NetApp: Fiscal 3Q20 Financial Results

Company shrinking with sales down 10% Q/Q and also 10% expected for FY20

This is a Press Release edited by StorageNewsletter.com on February 13, 2020 at 2:21 pm| (in $ million) | 3Q19 | 3Q20 | 9 mo. 19 | 9 mo. 20 |

| Revenue | 1,563 | 1,404 | 4,554 | 4,011 |

| Growth | -10% | -12% | ||

| Net income (loss) | 249 | 249 | 773 | 623 |

• AFA annualized net revenue run rate of $2.3 billion increased 7% Q/Q

• Cloud data services annualized recurring revenue of $83 million, an increase of 146% Y/Y

• Consolidated GAAP gross margin of 67.0%, non-GAAP gross margin of 67.8% (company had no ELA revenue in Q3)

• $420 million in cash from operations; $388 million in free cash flow

• $608 million returned to shareholders in share repurchases and cash dividends

NetApp, Inc. reported financial results for 3FQ20, which ended on January 24, 2020.

“Our third quarter results, highlighted by strong gross margins, cash flow and operating leverage, reflect our continued operational discipline. Customers are on a journey to the cloud and are looking to NetApp to help them address the complexities of data management in hybrid multicloud,” said George Kurian, CEO. “We see significant opportunity ahead and are focused on replicating the areas where we have proven success. Our strong business model enables us to navigate the market dynamics, while making the strategic investments necessary to position the company for long-term growth.”

3FQ20 Financial Results

• Net Revenues: $1.40 billion, compared to $1.56 billion in 3FQ19

• Net Income: GAAP net income of $277 million, compared to GAAP net income of $249 million in 3FQ19; non-GAAP net income1 of $265 million, compared to non-GAAP net income of $305 million in 3FQ19

• Earnings per Share: GAAP net income per share2 of $1.21 compared to GAAP net income per share of $0.98 in 3FQ19; non-GAAP net income per share of $1.16, compared to non-GAAP net income per share of $1.20 in 3FQ19

• Cash, Cash Equivalents and Investments: $3.0 billion at the end of 3FQ20

• Cash Provided by Operations: $420 million, compared to $451 million in 3FQ19

• Share Repurchase and Dividend: Returned $608 million to shareholders through share repurchases and cash dividends

Organizational Update

Ron Pasek, EVP, CFO, has informed his intent to retire by the end of the FY20 after a 4-year tenure. He will remain on to ensure a transition to his successor, which the company expects to name prior to the end of FY20. he joined in April 2016, assuming leadership of the company’s finance, customer leasing, workplace resources, internal audit, and IT functions. “Ron has been an integral part of the NetApp executive leadership team. He has helped increase product margins by 10 points, nearly doubled our earnings power and raised our dividend by over 100%,” said Kurian. “We are grateful for Ron’s achievements at NetApp and wish him well in his future endeavors.”

4FQ20 Financial Outlook: Net revenues are expected to be in the range of $1.455 billion to $1.605 billion

FY20 Financial Outlook: Net revenues are expected to decline approximately 10% Y/Y

Dividend

Next cash dividend of $0.48 per share to be paid on April 22, 2020, to shareholders of record as of the close of business on April 3, 2020.

3FQ2020 Business Highlights

Delivering Innovations

• Announced its reinvention of the customer experience with the NetApp Keystone program which offers a range of flexible solutions for customers, whether they choose to build or to buy their cloud infrastructure, on or off their premises.

• To meet the increasing demand for object storage, announced StorageGRID enhancements: StorageGRID 11.3 software, SGF6024 all-flash appliance, SG6060 expansion appliance, SG1000 service appliance, and StorageGRID tiering to Azure Blob storage.

• Cloud Manager 3.7.5 (formerly OnCommand Cloud Manager) offers new features and tighter integration with the NetApp cloud portfolio which enables customers to get more out of their data.

• Enhanced NetApp Cloud Volumes ONTAP for AWS with new NetApp Cloud Backup Service, the new NetApp Cloud Compliance service, and the ability to leverage NVMe flash available on virtual compute instances.

• Expanded its multiprotocol file services to encompass NFSv4.1, NFSv3, and SMB for both Azure NetApp Files and NetApp Cloud Volumes Service for AWS. With this expansion, the firm now delivers a wide range of support for Windows and Linux workloads.

• Introduced new storage systems: the A400 end-to-end NVMe all-flash system, the FAS8700 high-end hybrid flash array, and the FAS8300 next-gen midrange hybrid flash array.

• ONTAP 9.7 offers expanded integration of hybrid cloud, with seamless and efficient migration of tiered data between private and public clouds by using FabricPool, symmetric active-active host-to-LUN access, and extended scale-out NAS deployments.

• Three new features for Cloud Insights were announced, including Kubernetes Topology Visualization, NetApp Cloud Secure Insider Threat Detection, and NetApp Active IQ Integration.

• Active IQ Unified Manager 9.7 (formerly OnCommand Unified Manager) delivers enhanced simplicity, automation, active management, and virtualization layer monitoring and reporting, along with strengthened dark site support.

• With the release of ONTAP Select 9.7, introduced support for software RAID configurations backed by NVMe drives.

• Announced that NFS-based NetApp Cloud Volumes has been added to its cloud services offerings on premises in preview mode.

Growing Partnerships and Awards

• NetApp and Google Cloud announced an expanded partnership, including the availability of NetApp Cloud Volumes ONTAP and Cloud Volumes Service for Google Cloud. The expansion also includes the availability of Cloud Volumes Service in the UK region and support for Anthos on Cloud Volumes ONTAP, Cloud Volumes Service, and NetApp HCI.

• Enterprise Networking Solutions, Inc. (ENS-Inc.) was granted a 3-year contract by the State of California Department of General Services to deliver NetApp data center modernization and hybrid cloud infrastructure solutions to the State of California.

• With NVIDIA unveiled the NVIDIA DGX SuperPOD, which helps simplify supercomputing and enables AI for HPC teams. The two companies also announced their collaboration on the NVIDIA Magnum IO, a multi-GPU, multinode networking and storage I/O optimization stack.

• Was named a leader of Scale-Out NAS (File-Based Storage) in the IDC MarketScape: Worldwide Scale-Out File-Based Storage 2019 Vendor Assessment.

• Was again named a leader in object storage in the IDC MarketScape: Worldwide Object-Based Storage 2019 Vendor Assessment.

Executive Team Growing

• Appointed James Whitemore as the company’s SVP and CMO, reporting to Kurian.

• Appointed Kim Stevenson as SVP and GM of the NetApp Foundational Data Services business unit, reporting to Brad Anderson.

Comments

As for other big storage companies, AFA is the only business growing following start-up's acquisition for all of them, and amidst a fierce competition. Run rate is here $2.3 billion or +7% Q/Q for NetApp including FAS, EF and SolidFire products and services and the company saw almost no degradation in product margins as a result of increased NAND pricing.

Quarterly global revenue at $1,404 is at the low end of the guidance and decreasing sharply (-3%, -16%, -10%, -10% for the last 4 fiscal quarters). The last one, the firm promises to be finally back to growth with sales up sequentially 1% to 12%. It was finally 2%.

It missed analysts’ forecasts for third-quarter revenue and profit, sending its stock plunging more than 11% in after-hours trading.

George Kurian, CEO, commented the financial results: "Despite the top line challenges, we continued our operational discipline, highlighted by strong gross margin, cash flow and operating leverage without the benefit from anticipated ELA revenue in the quarter (...) However, macroeconomic headwinds and unpredictability in large enterprise purchasing behavior persist."

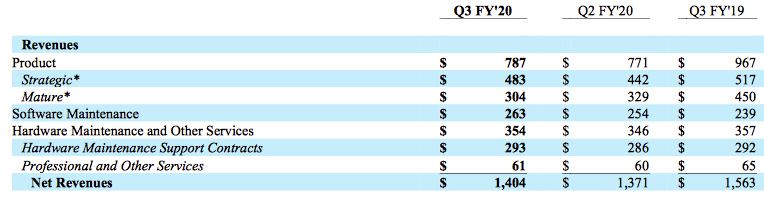

* In Q1 FY20 NetApp made changes to the products and solutions contained in each of the Strategic and Mature product groupings. Strategic now includes FAS products, including all related add-on hardware and OS software, private cloud solutions, enterprise software license agreements and other optional add-on software products. Mature now includes hybrid FAS products, including all related add-on hardware and OS software, OEM products, and branded E-Series. Prior to this change, hybrid FAS and branded E-Series were included in Strategic, while all add-on hardware and OS software were included in Mature.

* In Q1 FY20 NetApp made changes to the products and solutions contained in each of the Strategic and Mature product groupings. Strategic now includes FAS products, including all related add-on hardware and OS software, private cloud solutions, enterprise software license agreements and other optional add-on software products. Mature now includes hybrid FAS products, including all related add-on hardware and OS software, OEM products, and branded E-Series. Prior to this change, hybrid FAS and branded E-Series were included in Strategic, while all add-on hardware and OS software were included in Mature.

Product revenue was $787 million for the quarter, decreasing 19% Y/Y.

Software maintenance and hardware maintenance revenue of $556 million was up 5% Y/Y.

Private cloud business, inclusive of products and services grew 10% from the former quarter, attaining an annualized net revenue run rate of around $350 million.

Deferred revenue increased 6% Y/Y in 3FQ20.

Based on the last month of 3FQ20, annualized recurring revenue for cloud data services increased to approximately $83 million, up 146% Y/Y.

NetApp is on track to increase sales capacity by approximately 200 primary sales resources by the end of 1FQ21 and without adding to the total operating expenses. The majority of the sales headcount will be deployed in America.

The firm expects 4FQ20 revenues to range between $1.455 billion and $1.605 billion, a mid-point decline of 4% Y/Y. For FY20, yearly decline is expected to be approximately 10% Y/Y.

At the end of the former, the storage company stated that it was expected revenue declining around 8% Y/Y. Itwas finally 10%.

| Fiscal Period | Revenue | Y/Y Growth | Net income (loss) |

| FY16 | 5,546 | -9% | 229 |

| FY17 | 5,519 | -0% | 509 |

| 1Q18 | 1,325 | -11% | 136 |

| 2Q18 | 1,422 | 7% | 175 |

| 3Q18 | 1,523 | 7% | (506) |

| 4Q18 | 1,641 | 8% | 271 |

| FY18 | 5,911 | 7% | 75 |

| 1Q19 |

1,474 | 12% |

283 |

| 2Q19 |

1,517 | 7% |

241 |

| 3Q19 |

1,563 | 2% |

319 |

| 4Q19 |

1,592 | -3% |

296 |

| FY19 |

6,146 | 4% |

1,169 |

| 1Q20 |

1,236 | -16% | 103 |

| 2Q20 |

1,371 | -10% | 243 |

| 3Q20 |

1,404 | -10% | 277 |

| 4Q20* |

1,455-1,605 | -8% |

NA |

| FY20* |

5,531 |

-10% |

Revenue and net income (loss) in $ million

* Estimations

To read the earnings call transcript

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter