Seagate Announces Cash Tender Offers

For certain outstanding debt securities

This is a Press Release edited by StorageNewsletter.com on September 4, 2019 at 2:24 pmSeagate HDD Cayman, a subsidiary of Seagate Technology plc, announced the commencement of cash tender offers for:

(i) up to an aggregate principal amount of $250,000,000 of its 4.250% senior notes due 2022,

(ii) up to an aggregate principal amount of $200,000,000 of its 4.750% senior notes due 2023, and

(iii) up to an aggregate principal amount of $75,000,000 of its 4.750% senior notes due 2025.

The offers are being made pursuant to and are subject to the terms and conditions, including a financing condition, set forth in the Offer to Purchase dated September 3, 2019 and the related Letter of Transmittal.

The purpose of the offers is to reduce the company’s refinancing risk by refinancing a portion of the company’s outstanding notes with term debt that has a later maturity date.

Notes purchased in each offer will be retired and cancelled.

The company expects to use cash on hand and borrowings under a new term loan pursuant to an amendment to its existing credit agreement that it intends to enter into concurrently with the Offers to effect the purchase of validly tendered notes pursuant to the offers.

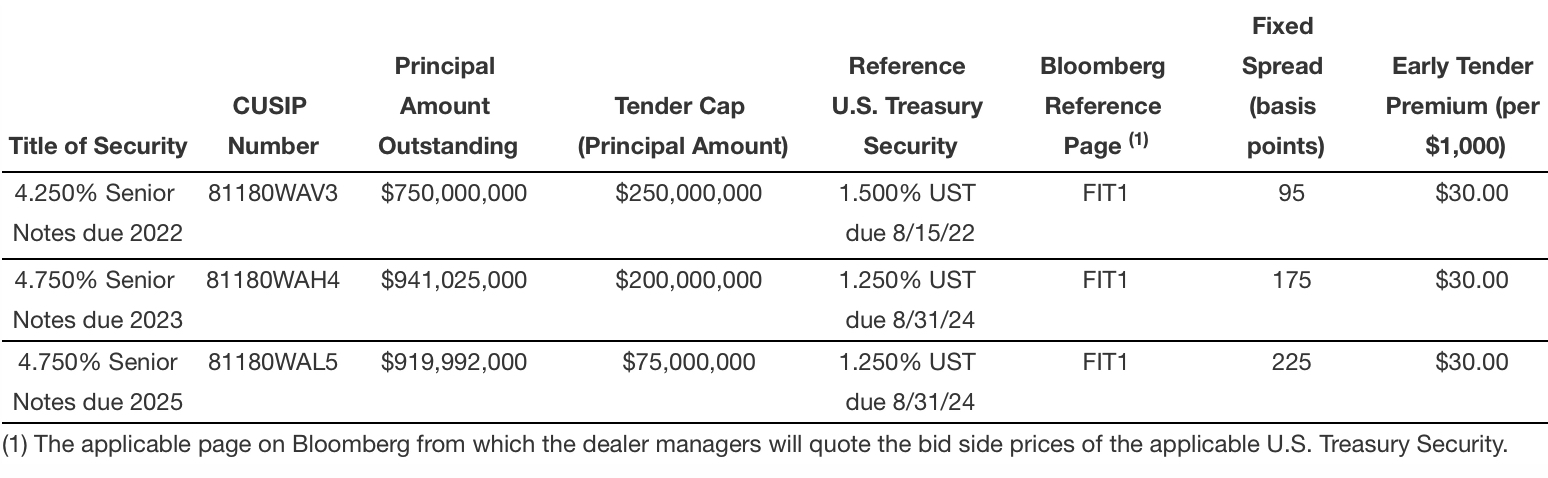

Following table sets forth certain information regarding notes and offers:

Each offer will expire at 11:59PM, New York City time, on September 30, 2019, unless extended or earlier terminated by the company. Tenders of notes may be withdrawn at any time at or prior to 5:00PM, New York City time, on September 16, 2019, but may not be withdrawn thereafter except as required by law.

The consideration paid for notes that are validly tendered and accepted for purchase will be determined in the manner described in the offer to purchase by reference to a fixed spread plus the yield to maturity of the applicable U.S. Treasury Security specified in the table above and in the offer to purchase.

Holders of notes that are validly tendered at or prior to 5:00PM, New York City time, on September 16, 2019 and accepted for purchase will receive the applicable Total Consideration, which includes an early tender premium of $30.00 per $1,000 principal amount of the notes accepted for purchase pursuant to the offers. Holders who validly tender their notes after the early tender deadline and on or prior to the expiration date will only receive the applicable Tender Offer Consideration per $1,000 principal amount of any such notes that are accepted for purchase, which is equal to the applicable total consideration minus the early tender premium.

Payments for notes accepted for purchase will include an amount equal to accrued and unpaid interest thereon from and including their last interest payment date up to, but not including, the applicable settlement date. The settlement date for notes that are validly tendered and not validly withdrawn on or prior to the early tender deadline and accepted for purchase is expected to be September 18, 2019. If the principal amount of a series of notes to be purchased on the early settlement date is less than the applicable tender cap, the settlement date for notes that are validly tendered after the early tender deadline but on or prior to the expiration date and accepted for purchase is expected to be October 2, 2019, the second business day after the expiration date.

Notes of each series validly tendered and not validly withdrawn on or prior to the early tender deadline will be accepted for purchase in priority to notes of such series validly tendered after the early tender deadline. If an offer is fully subscribed as of the early tender deadline, holders who validly tender notes of the applicable series after the early tender deadline will not have any of these notes accepted for purchase. Notes of any series accepted for payment on any settlement date are subject to proration (rounded to avoid the purchase of notes in a principal amount other than $2,000 or an integral multiple of $1,000 in excess thereof) if the aggregate principal amount of the notes of such series validly tendered and not validly withdrawn is greater than the applicable tender cap.

The company’s obligation to accept for purchase and to pay for the notes validly tendered in each offer is subject to the satisfaction or waiver of certain conditions, including a financing condition, as described in the offer to purchase.

Company reserves the right, subject to applicable law, to:

(i) waive the financing condition or any or all other conditions to the offers;

(ii) extend or terminate each offer;

(iii) increase, decrease or eliminate any or all of the tender caps without extending the early tender deadline or the withdrawal deadline; or

(iv) otherwise amend the offers in any respect. The company may amend or modify an offer, or extend the early tender deadline, withdrawal deadline, price determination date, early settlement date, expiration date, or final settlement date with respect to an offer, without amending or modifying or extending such deadline or date with respect to the other offers.

Information relating to offers

BofA Merrill Lynch and Morgan Stanley are acting as the dealer managers for the offers. The information agent and tender agent for the offers is Global Bondholder Services Corp.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter