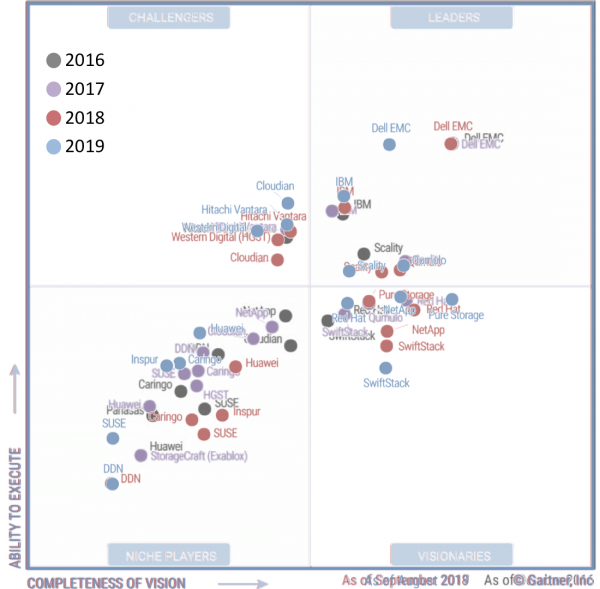

Gartner Magic Quadrant for Distributed File Systems and Object Storage in 2019

4 leaders: Dell EMC, IBM, Qumulo and Scality, and Pure Storage most visionary

By Philippe Nicolas | October 3, 2019 at 2:11 pm

Gartner, Inc. just released its Magic Quadrant for Distributed File Systems and Object Storage for 2019 and again it contains some surprises.

The team of authors changes one more time as John McArthur is replaced by Chandra Mukhyala and the two others, Julia Palmer and Raj Bala, already contributed to the 2018 edition.

The first comment is why Gartner continues to mix file and object storage. In that case, why not rename this Magic Quadrant Unstructured Data Storage?

Gartner maintains incomplete definition for distributed file system as they continue to say that such file system uses a single parallel model. In fact, it exists some distributed file system not parallel at all.

To summarize a parallel file system is a distributed one but a distributed file system can be non-parallel. And to clarify the parallel terminology, a file system is qualified of such behavior when a file written by a client is split across multiple data servers, each server receiving a portion of the file. When a file is written by a client entirely to a data server, it is obviously non parallel. The parallel characteristic is not given by data servers collaborating or contributing in the file storage space but by the split of the file across data servers. For a report related to distributed file system, no mentioning pNFS (Parallel NFS) is a big miss.

The next reaction is related to the products chosen for each company, some have multiple, some have one because they sell only one product but why DDN is only limited to WOS while they have ExaScaler, GridScaler, now Tintri and Nexenta. IBM is considered with Spectrum Scale and COS and Dell EMC with Isilon and ECS, so what is the rationale behind this selection. The result for DDN would have been completely different, landing in the leader quadrant with these 5 technologies. We understand that the Magic Quadrant is about company playing in a category and not about a product. The latter option can’t be even considered as the two examples listed above (IBM and Dell EMC) show two products in the report. But we understand that some companies have refused to participate, in that case, it seems that they were sanctioned.

The position of IBM should be associated with Red Hat and Red Hat should be removed from the report then IBM has to be replaced more right and top in the leader quadrant. The position for Western Digital Active Scale is strange, it has to move back in the niche quadrant.

The value of such study resides in two ways : snapshot and flow. Criteria explain the snapshot even if the remark of product selection creates confusion as mentioned above. The second dimension is about the move analysis and we did such study over the last 4 editions and list moves with the image below with 4 colors:

- Representing object storage part, Scality is a leader in all 4 editions but positions moved backward in the last 2 reports,

- Qumulo consolidates its position being the only file system vendor in that quadrant. Speaking recently with Bill Richter, CEO of Qumulo, he confirms the good product adherence at partners and end-users sites, demonstrating also good support that boosts repeat sales and the addition of cloud offering illustrating the hardware agnostic approach of the company and the flexibility of company’s software.

- Dell EMC moves backward horizontally after 3 years of immobility …,

- Pure Storage also makes strong move to the right being the most visionary company,

- IBM is a clear leader and stay in the same region during the last 4 years,

- NetApp makes progress and almost touches now the leader quadrant,

- Cloudian moves up with clear new execution capabilities,

- DDN stays at the same position and clearly is sanctioned in this report,

- Caringo stay approximately in the same area, same remark for Hitachi Vantara but the Japanese company is close to the leader quadrant.

We mentioned last year some absences. It is the case this year again for Fujitsu, Hedvig, Minio, NEC, Panasas, Quobyte, Rozo Systems, Veritas, WekaIO, and the recent Vast Data.

With the disaggregated wave and especially NVMeoF, we’d like to see criteria evolvement as new architecture arrive on the market and are taken seriously by end-users and partners.

Every year we write some comments and invite Gartner to make changes to reflect the market reality so we hope the 2020 report will consider these few points.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter