WW Cloud IT Infrastructure Revenue Declined 2% Y/Y in 3Q19

On top again Dell, HPE Inspur, Cisco and Lenovo in order

This is a Press Release edited by StorageNewsletter.com on January 16, 2020 at 2:23 pmAccording to the International Data Corporation, Worldwide Quarterly Cloud IT Infrastructure Tracker, vendor revenue from sales of IT infrastructure products (server, enterprise storage, and Ethernet switch) for cloud environments, including public and private cloud, declined in 3Q19 as the overall IT infrastructure market continues to experience weakening sales following strong growth in 2018.

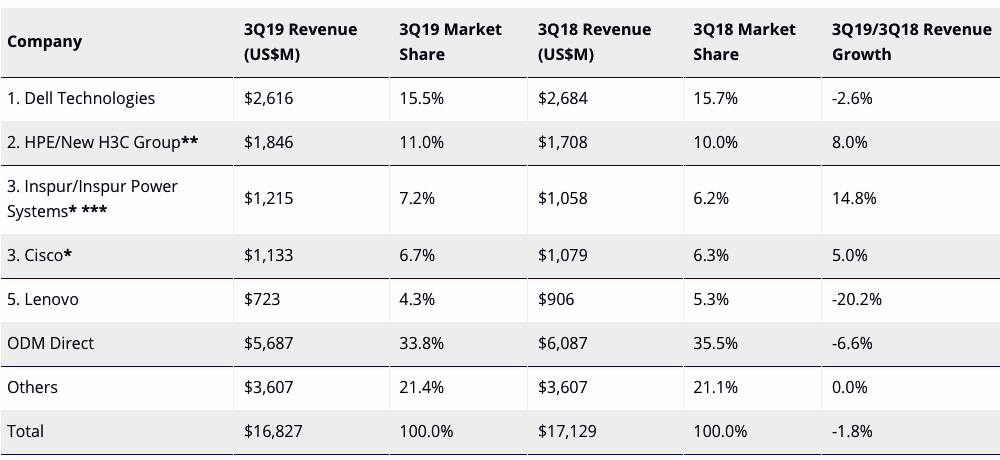

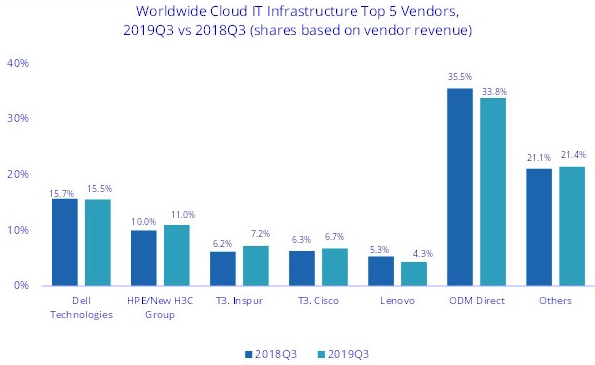

Top Companies, WW Cloud IT Infrastructure Vendor Revenue, Market Share, and Y/Y Growth, 3Q19

(revenue in $million)

* IDC declares a statistical tie in the worldwide cloud IT infrastructure market when there is a difference of one% or less in the vendor revenue shares among two or more vendors.

** Due to the existing joint venture between HPE and the New H3C Group, IDC reports external market share on a global level for HPE as “HPE/New H3C Group” starting from Q2 2016 and going forward.

*** Due to the existing joint venture between IBM and Inspur, IDC will be reporting external market share on a global level for Inspur and Inspur Power Systems as “Inspur/Inspur Power Systems” starting from 3Q 2018.

The decline of 1.8% Y/Y was much softer than in 2Q19 as the overall spend on IT infrastructure for cloud environments reached $16.8 billion. IDC slightly increased its forecast for total spending on cloud IT infrastructure in 2019 to $65.4 billion, which represents flat performance compared to 2018.

The decline in cloud IT infrastructure spending was driven by the public cloud segment, which was down 3.7% year over year, reaching $11.9 billion; sequentially from 2Q19, this represents a 24.4% increase. As the overall segment is generally trending up, it tends to be more volatile quarterly as a significant part of the public cloud IT segment is represented by a few hyperscale service providers.

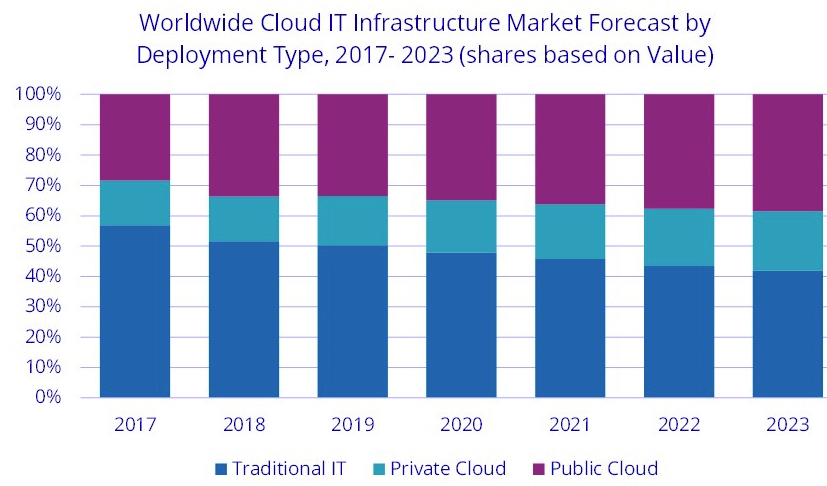

This softness of the public cloud IT segment is aligned with IDC’s expectation of a slowdown in this segment in 2019 after a strong performance in 2018. It is expected to reach $44 billion in sales for the full year 2019, a decline of 3.3% from 2018. Despite softness, public cloud continues to account for most of the spending on cloud IT environments. However, as demand for private cloud IT infrastructure is increasing, the share of public cloud IT infrastructure continued to decline in 2019 and will be declining slightly throughout the forecast period. Spending on private cloud IT infrastructure has shown more stable growth since IDC started tracking sales of IT infrastructure products in various deployment environments.

In 3Q19, vendor revenues from private cloud environments increased 3.2% year over year, reaching nearly $5 billion. Spending in this segment will grow 7.2% year over year in 2019 to $21.4 billion.

As investments in cloud IT infrastructure continue to increase, with some swings up and down in the quarterly intervals, the IT infrastructure industry is approaching the point where spending on cloud IT infrastructure consistently surpasses spending on non-cloud IT infrastructure. Until 3Q19, it happened only once, in 3Q18, and in 3Q19 it crossed the 50% mark for the second time since IDC started tracking IT infrastructure deployments. In 3Q19, cloud IT environments accounted for 53.4% of vendor revenues. However, for the full year 2019, spending on cloud IT infrastructure is expected to stay just below the 50% mark at 49.8%. This year is expected to become the tipping point with spending on cloud IT infrastructure staying in the 50+% range.

Across the three IT infrastructure domains, Ethernet switches is the only segment expected to deliver visible Y/Y growth in 2019, up 11.2%, while spending on compute platforms will decline 3.1% and spending on storage will grow just 0.8%. Compute will remain the largest category of cloud IT infrastructure spending at $34.1 billion.

Sales of IT infrastructure products into traditional (non-cloud) IT environments declined 7.7% from a year ago in 3Q19. For the full year 2019, WW spending on traditional non-cloud IT infrastructure is expected to decline by 5.3%.

By 2023, IDC expects that traditional non-cloud IT infrastructure will only represent 41.9% of total WW IT infrastructure spending (down from 51.6% in 2018). This share loss and the growing share of cloud environments in overall spending on IT infrastructure is common across all regions. While the industry overall is moving toward greater use of cloud, there are certain types of workloads and business practices, and sometimes end user inertia, which keep demand for traditional dedicated IT infrastructure afloat.

Geographically, the cloud IT Infrastructure segment had a mixed performance in 3Q19. Declines in the U.S., Western Europe, and Latin America were driven by overall market weakness; in these and some other regions 3Q19 softness in cloud IT infrastructure spending was also affected by comparisons to a strong 3Q18. In AsiaPac (excluding Japan), the second largest geography after the U.S., spending on cloud IT infrastructure increased 1.2% year over year, which is low for this region. However, it is in comparison with strong double-digit growth in 2018. Other growing regions in 3Q19 included Canada (4.9%), Central and Eastern Europe (4.6%), and Middle East and Africa (18.1%).

Long-term, IDC expects spending on cloud IT infrastructure to grow at a five-year CAGR of 7%, reaching $92 billion in 2023 and accounting for 58.1% of total IT infrastructure spend. Public cloud datacenters will account for 66.3% of this amount, growing at a 6% CAGR. Spending on private cloud infrastructure will grow at a CAGR of 9.2%.

Read also:

Cloud IT Infrastructure Revenue Down 10% Y/Y at $14 Billion

Amid slow down in overall spending

October 1, 2019 | Press Release

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter