WW Converged Systems Market Up 11% Y/Y in 2Q19 at $4 Billion – IDC

Top vendors being Dell, Nutanix and Cisco

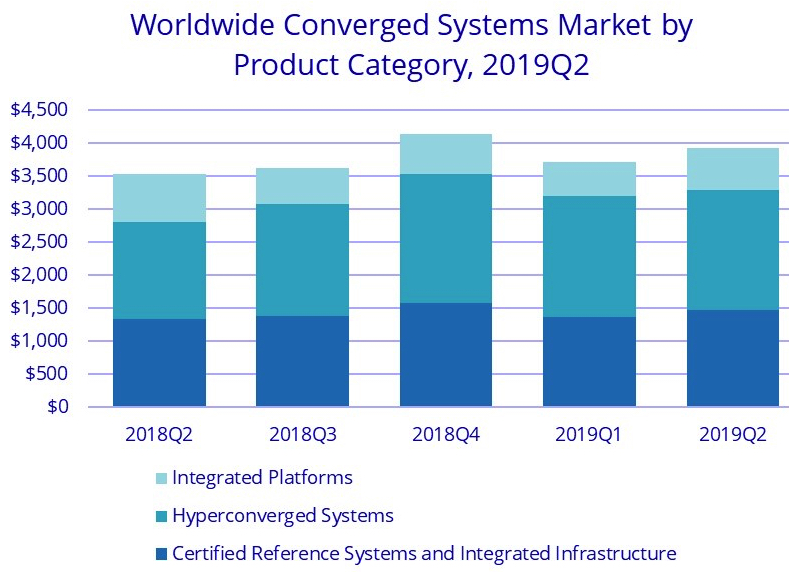

This is a Press Release edited by StorageNewsletter.com on September 26, 2019 at 2:27 pmAccording to the International Data Corporation‘s Worldwide Quarterly Converged Systems Tracker, WW converged systems market revenue increased 10.9% Y/Y to $3.9 billion during 2Q19.

“The value proposition of converged infrastructure solutions has evolved to align with the needs of a hybrid cloud world,” said Eric Sheppard, research VP, infrastructure platforms and technologies. “Modern converged solutions are driving growth because they allow organizations to leverage standardized, software-defined, and highly automated datacenter infrastructure that is increasingly the on-premises backbone of a seamless multi-cloud world.”

Converged Systems Segments

Converged systems market view offers 3 segments: certified reference systems and integrated infrastructure, integrated platforms, and hyperconverged systems.

The certified reference systems and integrated infrastructure market generated nearly $1.5 billion in revenue during 2Q19, which represents 10.5% Y/Y growth and 37.5% of total converged systems revenue.

Integrated platforms sales declined 14.4% Y/Y during 2Q19, generating $626 million worth of sales. This amounted to 16.0% of the total converged systems market revenue.

Revenue from hyperconverged systems sales grew 23.7% Y/Y during 2Q19, generating $1.8 billion worth of sales. This amounted to 46.6% of the total converged systems market.

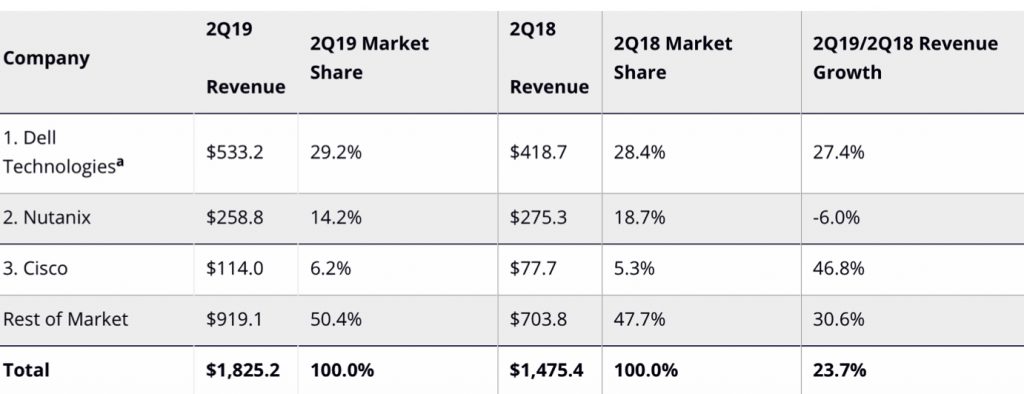

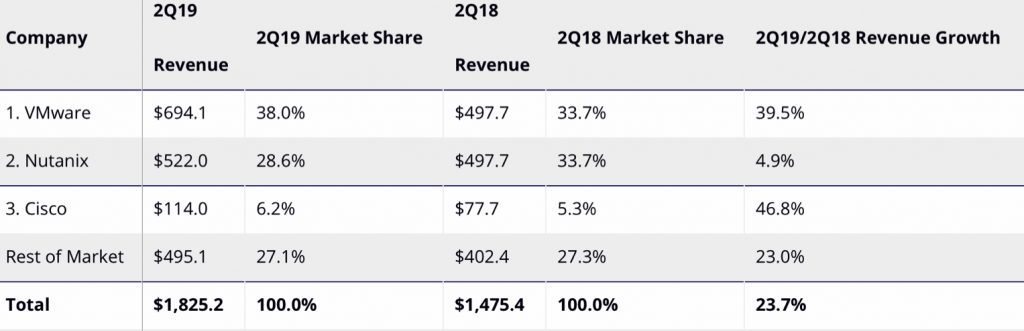

The analysts offer two ways to rank technology suppliers within the hyperconverged systems market: by the brand of the hyperconverged solution or by the owner of the software providing the core hyperconverged capabilities. Rankings based on a branded view of the market can be found in the first table and rankings based on the owner of the hyperconverged software can be found in the third table. Both include all the same software and hardware, summing to the same market size.

As it relates to the branded view of the hyperconverged systems market, Dell Technologies was the largest supplier with $533.2 million in revenue and a 29.2% share. Nutanix generated $258.8 million in branded revenue, which represented 14.2% of the total HCI market during the quarter. Cisco was the third largest branded HCI vendor with $114.0 million in revenue representing a 6.2% market share.

Top 3 Companies, WW Hyperconverged Systems as Branded, 2Q19

(in $ million)

Notes:

- Dell Technologies represents the combined revenues for Dell and EMC sales for all quarters shown.

- From the software ownership view of the market, systems running VMware hyperconverged software represented $694.1 million in total 2Q19 vendor revenue, or 38.0% of the total market.

- Systems running Nutanix hyperconverged software represented $522.0 million in second quarter vendor revenue or 28.6% of the total market.

- Both amounts represent the value of all HCI hardware, HCI software and system infrastructure software, regardless of how it was branded.

Top 3 Companies, WW Hyperconverged Systems

Based on Owner of HCI Software, 2Q19

(in $ million)

Taxonomy Notes

Beginning with the release of 2019 results, IDC has expanded its definition of the hyperconverged systems market segment to include a new breed of systems called disaggregated HCI (hyperconverged infrastructure). Such systems are designed from the ground up to only support distinct/separate compute and storage nodes. An example of such a system in the market today is NetApp’s HCI solution. They offer non-linear scaling of the hyperconverged cluster to make it easier to scale compute and storage resources independent of each other while offering crucial functions such as QoS. For these disaggregated HCI solutions, the storage nodes may not have a hypervisor at all, since they don’t have to run VMs or applications.

IDC defines converged systems as pre-integrated, vendor-certified systems containing server hardware, disk storage systems, networking equipment, and basic element/systems management software. Systems not sold with all four of these components are not counted within this tracker. Specific to management software, IDC includes embedded or integrated management and control software optimized for the auto discovery, provisioning and pooling of physical and virtual compute, storage and networking resources shipped as part of the core, standard integrated system.

Numbers in this press release may not sum due to rounding.

Certified reference systems and integrated infrastructure are pre-integrated, vendor-certified systems containing server hardware, disk storage systems, networking equipment, and basic element/systems management software. Integrated platforms are integrated systems that are sold with additional pre-integrated packaged software and customized system engineering optimized to enable such functions as application development software, databases, testing, and integration tools. Hyperconverged systems collapse core storage and compute functionality into a single, highly virtualized solution. A key characteristic of hyperconverged systems that differentiate these solutions from other integrated systems is their scale-out architecture and their ability to provide all compute and storage functions through the same x86 server-based resources.

Market values for all three segments includes hardware and software but excludes services and support.

IDC considers a unit to be a full system including server, storage, and networking. Individual server, storage, or networking nodes are not counted as units. Hyperconverged system units are counted at the appliance (aka chassis) level. Many hyperconverged appliances are deployed on multinode servers. The frim will count each appliance, not each node, as a single system.

Read also:

Worldwide Converged Systems Revenue Increased 14.8% Year Over Year During the Fourth Quarter of 2018 with Vendor Revenue Reaching $4.15 Billion, According to IDC

Top vendors being Dell, Nutanix and HPE

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter