Manufacturing Operations of China-Based DRAM and NAND Flash not Affected by COVID-19

It's the case for Samsung's Xi'an fab, SK Hynix's Wuxi fab, YMTC, CXMT and JHICC.

This is a Press Release edited by StorageNewsletter.com on February 19, 2020 at 2:23 pmThe following analysis shows TrendForce, Inc.‘s investigations of key component and other downstream technology industries, under the impact of the COVID-19 outbreak, with the latest data as of February 14, 2020.

Semiconductors

Compared to the OSAT industry, the foundry industry has a much higher degree of fab automation and thus is less impacted by the outbreak. But because most workers at semiconductor manufacturing sites in China come from out of town, labor shortages and traffic restrictions will lower work resumption rates at foundries more than expected. In the short term, fab utilization rates may not make a full recovery. As a result, given that the outbreak has not yet been effectively contained, TrendForce is projecting a possible decline in shipment for the Chinese foundry industry in 1Q20, in turn affecting downstream Chinese OSAT companies. The industry’s overall performance recovery remains to be seen. The fabless operations of IC design lead to less demand on direct labor, compared to foundries and OSAT companies; consequently, the IC design industry has not been as affected by the outbreak as other semiconductor industries. Also, in recent years EDA companies and foundries have been expanding their cloud-based design and verification environments; through these cloud-based environments, IC designers may be able to compensate for operational and output deficiencies involved in having their employees work from home. Whether they are successful in doing so depends on the IC designers’ magnitude of capital expenditure and degree of integration for cloud services.

Memory Products

On the supply side, manufacturing operations of China-based DRAM and NAND flash production bases, such as Samsung’s Xi’an fab, SK Hynix’s Wuxi fab, YMTC, CXMT, and JHICC, are not affected by the outbreak, since semiconductor fabs are highly automated, with very low demands for manpower. In addition, companies stocked up on materials before Chinese New year, enough to avoid shortages in the short term. As long as additional materials that need to be imported can pass through customs as usual, the outbreak should not cause any problems for the DRAM and NAND flash industry. Finally, with regards to shipping, all semiconductor fabs in China hold national special licenses, which allow them to ship their products throughout domestic China, even as cities are under quarantine. From a global perspective, memory product suppliers do not reduce their manufacturing operations unless a global systems-wide risk were to occur. Furthermore, as client-side inventories are still showing shortages, the purchasing momentum of memory products will continue to hold up despite problems of labor and material shortages faced by downstream clients. Therefore, 1Q20 DRAM prices will continue its uptrend in spite of the outbreak. On the demand side, the COVID-19 outbreak has not currently caused any obvious impact on overall server shipment, with only a possible two-week delay in PCB supply. Even so, because manufacturers already prepared extra inventory before Chinese New Year, the delay in PCB supply will cause limited impact on server shipment. Notably, the Chinese data center industry has benefitted from the outbreak. For instance, Tencent’s server demand grew due to the rising need of distance education, while ByteDance also saw increased server demand because of the increased usage of its web apps.

Panels

Panel makers are currently maintaining maximum wafer input for front-end arrays. However, back-end module houses, downstream brands, and ODMs face great manufacturing uncertainties because of the coronavirus outbreak. First, most manufacturers in Chinese cities originally planned for a February 10 work resumption date; however, as the outbreak shows no signs of slowdown, and more and more cities are now under closed-off management, the actual state of work resumption remains unpredictable. Second, even if work is to be resumed, the outbreak has severely affected domestic traffic and logistics. The impact is expected to cause difficulties in the transport of key components and labor force. In terms of panel prices, we predict TV panels to continue the uptrend which began in January. But panel prices for monitors and notebooks face many uncertainties. In February, their quote prices are expected to stay flat as that in January. The future prices will depend on how the situation develops after the work is resumed in the second half of February.

Telecommunications

1. Optical Communications Industry

The largest concentration of the fiber optics supply chain can be found in Wuhan, home to Fiberhome, YOFC, and Accelink, among other companies, which together comprise 25% of the global optical fiber production capacity. 5G base stations place higher demand in both the quantity and quality of optical fiber cables, with 5G optical fiber demand estimated at double that of 4G. Since the supply of optical fibers is disrupted by the recent citywide quarantine in Wuhan and the subsequent work stoppage, China’s 5G development schedule may be indirectly affected.

2. IoT Industry

The supply of IoT products remains unaffected in the short run because major Chinese manufacturers, such as Huawei, have already resumed operations and because each link in the IoT supply chain is highly substitutable. But if the outbreak persists, parts of the industry will still be affected. For instance, R&D operations at Xiaomi and Mediatek have been suspended, causing a delay in the release of new products. Video surveillance companies Hikvision and Dahua Technology are shifting more production capacity to thermometer manufacturing. It remains to be seen whether their video surveillance capacities will become constricted owing to the outbreak, forcing the two companies to redirect existing orders elsewhere. Finally, since the development of NB-IoT in China hinges on the collaboration between government and industry, large-scale expansion efforts will be hindered if officials continue to implement closed-off management in the manufacturing regions.

3. 5G Industry

Most Chinese telecommunications bids, including 5G infrastructure construction and application demonstration purchasing agreements, have been postponed. On the other hand, suppliers of key components for 5G base stations, such as PCB and optical fibers, are mostly based in Wuhan and other regions in Hubei; given that Wuhan is the epicenter of COVID-19, the outbreak is expected to negatively affect the 5G supply chain somewhat. The delay in 5G infrastructure build-out, limited smartphone replacement demand, and postponed work resumption at fabs will collectively decrease the shipment of Chinese 5G smartphones.

Green Energy

1. LED

In terms of the upstream substrate, chip to downstream packaging sector, because the number of LED manufacturers in Wuhan and Hubei core affected areas is limited, only a few manufacturers affected; the LED manufacturers in other parts of China were constrained by the slow pace of the resumption of work, and they may be unable to return to full production in the short term. Overall, the LED industry has been oversupplied since 2019, and there has been inventory for sale, so the short-term impact will be small. The medium to long term will depend on the condition of resumption of work. In addition, the LED packaging industry chain is mainly distributed in Guangdong Province and Jiangxi Province. Although they are not the center of the epidemic, because their manpower demand is large and most of the employees come from the expatriate population all over China, if the medium- and long-term problem of labor shortages is not resolved, the impact will be more severe. As for the demand side, various operators have begun to stock up orders in advance and increase the inventory level, thus pushing up a wave of stock demand. Each production link will decide whether to raise the price in response according to each supply status.

2. Lithium-Ion Batteries

In terms of the main lithium-ion battery applications, the production of power battery cell and non-battery cell components diversifies and mostly comes from Japan, Korea and the US, which was less affected by the outbreak in China. For IT applications, the industry chain is highly concentrated in China, so they have been most affected by the outbreak so far.

3. Photovoltaics

The supply of key equipment such as modules and inverters will suffer the most damage from the coronavirus outbreak. Many raw materials involved in module production, namely, silicon wafers and other auxiliary materials, such as EVA, aluminum frames, and glass, are sourced from the Chinese supply chain, which is now constrained by both logistical problems and work resumption delays. Taiwanese manufacturers’ stockpile of raw materials from pre-Chinese New Year is expected to last until the end of February, at best. Whereas some manufacturers can rely on their factories in Southeast Asia for module and inverter production, manufacturers without such an option must look to other means of production and adapt to market situations accordingly. Should the projects overseas be bound by deadlines for grid-connections, it is inevitable that they will be delayed due to supply shortage. This is due to suppliers’ temporary inability to maximize the manufacturing capacity in each link of the PV supply chain as well as the significant reduction in the volume of transportation and logistics services. For example, the projects in the Chinese and U.S. markets must be completed before the grid-connection deadline, which is the end of March. However, the projects in the European market are not required to complete the installation by the first quarter. Judging from the current situation, all grid-connection projects will be postponed to 3Q20.

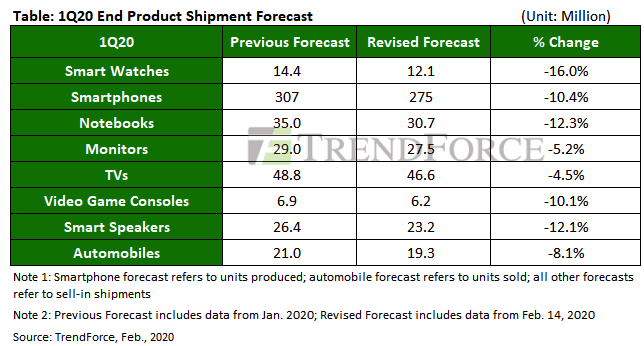

Consumer Electronics and Automobiles

1. Wearables

Product assembly of smart watches, smart bracelets, and TWS Bluetooth earphones primarily takes place in Guangdong, Jiangsu, and Zhejiang. In spite of the projected mid-February work resumption date, work stoppages, labor shortages, and material shortages can bring about a decline in 1Q20 production volume, with deferred releases of new products originally scheduled for 1H20 release. But on the whole, peak sales season for wearable devices happens in 2H20, during which market-leading devices such as Apple Watch will be released. Given that the outbreak does not persist in 2Q20, TrendForce remains neutral to slightly optimistic about this year’s shipment of wearable devices worldwide. In terms of the Chinese market, Chinese-branded wearables are mainly aimed at domestic sales and therefore expected to suffer more losses in 1H20 compared to international brands. In particular, competitive-priced generic brands and new brands may be even more affected by the outbreak because component suppliers and production capacities are prioritized to fulfill orders from established brands first, and consumers will have reduced willingness to buy in the short term.

2. Smartphones

The outbreak has made a relatively high impact on the smartphone industry because the smartphone supply chain is highly labor-intensive. 1Q20 smartphone production is projected to decline by 12% Y/Y, making it the quarter with the lowest output within the past five years. Parts in the upstream supply chain, including passive components and camera modules, are also showing shortages, which can potentially continue to negatively affect smartphone production in 2Q20, if the outbreak is not contained by the end of February. Should the outbreak intensify, TrendForce considers market need to be the most important consideration in the long-term analysis of the smartphone industry. Because of the interconnectedness of the global economy, the progression of China’s outbreak damages not only China’s GDP, but also the overall global economy, leading to a reduction of consumer purchasing power and subsequently presenting a difficult challenge for the overall smartphone industry. 2020 smartphone production is projected to reach 1.381 billion units, a 1.3% decline Y/Y and the lowest output since 2016. Still, due to the outbreak’s mercurial nature, it is entirely possible for 2020 smartphone production to fall below this forecast.

3. Notebooks, LCD monitors, and LCD TVs

The downstream ODMs and brands in the supply chain are undoubtedly hit the most by the coronavirus outbreak. These companies lost precious working days after work resumption was postponed. After their production is resumed, on a whole, operators’ work resumption rate is low. Besides, all types of materials and components are in shortage. Hence, productivity plummets. For TVs and monitors, their manufacturing processes and demand for materials are similar. Therefore, according to TrendForce, in 1Q20, the TV set shipment is predicted to fall from previous prediction (48.8 million units) to 46.6 million units because of the outbreak. The monitor set shipment is projected to decrease from previous prediction (29 million units) to 27.5 million units. To assemble a NB set requires complicated key components. At the current stage, NB’s batteries, hinge, and PCB already experienced shortage or out of stock. This factor might cause some brands’ shipment quantity to remarkably drop from previous prediction (35 million units) to 30.7 million units in 1Q20. The pandemic not only negatively affected the production’s supply chain, but it also hurts China’s consumer confidence and reduces end-market demand in the short and long run, respectively. Considering the pestilence’s potentially negative impact to China market’s demand, TrendForce moved down the top 3 application categories’ shipment scales for the year 2020. TVs’ shipment scale was reduced from previous prediction (219.6 million units) to 218.0 million units, down by 0.7%age point. Monitors’ shipment was reduced from previous prediction (125.8 million units) to 124.5 million units, down by 1.0 percentage point. Notebooks’ shipment was moved down from previous prediction (162.4 million units) to 160.2 million units, down by 1.4% percentage points.

4. Video Game Consoles

The bulk of console assembly happens in China, with only a few processes done abroad. Consequently, domestic labor and material shortages have severely impaired console manufacturing. However, the majority of console sales occurs in 4Q, meaning peak season manufacturing for the console supply chain will take place in 2H20. Thus, 1Q is a weak season for sales. Assuming the overall industrial impact of the COVID-19 outbreak can be fully addressed by the end of March, then losses in the supply chain can be offset in 2Q20, thereby limiting the impact on console supplies. 2019 sales of Sony’s PS4 and Microsoft’s Xbox One plummeted due to consumer anticipation of year-end next-gen console releases. Reduced demand means less likelihood for the outbreak to result in inventory shortages. At the same time, manufacturing of next-gen consoles will not start until 2Q20. Therefore, new consoles will release on schedule, unless the outbreak persists. Ultimately, COVID-19’s impact on the 2020 video game industry is, at most, mild.

5. Smart Speakers

The supply chain of smart speaker assembly is spread throughout Chongqing, Jiangzhe, Beijing, Shanghai, and Guangdong – all of which are currently under closed-off management; personnel entering and leaving the areas are strictly monitored. Under the closed-off management and in spite of some manufacturers’ work resumption on February 10, neither personnel nor goods and services can be freely transported as of now. As such, smart speaker manufacturers are seeing reduced rate and degree of capacity recovery. Labor and material shortages are projected to extend the traditionally weak season owing to reduced output during Chinese New Year, in turn weakening 1Q20 smart speaker shipment numbers.

6. Automobiles

The COVID-19 outbreak resulted in decreased supply and demand in the Chinese automotive market, whereas work stoppages at Chinese component factories caused material shortages for overseas automakers. The two primary difficulties facing suppliers in the Chinese auto market are work stoppages and uncertain work resumption dates. These problems are, however, eclipsed by decreased demand. Because the car-buying process is long and takes many trips to and from the dealer, once buyers are unwilling to visit dealers in person, sales will become virtually impossible. 1Q20 car sales in the Chinese market are projected to decline by 25-30% Y/Y. Potential unavailability of materials remains the greatest risk factor directly impacting the auto industry. Although automakers can compensate for material shortage through overseas factories, the process of capacity expansion and shipping of goods is still expected to create gaps in the overall manufacturing process. TrendForce believes that overseas automakers’ supply shortage will briefly impact market demand; however, after accounting for all market segments, It is expected that the 1Q20 global auto market to suffer a 14% decline Y/Y – the largest decline in recent years.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter