Seagate: Fiscal 2Q20 Financial Results

Record exabyte shipments but flat revenue

This is a Press Release edited by StorageNewsletter.com on February 6, 2020 at 2:29 pm| (in $ million) | 2Q19 | 2Q20 | 6 mo. 19 | 6 mo. 20 |

| Revenue | 2,715 | 2,696 | 5,706 | 5,274 |

| Growth | -1% | -8% | ||

| Net income (loss) | 384 | 318 | 824 | 518 |

– Reported revenue of $2.7 billion

– Expanded GAAP operating margin to 14.2%; non-GAAP operating margin to 15.7%

– Delivered GAAP diluted earnings per share (EPS) of $1.20; non-GAAP diluted EPS of $1.35

– Returned $315 million to shareholders; declared cash dividend of $0.65 per share

Seagate Technology plc reported financial results for its fiscal second quarter ended January 3, 2020.

“In the December quarter, Seagate expanded non-GAAP operating margin by nearly 300 basis points and delivered non-GAAP EPS growth of more than 30% quarter-over-quarter while driving strong operational cash flow in an improving demand environment,” said Dave Mosley, CEO. “We executed the company’s fastest ever product ramp with our industry capacity leading 16TB drives, which contributed to both sequential revenue growth and record exabyte shipments in the December quarter. We are poised to benefit from ongoing demand for mass capacity storage which we expect to offset typical seasonal declines in the legacy markets in the first half of the calendar year.”

The company generated $480 million in cash flow from operations and $286 million in free cash flow during 2FQ20. It maintained a healthy balance sheet and during 2FQ20, the company paid cash dividends of $165 million and repurchased 2.5 million ordinary shares for $150 million. Cash and cash equivalents totaled $1.7 billion at the end of 2FQ20. There were 261 million ordinary shares issued and outstanding as of the end of the quarter.

Quarterly Cash Dividend

The board of directors of the company declared a quarterly cash dividend of $0.65 per share, which will be payable on April 8, 2020 to shareholders of record as of the close of business on March 25, 2020.

Business Outlook for 3FQ20

• Revenue of $2.7 billion, plus or minus 7%

• Non-GAAP diluted EPS of $1.35, plus or minus 7%

Comments

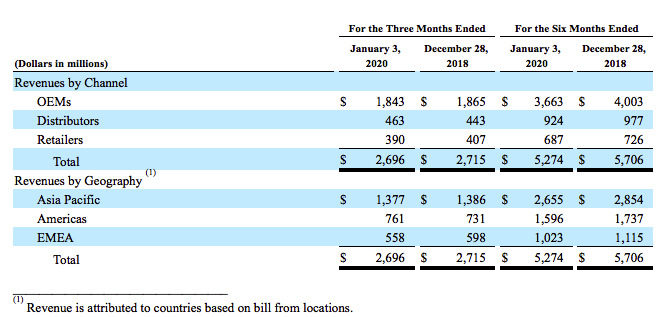

Revenue increased 5% to $2.7 billion Q/Q and decreased 1% Y/Y. It corresponds to outlook expected former quarter and is equivalent to guidance, plus or minus 7%, for 3FQ20, which means global sales stabilizing.

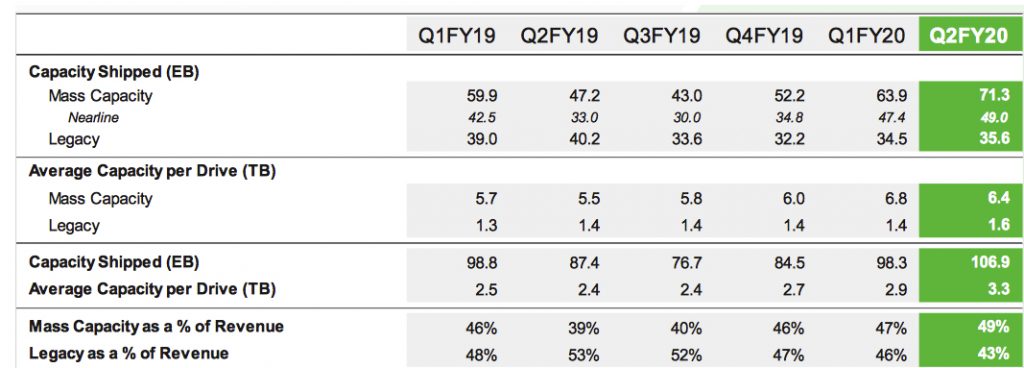

HDD average capacity per drive increased 11% sequentially at 3.3TB and total capacity shipped reached 106.9TB, up 9% Q/Q, for a total of 29.2 million units for 2FQ20.

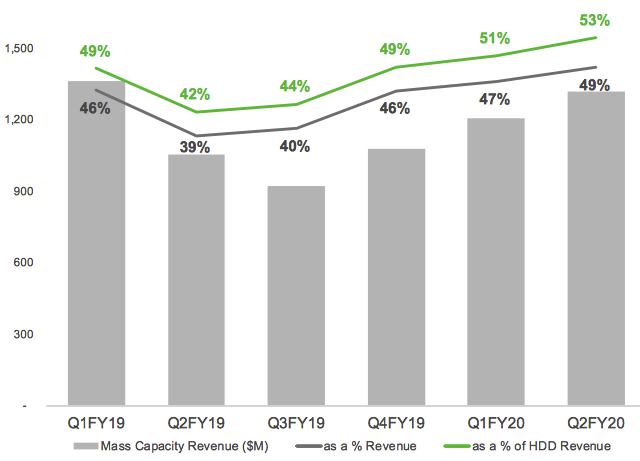

Mass capacity storage, which include nearline, video and image application and NAS drives, represented 49% of total December quarter revenue, up from 47% in the prior quarter and 39% in the prior year. Exabyte shipment into this market increased 12% sequentially to 71EB or 33% of the total shipped. Revenue from mass capacity storage increased 9% Q/Q and 25% Y/Y. Nearline comprises 49EB, up 3%.

Mass capacity trends

Revenue from 16TB HDDs, with 1 million units shipped, nearly tripled Q/Q making them highest revenue product during the quarter, a trend the company expects to persist through the rest of the fiscal year.

The 18TB launch is progressing to plan and shipments are expected in the 1CH20.

In thin the December quarter, Seagate shipped 12EB in portable external drives.

Revenue from the legacy market remained flat on a sequential basis and represented 43% of December quarter revenue, compared with 46% in the September quarter, as SSDs are furiously competing. Exabyte shipment here increased 3% sequentially and fell 11% Y/Y to 36EB.

HDD product mix trends

Revenue by channel and geography

The remaining 8% of the most recent quarter revenue or $215 million, was derived from non-HDD business, in which revenue increased 14% sequentially - but decreased 4% Y/Y -, driven by growth in systems and SSDs.

Revenue by products in $ million

| 1FQ20 | 2FQ20 | Q/Q Growth | % of total revenue in 2FQ20 |

|

| HDDs | 2,204 | 2,481 | 13% | 92% |

| Enterprise data solutions, SSD and others |

188 | 215 | 14% | 8% |

Seagate's HDDs from 2FQ15 to 2FQ20

| Fiscal period | HDD ASP | Exabytes shipped |

Average GB/drive |

| 2Q15 | $61 | 61.3 | 1,077 |

| 3Q15 | $62 | 55.2 | 1,102 |

| 4Q15 | $60 | 52.0 | 1,148 |

| 1Q16 | $58 | 55.6 | 1,176 |

| 2Q16 | $59 | 60.6 | 1,320 |

| 3Q16 | $60 | 55.6 | 1,417 |

| 4Q16 | $67 | 61.7 | 1,674 |

| 1Q17 | $67 | 66.7 | 1,716 |

| 2Q17 | $66 | 68.2 | 1,709 |

| 3Q17 | $67 | 65.5 | 1,800 |

| 4Q17 | $64 | 62.2 | 1,800 |

| 1Q18 | $64 | 70.3 | 1,900 |

| 2Q18 | $68 | 87.5 | 2,200 |

| 3Q18 | $70.5 | 87.4 | 2,400 |

| 4Q18 |

$72 | 92.9 | 2,500 |

| 1Q19 | $70 | 98.8 | 2,500 |

| 2Q19 |

$68 | 87.4 | 2,400 |

| 3Q19 |

$72 | 76.7 | 2,400 |

| 4Q19 | $79.7 | 84.5 | 2,700 |

| 1Q20 |

$81 | 98.3 | 2,900 |

| 2Q20 |

$77 |

106.9 |

3,300 |

Seagate vs. WD for 2FQ20

(revenue and net income in $ million, units in million)

| Seagate | WD | % in favor of WD |

|

| Revenue | 2,696 | 4,234 | 57% |

| Net income | 318 | (139) | NA |

| HDD shipped | 32.4 | 29.2 | -10% |

| Average GB/drive | 3,300 | 4,575 | 39% |

| Exabytes shipped | 106.9 | 133.6 | 29% |

| HDD ASP | $77 | $81 | 5% |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter