History (1991): Flat Revenue for Half-Inch Tape Drive Market – Freeman

Migration from half-inch reels to cartridges

By Jean Jacques Maleval | February 20, 2020 at 2:18 pm“High-end cartridge drives will dominate the half-inch tape drive market by 1992,” declare Robert C. Abraham and Raymond C. Freemen, Jr., authors of the newly-completed Freeman Report, Computer Tape Outlook – Half Inch Products (270 pages, $1,695).

“Performance enhancements, such as the recent introduction of 36-track models by IBM, and widespread acceptance of compatible low-cost models will accelerate the already strong migration from half-inch reels to cartridges,” the authors contend.

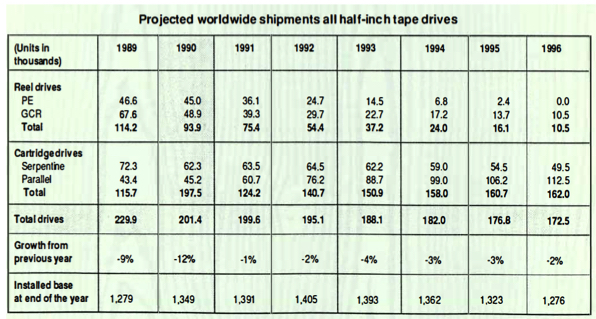

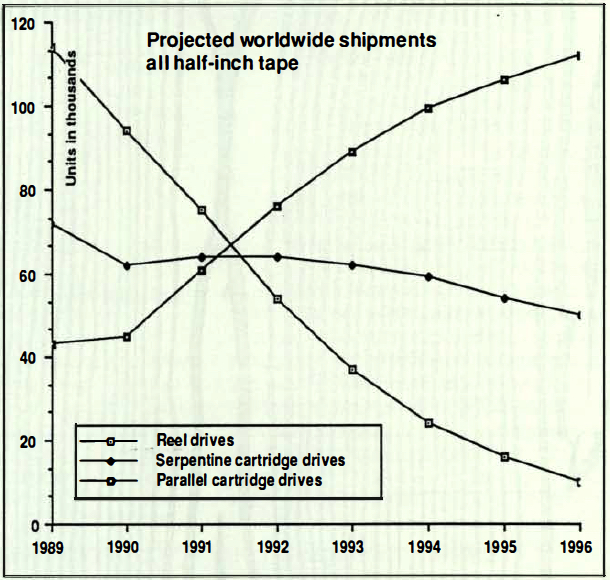

Reel drives will account for only 6% of half-inch tape drives shipped in 1996, and only 4% of revenue. Demand for 18 and 36-track parallel-recording tape subsystems will grow from 45,000 drives in 1990 to 112,000 drives in 1996, a CAGR of 16%.

Demand for much-lower-cost serpentine cartridge devices will exhibit moderate growth through 1992 before starting to roll off. PE and GCR reel segments of the half-inch tape market will continue to wane, with several classes ceasing to exist by 1996.

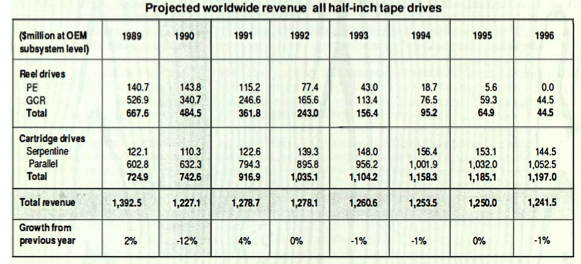

Freeman Associates predicts the WW market for all types of half-inch cartridge tape subsystems will reach $1.2 billion at OEM price levels in 1996, a CAGR of 8% from the $743 million value in 1990.

Unit shipments of these drives will grow at a 7% rate over that 6-year period, from 107,000 transports in 1990 to 162,000 in 1996.

The report analyzes the important role of low-cost IBM-compatible cartridge subsystems, such as those already available from Cipher, Fujitsu, Laser Magnetic Storage, and Storage Technology.

These drives, comprising the fastest growing half-inch tape class, are targeted at OEM accounts and can read and write tapes compatible with IBM 3480/3490 mainframe tape subsystems. Not intended as replacements for mainframe drives, these devices extend the use of parallel-recorded half-inch cartridges to smaller, lower-cost systems and stimulate use of the cartridges for data interchange.

Shipments of these new products will swell from 4,200 units in 1990 to 53,500 units in 1996, an annual growth rate of 53%. Revenue will surge from $46 million to $267 million over the same 6-year period, an annual rate of 34%.

High-end parallel recording cartridge drives, principally IBM 3490 and compatible 18 and 36-track devices, will continue to serve the mainframe market. Shipments will grow at a 6% rate, from 41,000 transports in 1990 to 59,000 in 1996. Adjusting for price erosion and later introduction of higher-performance models, revenue for these subsystems will grow from $586 million to $785 million, a 5% growth rate. These revenue figure are the highest of any half-inch tape products class.

“Shipments of low-cost serpentine recorded cartridge drives peaked at 72,000 units in 1989, dipped to 62,000 units in 1990 before rising slightly, finally declining to 49,000 units in 1996,” Freeman predicts. “This lackluster performance is partly the result of product delays and partly due to availability of newer low-end and mid-range devices products. “

The revenue growth rate for serpentine products is estimated to be 5% at OEM levels for the 6-year period, rising from $110 million in 1990 to $144 million in 1996 after peaking at $156 million in 1994. The longer duration of revenue growth reflects a change in mix to higher-performance higher-cost products.

“Sales of half-inch reel-to-reel magnetic tape drives peaked in 1986. The last survivor in the reel market will be low-cost GCR drives, comprising 100% of shipments of reel drives by 1996,” claims Abraham.

All other categories of reel drives are forecast to continue to subside and then terminate production du ring the 6-year forecast period. Shipments of all GCR drives will drop from a peak of 71,000 in 1988 to 48,000 in 1990, then to 10,000 in 1996. Across the 6-year period starting in 1990, this represents a 23% annual rate of decline.

This article is an abstract of news published on the former paper version of Computer Data Storage Newsletter on issue ≠41, published on June 1991.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter