History (1990): Asians Eating Up Americans in Floppy Disks

Hanny Magnetics acquiring Xidex (Dysan) and Mitsubishi to buy Kodak Verbatim

By Jean Jacques Maleval | November 27, 2019 at 2:06 pmThe Korean company Hanny Magnetics is acquiring Xidex’ (Dysan) Flexible Disk Division and the Japanese Mitsubishi is going to buy Kodak’s Verbatim.

After it almost completely dominated the FDD market, Asia is now slowly laying hands on the worldwide diskette industry.

According to the 1989 Disk/Trend report, 92% of the 1988 WW revenues total of FDDs are held by the Japanese.

Are Americans also going to give up diskette business? According to several market surveys, 2.3 billion FDs were produced in the world in 1988, and 2.8 billion are forecasted for 1989, then 3.5 billion in 1995. In 1988, 30% of WW volume was produced in Japan, vs. 50% in USA, 11% in Europe and 9% in the rest of the world.

But these figures don’t really give an idea of the importance of Asians because they do own many plants outside of their country.

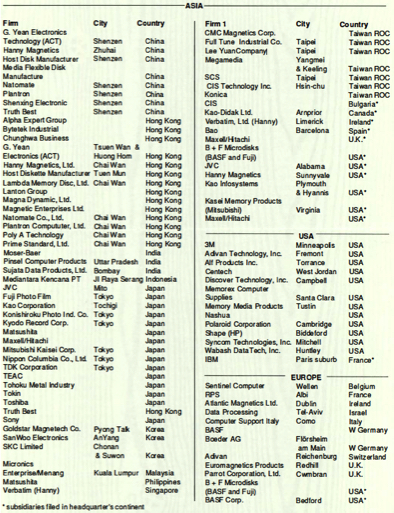

We have counted at least 91 FD manufacturing plants throughout the world. 68 were in Asia or controlled by Asian companies.

The new reorganization of this industry will add a little more to the Asian balance since Verbatim and Xidex are the biggest US manufacturers with 3M.

Mitsubishl to buy Verbatim

Eastman Kodak Co. (Rochester, NY) agreed to sell its Verbatim storage unit to Mitsubishi Kasei, a subsidiary of Mitsubishi. The Japanese will obtain the floppy disk and digital cassette-tape businesses. Small format optical disk program and other tape businesses are not included in the sale.

Verbatim’s annual sales are estimated at about $300 million. The price of the transaction was not unveiled, but, according to the Japanese press agency Kyodo, It should be between ¥30 and ¥40 billion yens.

What’s Mltsubishi Kasei?

Founded in 1950, it is one of the largest chemical manufacturers with nearly 9,000 employees and sales of $2,5 billion for last fiscal year, which was only six month long due to a change in the accounting period.

The firm started manufacturing FDs 8 years ago. It has a plant in Odawara, near Tokyo, Japan, that produces 2,5 million 3,5-inch FDs per month. The department is engaged in the promotion of HDDs, optical and floppy disks. The firm began exporting FDs 4 years ago under its own brand name and on an OEM basis. To enhance marketing in USA, the firm established a 100%-owned subsidiary, Kasei Memory Products, in Virginia. It began manufacturing FDs in April 1989 with a monthly capacity of 2 million units. It plans to expand production to 7 million a year in the near future.

Hanny to buy Xidex Flexible Disk Division

Hanny Magnetics of Hong-Kong has reached an agreement in December 1989 to buy Xidex Flexible Disk Division of Anacomp. The division is one that Anacomp picked up with its acquisition of Xidex in 1988. Hanny, that produces about 10 million FDs a month, had already supplied Xidex with over 40 million 3,5-inch disks in 1989.

“Hanny is probably among the five top FD manufacturers in the world today, after Sony, Maxell, 3M and Verbatim,” says Berthold Blatecki, GM of Dysan Magnetics, a new firm established by Hanny to market Xidex and Dysan’s line of products.

Philip J. Micciche, president of Dysan Magnetics explains for his part: ” The purchase (of Xidex by Hanny) was motivated by the fact that while Hanny was a strong manufacturer of 3.5-inch floppy disks, it had little presence in the 5.25-inch market and no presence in the branded disk market. With our established product lines, distribution, channels and knowledge of the market, we can help that presence.”

Sales are expected to be in excess of $120 million in the first year.

Xidex started producing FDs in 1980, because they use polyester, the same basic component as micrographics film, and with the idea to expand elsewhere than in the micrographics market that is rather slowing down. A subsidiary, Xidex Magnetics was set up in 1981. The real take-off point was when it acquired in February 1985, for $190 million, Dysan Corp., leader in flexible and rigid media, a $200 million company at that time, approximately equal in size to Xidex.

The company had set up a plant in Le Locle (Switzerland) but had to close it suddenly in 1986 when fluctuation of the dollar made European manufacturing less competitive.

In 1988, Anacomp Corp. (Indianapolis, IN), the biggest micrographics service-bureau in the USA, and the number one manufacturer of micrographics products in the world, acquired Xidex. As from the beginning of the deal, Anacomp was trying to sell the newly-acquired diskette activity that was becoming less and less profitable and that called for strong investments to go from 5.25- to 3.5-inch FD production with a much stronger growth.

At the end of 1988, Xidex started to buy automated assembly equipments from Gima (Bologna, Italy) for 3.5-inch diskettes. Each line is able to produce 1.2 million FDs a month. A second line was to be installed in February 1989, and a total of 7 production machines were ordered, to be able to produce about 80 million units this year.

Xidex even expected to produce 600 million all size diskettes in its last FY, ending June 30,

1989. According to Blatecki, Xidex, even if it is the worldwide leader in 5.25-inch FDs, only produced around 310 million in 1989, and hardly more than 20 million 3.5-inch ones.

In spite of sales rumors by Anacomp, on December 9, 1988, the day Xidex celebrated its one billionth FD, Bert Zaccaria, founder of Xidex and CEO of the subsidiary, declared before the whole press: “I expect that we shall all be together very soon again, celebrating the production of Xidex’ two billionth diskette.”

Maybe, but not with Anacomp

Xidex also had its own duplication department, Xemag, bought in 1982, but it was sold to Sullivan Software Manufacturing in 1989. Dysan Magnetics was formed to continue marketing Xidex/Dysan line of production. On March 1, 1990, a few days after the acquisition of Xidex’ division, Hanny Magnetics founded a new company, Dysan Magnetics, headquartered in Hong Kong, with further offices in Milpitas, CA, Canada, West Germany (Frechen), Australia and the UK, to continue marketing Dysan FDs on a mutually exclusive basis.

Hanny has formed a joint venture with Philip Micciche, who will serve as president of Dysan Magnetics. The firm will bring Dysan, Precision, StorageMaster and XM2 branded disks, as well as bulk and white box, to worldwide market for Hanny Magnetics.

It will also distribute quarter-inch data tape cartridges and Dysan branded diagnostic and alignment products for floppy disk drives, previously in Xidex’ product offering.

Who’s Hanny?

Hanny Magnetics (Hong Kong) was formed in 1968 as an audio cassette manufacturer. In 1980, the firm started making video cassettes and switched in 1986 to manufacturing 5.25-inch FDs.

Annual sales of 5.25-inch diskettes have grown to 36 million pieces. In May 1988, the company invested about $15 million to produce 3.5-inch FDs. Annual sales have increased to 120 million disks, from 36 million last year. In 1990, the production will be increased to 12 million a month.

About 70% of exports go in USA, 20% to Europe and the remainder to Southeast Asia.

The firm has two factories in Hong Kong, one in the Tai Po Industrial Estate to carry out injection molding, and one in Chai Wan with a 6,500 square foot plant for assembly work. Sumimoto injection molding machines are used for manufacturing 3.5-inch FDs. High-impact ABS resin is imported from Japan and the U.S. as well as cookers and liners. Other components, including shutters and springs, write protectors, clam shells, center plates and cores, are manufactured by the company itself.

Hanny Magnetics of Zhuhai, a wholly-owned subsidiary of Hanny Magnetics of Hong-Kong, was established in China in the summer of 1988 with an investment of more than $2 million, because of rising orders and a shortage of labor in Hong Kong. The initial capacity of the plant was 20 million 3.5-inch disks and 10 million 5.25-inch disks a year. The plan is to expand the capacity in Zhuhai to a total of 60 million disks a year.

FD manufacturing plants by continent and country

Here is a list, neither perfect or exhaustive, of FD manufacturers in the world:

This article is an abstract of news published on the former paper version of Computer Data Storage Newsletter on issue ≠27, published on April 1990.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter