History (1990): Standards Magnetic Tape Cartridges and Cassettes Threatened by 4mm and 8mm Helical Scan Units

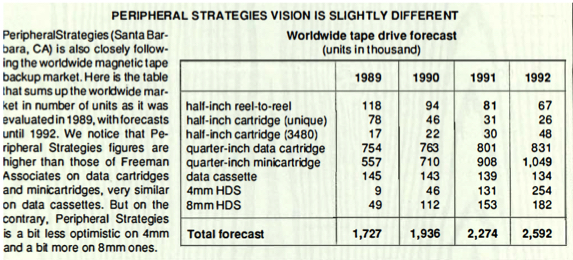

Freeman Associates and Peripheral Strategies reports

By Jean Jacques Maleval | January 9, 2020 at 2:21 pmThe new 4 or 8mm DAT units using helical scan recording technology are going to ferociously compete with standard longitudinal cartridges in the coming years.

And this will occur in a storage market stronger than it was expected.

It’s not surprising to see DATs, with higher storage capacities, 1GB and more, slowly catch up with standard tapes, except in mainframes that require transfer rates not offered by actual helical scan units.

At what rate will ordinary cartridges and cassettes be replaced? Will they no longer exist?

Let’s see what Freeman Associates (Santa Barbara, CA) have to say about it, as they published two separate surveys, one on cartridges, the other one on Data-DATs, that we will detail further.

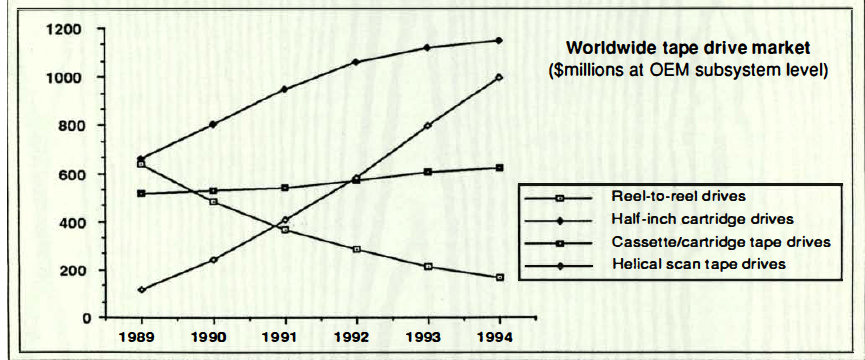

The magnetic backup market is not about to die. Without counting reel-to-reel tapes and 3480 cartridges, mainly used in mainframes and that are not part of this subject, sales of recording units will grow from 1.8 million in 1990 to 2.5 million in 1994, an average of 10% a year and 20% in value on a $768.2 million basis this year to reach $1.6 billion in four years.

Including large computer backup systems, which means reel-to-reel drives and half-inch cartridge drives, the magnetic tape market reaches $1.93 billion sales in 1989 and will attain $2.9 billion in 1994. And this, without including another backup system, optical disks, WORM or rewritable, with a stronger growth rate.

Let’s come back to cassettes, quarter-inch cartridges and DATs. A closer analyze shows notable disparities in these different magnetic Supports. Units based on helical scan technology from video recording, will mostly take advantage of this growth, and especially 4mm DATs, that will double their sales each year from 1989 to 1995. The capacity (1.3GB) of a 4mm DAT cartridge is lower than the 8mm one (2.3GB) but its small size can already forecast 3.5-inch form factor drives at a much cheaper price.

Peripheral Strategies, another U.S. company that studies magnetic tape market, predicts for the end of 1991, a unit price for OEM orders of $700 for 4mm drives and $1,300 for 8mm ones.

This same firm counted 49 different 4mm systems worldwide, 37 of them in the DDS format, launched by Hewlett-Packard and Sony in competition with another standard launched by the German company Gigatape.

The 8mm system has no standardization problem, there is only one source for the drives based on a Sony mechanism. Exabyte, a Colorado-based company, is having the highest growth in the tape storage industry. Its drive was adopted by most workstation manufacturers, IBM ahead in its RS/S000 and recently in some of its PS/2s.

8mm units, developed before 4mm drives, accounted for 62% of the total DAT market in 1990, but Freeman and Peripheral Strategies agree on the fact that 4mm unit placements will finally be higher in 1991.

We’ll just mention another helical scan recording support that will remain secondary, based on the large VHS cassette used for digital storage.

“DATs are seriously being considered by just about all system manufacturers,” say the authors of the Freeman report.

But longitudinal recording systems, actually on more than 90% of the installations will still be in majority even after 1994. Their sales will nevertheless be surpassed by higher costing DATs as soon as the end of 1992.

Audio type storage systems on cassettes, that only seem to interest the Japanese company TEAC, haven’t and won’t ever have an important share of the market.

Its major part is taken by quarter-inch magnetic media, that exists in two different forms, DC600 cartridges and DC2000 minicartridges.

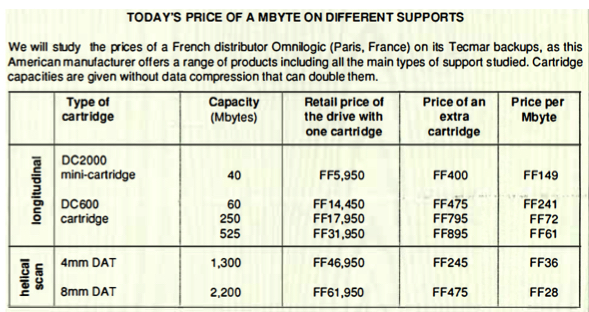

The quarter-inch format has three main advantages: 1) cheaper price per unit (see price chart behead); 2) a rising compatibility, with increasing capacities on account of a standard unanimously followed by manufacturers under the aegis of QIC (Quarter-Inch Committee); 3) these last ones don’t intend to leave the gigabyte monopoly to DATs since 525MB cartridges are already offered and their capacity will reach 1.35GB next year. This is why sales of quarter-inch cartridges will remain high and will only begin to drop slowly in 1993.

And no recession is planned even in the segment of high-capacity units, more than 70MB on DC2000, more than 300MB on DC600.

Globally, the best estimates are in favor of minicartridges that are already used in 3.5-inch drives.

At the end, you can wonder if, behind technical debates, the true problem is not elsewhere, psychological, when users, especially those of microcomputers, realize how important regular backing up is, and not just on diskettes, the main backing up system.

This kind of situation cannot last on account of imperative and irreversible needs of high-capacity HDDs, meaning even more crucial backups, to run OSs and applications that require more and more megabytes.

And because, at the same time, floppy disks are still topping less than 2 million bytes.

It’s not IBM’s announcement, delayed but still scheduled, to reach 2.7MB of formatted capacity that will ease the backup operation, very fastidious for 20MB, and nearly unbearable after 40MB.

Things will be different when 20MB diskettes from Insite Peripherals, Brier Technology or Citizen, in evaluation at IBM, arrive, and even more the day removable 128MB magneto-optical 3.5-inch disks appear.

Data cartridge drives will withstand several years

The WW market for data cartridge tape drives will grow to $583 million at OEM price levels in 1995, a 4% CAGR from the $470 million value of the 1989 market, according to a newly completed market analysis (276 pages, $1,595) published by Freeman Associates.

These tape drives are facing a strong competition from helical scan products – particularly 4mm and 8mm drives – and also from rewritable optical disk drives in feeling the growing need for removable storage on personal and mid-range computer systems.

“New higher-capacity categories of data cartridge and data cassette drives will be the winners,” declare Robert Abraham and Raymond Freeman, the authors of the report.

Both product classes have well defined performance migration paths – strategies designed to enhance future competitive positioning of these industries.

Strong growth of the high capacity segment is predicted despite the competitive threats, as performance levels of data cartridge and cassette products continue to improve while costs remain competitive.

“Because of a strong desire for backward compatibility, few existing users are expected to opt for helical scan or optical as they migrate to higher performance and capacity devices. The competitive products will be challenging the incumbents on a more even playing field, however, for those new applications and systems yet to be developed.”

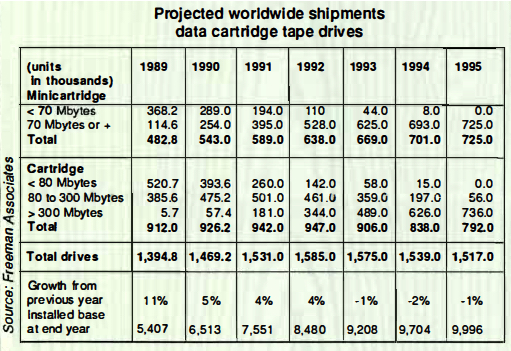

The authors predict combined shipments of all classes of data cartridge drives to grow from 1.4 million units in 1989 to 1.5 million in 1995, effectively a 1% growth rate.

During that same period, combined shipments of all classes of data cassette drives will decline from 145,000 units in 1989 to 131,000 units in 1995, a 2% decline.

Drives using compact mini data cartridges have the favored position among categories of data cartridge devices, according to the report.

“This class of drive has become a popular choice in new portable and desktop systems which have shifted to 3.5-inch HDDs,” observes Freeman,

The report forecasts shipment growth from 482,000 units in 1989 to 725,000 in 1995 – a 7% annual rate – for minicartridge drives. A shift to higher capacity models is predicted within these shipment projections.

Meanwhile, demand for drives using full-size data cartridges will also migrate to higher capacity models. Shipments of drives in the less than 80MB capacity range, the dominant category today, peaked at 605,000 units in 1988 and will decline to zero in 1995. This device category includes the popular 60MB QIC-24 product class.

Shipments of drives in the 80MB to 300MB capacity range are forecast to peak at 501,000 drives in 1991 – up from the 385,600 units of 1989 – before declining to 56,000 units in 1995. Most of these mid-range drives are defined by QIC development standards QIC-125 and QIC-150.

“Higher capacity devices – currently in the 525MB range, soon to be at 1.35GB, and eventually at higher levels – will sustain shipment growth of 5.25-inch data cartridge devices well into this decade,” claims Abraham.

The highest capacity segment started shipping in 1989 at 5,700 units with the first QIC-525 drives, and will grow to 736,000 units in 1995 – an annual growth rate of 125%.

Pending QIC development standards are expected to define product classes with capacities greater then 1.35GB.

The report foresees only modest market acceptance for streaming data cassette drives, a compact, low-cost backup class not widely noticed amid the attention given to quarter-inch and helical scan products. Demand for these drives benefits from their ability to fit the 3.5-inch form factor – an increasingly important feature. Based on availability of a 160MB version, the recent introduction of a 600MB model, and the standardization achieved by the of CAS Working Group, the report predicts shipments of cassette drives with capacities between 10 and 80MB to decline from 78,000 units in 1989 – after peaking in 1988 at 99,000 units – to zero unit in 1993.

Shipments of cassette drives with capacities exceeding 80MB are projected to increase from 39,000 units in 1989 to a peak of 140,000 units in 1993 before declining to 131,000 units in 1995 – an average annual growth rate of 22%t.

The total of all categories of cassette drives will increase from 145,000 units in 1989 to 149,000 in 1991 – the peak year – before declining to 131,000 drives in 1995. These total figures equate to an annualized rate of decline of 2% over the 6-year period.

The reports counts 11 models of tape drives produced by 30 manufacturers; 82 offerings from 11 media makers are also listed.

Helical scan drives: high growth market

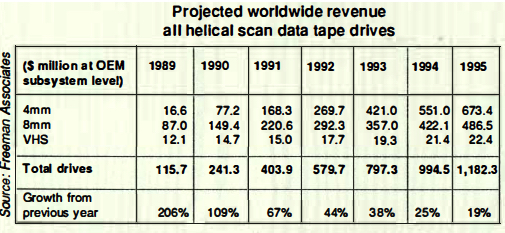

WW market demand for computer tape drives utilizing helical scan technology will exceed $1.2 billion at OEM price levels in 1995. a 47% annual growth rate from the $115 million value of the 1989 market. according to a newly market analysis (228 pages, $1,595) published by Freeman Associates.

“DAT and 8mm drives used for data recording will share the lead in this fast growing market,” declare the authors.

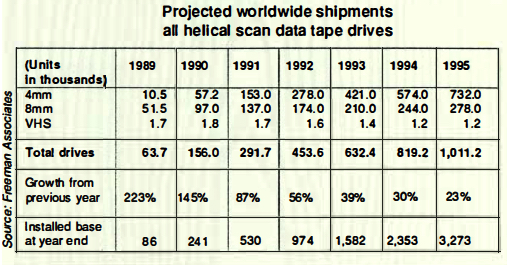

They predict unit shipments of 4mm DAT data tape drives to grow at a 103% rate from 10,500 units in 1989, the first year of production shipments, to 732,000 units in 1995.

These drives, providing up to 1.3GB of storage capacity in half-high 5.25-inch packages, have wide user appeal due to compact, low-cost media and the ability eventually to fit the 3.5-inch form factor.

Prototype 3.5-inch models are now being shown privately to selected OEM prospects.

A highly competitive market environment is evolving, with many of the helical scan device manufacturers entering the storage industry for the first time.

Data compression techniques and availability of cartridges with longer lengths of tape promise to increase capacity by a factor of 2 to 3X in the near future.

Projected WW shipments data drives using 8mm media captured 81% of the 1989 market for helical scan data drives and will be the second-fastest growing category of such products according to Freeman.

“This class of drives has become a popular choice in networked desktop systems and workstations which utilize high capacity HDDs,” Freeman states.

The report forecasts shipment growth of 8mm devices from 51,500 units in 1, – the third year of commercial shipment – to 278,000 in 1995, a 32% annual growth rate.

8mm data drives with 2.3GB of storage capacity in a 5.25-inch package have the highest storage capacity of any small form factor tape drive. Drives specified at 5GB capacity have been announced for late 1990 delivery.

Demand for high-capacity small-form-factor tape drives, as epitomized by 4mm and 8mm products, is fueled by increased shipments of high-capacity HDDs and the increased usage of color graphics.

Volume shipments of 5.25-inch 760MB HDDs have begun; initial shipments of 5.25-inch drives with capacities greater than 1GB have started and are expected to grow rapidly.

A total of 27 different companies are identified which have either announced helical scan drives or are believed to be developing such products. There are 34 models of tape drives currently offered by 18 manufacturers; 23 offerings from 6 media makers.

This article is an abstract of news published on the former paper version of Computer Data Storage Newsletter on issue ≠34, published on November 1990.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter