with several other key drivers of growth for our business in the quarter, including our partnership with HPE and traction in the US commercial segment.”

“We saw strong momentum in the shift of our business towards subscription. In 2FQ20, 79% of billings came from subscription, surpassing our stated goal of 75% by the end of the fiscal year and well ahead of our internal plan, while still delivering on our guidance for top line growth,” said Duston Williams, CFO. “Looking forward, the change in our fiscal 2020 TCV guidance is driven by two factors – first, a much faster than expected shift to subscription, coupled with a more cautious view on business activities in the greater APJ region due to the anticipated impact of the coronavirus.”

Recent company Highlights

• Reached 79% of Billings From Subscription, Well Ahead of Plan: It continued its transition to a subscription-based revenue model, outperforming its internal expectations, with subscription billings up 45% Y/Y to $339 million, representing 79% of total billings, and subscription revenue up 69% Y/Y to $267 million, representing 77% of total revenue.

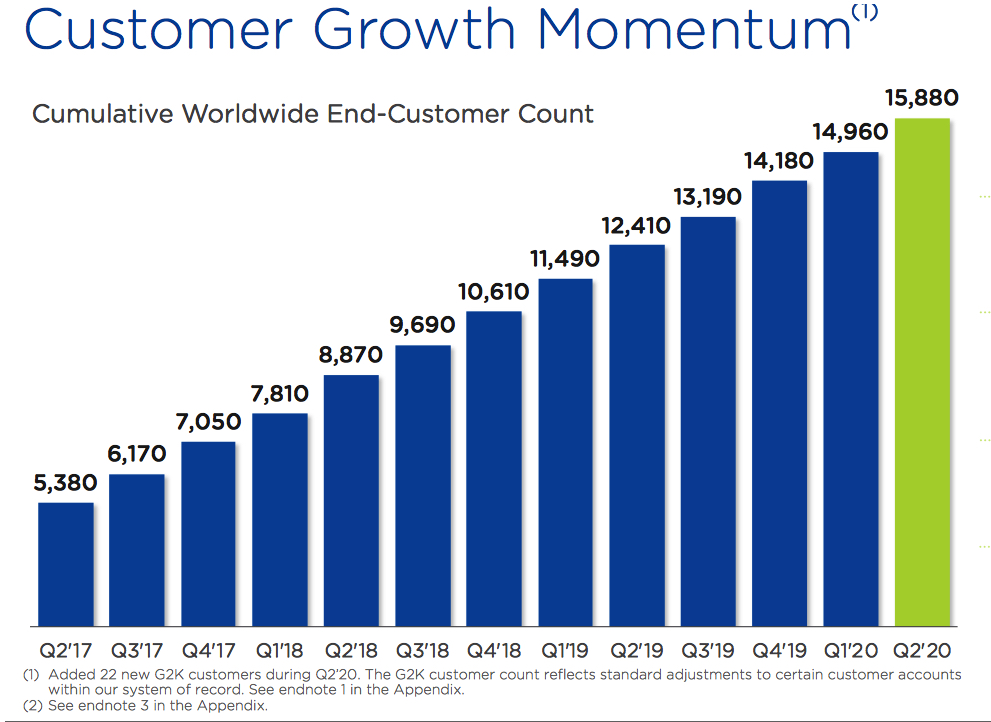

• Expanded Customer Base: Nutanix added 920 new customers in the quarter, bringing total customers to 15,880. Second quarter customer wins included Banco Azteca, Caesars Entertainment, Dole Philippines, Inc., Dunn-Edwards Corporation, HARDIS GROUP and Purdue University.

• Refined Solution-Selling Drove New Product Adoption: 31%3 of deals included at least one product outside of the company’s core HCI offering, up from 21% (3) in 2FQ19. Notably, TCV billings from new products reached a record high, growing 99% Y/Y.

• Introduced Karbon 2.0: The company announced the availability of Karbon 2.0, which simplifies the configuration, deployment and lifecycle management of Kubernetes clusters, bringing the simplicity of Kubernetes in the public cloud to the on-prem environment. Built on top of its core software, Karbon delivers a full cloud native environment to the datacenter.

• Launched availability of Nutanix Mine: During the quarter the company announced the GA of Nutanix Mine, an integrated data protection solution, allowing customers to experience the advanced data management of Nutanix HCI software along with the backup and replication solutions from Veeam and HYCU.

• Appointed New WW Sales Leader: The firmm recently announced the promotion of Chris Kaddaras to EVP of WW sales. He brings his track record of leading sales for Nutanix in the Americas and international markets to his new role.

• Named a Leader in Gartner Magic Quadrant for Hyper Converged Infrastructure (4): Gartner named the company as a leader in its November 2019 Magic Quadrant for HCI for the third time in a row, with the firm positioned highest for ability to execute, even during a significant business model change.

• Attained Champion Status in Canalys EMEA Channel Leadership Matrix: It achieved Champion status in calendar 2019 from Canalys EMEA, and was the highest-ranked hyperconverged infrastructure company in channel management throughout EMEA in their published report.

• Announced Nutanix Software is Now Optimized to Run on Epic: HCI software is able to host all Epic infrastructure components, including production databases. Epic Systems is one of the largest providers of health information technology in the US and Nutanix is currently the number one deployed HCI solution within the Epic community.

• Named One of the Fortune 100 Best Companies to Work For by Great Place to Work and Fortune: In mid-February the company announced its inclusion in the coveted 2020 Fortune 100 Best Companies to Work list, taking the 84th spot. Predominantly based on employee feedback, the list evaluates over 60 different elements of employee work experiences.

3FQ20 and FY20 Financial Outlook

TCV guidance for both the 3FQ20 and FY20 is impacted by the much faster than expected transition to subscription coupled with a more cautious view on business activities in the greater APJ region due to the anticipated impact of the coronavirus.

For 3FQ20, Nutanix expects:

• Software and support (TCV) billings between $365 million and $385 million;

• Software and support (TCV) revenue between $300 million and $320 million;

• Non-GAAP gross margin of approximately 80%;

• Non-GAAP operating expenses between $420 million and $430 million; and

• Non-GAAP net loss per share of approximately $0.89, using approximately 196 million weighted shares outstanding.

For FY20, the company updates its guidance:

• Software and support (TCV) billings between $1.60 billion and $1.67 billion;

• Software and support (TCV) revenue between $1.29 billion and $1.36 billion;

• Non-GAAP gross margin of approximately 80.5%; and

• Non-GAAP operating expenses between $1.63 billion and $1.65 billion.

(1) Reflects total billings/revenue compression from the company’s ongoing transition to subscription and the significant reduction of hardware billings/revenue.

(2) TCV, or Total Contract Value, for any given period is defined as the total software and support revenue or total software and support billings, as applicable, during such period, which excludes revenue and billings associated with pass-through hardware sales during the period.

(3) Based on a rolling four-quarter average.

(4) Gartner, Inc, Magic Quadrant for Hyperconverged Infrastructure, Jeffrey Hewitt, Philip Dawson, Julia Palmer, John McArthur, November 25, 2019.

Comments

Since 4 financial quarters, Y/Y revenue is flat for the company yet in growing WW HCI market: +0%, -1% and +0% and +3% for the last three-month periods in order respectively, with losses never ending and reaching even $218 million for the most recent quarter. But is expects better results for next 6-month period.

Based on the midpoint of 3FQ20 guidance and implied 4FQ20 guidance, the company anticipates that the Y/Y growth rate will accelerate to approximately 10% in 3FQ20, and 25% in 4FQ20.

Subscription billings increased and now account for 79% of total billings up from 73% in 1FQ20. And subscription revenue now accounts for 77% of total revenue, up from 69% in 1FQ20.

The firm wants to move forward through its subscription transition as fast as possible as made progress on this goal in the quarter. Execution in this area exceeded expectations in 2FQ20 surpassing 4FQ20 goal of 75% and almost equaling its stated CY21 goal of 80% mentioned at least year's Investor Day.

The average dollar weighted term length in 2FQ20 including renewals was 3.9 years flat with the 3.9 years reported in 1FQ20.

The TCV billings were negatively impacted by approximately $5 million due to the faster than expected shift to subscription. ACV booked in the quarter was $130 million and was up 18% from the year ago quarter.

TCV revenue or software and support revenue for 2FQ20 exceeded guidance range of $330 million to $335 million coming in at $338 million up from 14% a year ago and up 11% from the previous quarter. TCV billings, firm's software and support billings were $420 million vs. guidance of $410 million to $420 million up 12% from the year ago quarter and up 13% from the prior quarter.

TCV bookings, its software and support bookings from international regions represent 49% of total bookings vs. the same 49% in 2FQ19.

New customers bookings represent 24% of total bookings in 2FQ20 vs. 26% in 2FQ19 and up from 23% in 1FQ20.

HPE DX related business continued its performance and accounted for 117 new customers.

Nutanix has 220 accounts that have each spent more than $4 million lifetime spend, accounting for more than $2 billion lifetime and this cohort has grown nearly 50% Y/Y.

Specifically in 2FQ20, it closed 52 deals worth over $1 million in the quarter including 11 deals worth over $3 million which includes 3 deals over $5 million. 11 of these customers also spend at least $1 million with the company last quarter and more than half substantially increase their node count with the firm during the quarter.

Nutanix saw a solid quarter in terms of new customers, but estimates that it could do better. 920 new customers rated total customer count to 15,880.

It saw continued momentum in the adoption of new products in the quarter 31% of deals on a rolling four quarter basis included at least one product outside of the company's HCI offering up from 21% in 2FQ19. In addition, TCV billings from new products reached to record high in the quarter growing 99% Y/Y.

The firm is recently taking a pause on a significant portion of its planned headcount in 2FH20, contributing to $20 million to $50 million expense reduction from previous guidance range

Cautious APJ view also includes Japan, which generally operates under a March fiscal year end period. The company has a few large deals pending in Japan, and which it assumes a reduced portion will close in 3FQ20. Based on its current outlook, both the Americas and EMEA region seem to be in a good position to deliver their expected results for 2FH20.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter