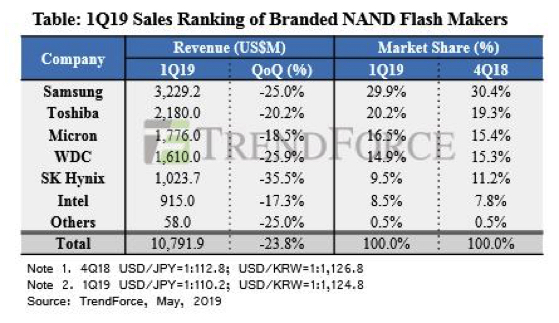

1Q19 Revenue for NAND Flash Brands Fall by 24% From 4Q18 – DRAMeXchange

Samsung -25%, SK Hynix -35.5%, Toshiba -20%, WD -26%, Micron -18.5%, Intel -17%

This is a Press Release edited by StorageNewsletter.com on June 5, 2019 at 2:20 pmDRAMeXchange, a division of TrendForce, Inc., says that besides the effects from the traditional offseason 1Q this year, the weakening demand in 4Q18 has pushed smartphone and server OEMs to begin adjusting their inventories.

This in turn lowered sales bit performance across all products, causing overall NAND flash contract prices to see the most dramatic drop since 1Q18.

1Q19 eMMC/UFS, client SSD and enterprise SSD contract prices fell by 15~20%, 17~31% and 26~32%, respectively.

Although TLC wafer product contract price drops narrowed somewhat, it still fell by up to 19~28 % Q/Q.

Demand for primary products including smartphones, notebook PCs and servers will see a recovery, but this will not be enough to ease inventory pressure, and suppliers will see no end to plunging prices if inventory pressures are unremoved.

Samsung

As other suppliers become affected by the first quarter and customers face falling bit shipments in their struggle to clear out inventories, the company still managed to maintain a 5% bit growth in the first season. This was mainly due to high capacity UFSs selling better than expected in 1Q19 and high capacity client SSDs performing better in shipments. Furthermore, Samsung had increased its sales momentum in the wafer market 1Q19, which did give rise to bit shipment growth but conversely intensified the fall percentage in ASP and brought it to around 25%. 1Q19 revenue came to $3.23 billion, a 25% decline Q/Q.

SK Hynix

Having been dealt a blow by declining shipments in the smartphone market, although it did enjoy a slight growth in average density, this growth still wasn’t enough to offset the deleterious effects. As for other products, SSD shipments experienced a decline simultaneously albeit narrowed to a 6% Q/Q overall, thanks to an increased outflow of sales directed toward wafer markets. The extent to which ASP dropped, however, came all the way to 32%, and 1Q19 NAND flash revenue declined by 35.5% to $1.02 billion.

Toshiba

Impacted likewise by the traditional offseason, and further by the fact that smartphone-manufacturing customers (including Apple) are still making the periodical inventory adjustments, shipments performed weakly for the company. Despite efforts by module manufacturers to strengthen shipment momentum, bit shipments still declined compared to the previous quarter. As prices across product categories fall off a cliff, ASP exhibits a Q/Q decline of around 20%, while total revenue stands at $2.18 billion, a 20.2% decline QoQ.

Western Digital

Despite the shipment weakening effects of the traditional offseason and relatively high inventories up- and down-stream, overall sales performance did not deviate much from firm’s predictions. In an attempt to stimulate sales, the company conducted further price negotiations with customers after the Chinese New Year, which also caused ASP to drop by 22%, even further than originally expected. Price elasticity stimulated demand even further, causing bit shipments to perform better than expected and drop only by about 5%. Total revenue came to $1.61 billion, a Q/Q decline of 25.9%.

Micron

Despite the effects of the traditional offseason and consolidating customer demand, its financial performance was spectacular compared to other suppliers, declining by only 18.5% Q/Q in total revenue to $1.78 billion. Besides the difference in financial periods, the company was also able to move customers to introduce PCIe SSD products adopting 64-layer 3D NANDs, all the while releasing their new client SSD products for PC OEM customers in the 96-layer department, which will prove helpful to its strategy of lowering the proportion of wafer sales. 1Q19 ends with a near-25% decline in ASP, whereas bit sales remain on the rise: 8-10%.

Intel

In wrestling for enterprise SSD market shares, suppliers placed their hopes on price reductions in 1Q19, and the company was no different, registering an ASP drop of over 20% in a single season. Clients, however, continued to switch to SSDs to satisfy their server hardware needs. Combined with the growth we see in content-per-box, this caused its sales bit performance to sustain growth by over 10%, rewarding Intel with a revenue of $915 million this quarter, a 17.3% decline Q/Q.

Read also:

Drop of 20% in 2Q19 NAND Flash Contract Prices – DRAMeXchange

Most dramatic drop since NAND flash supply surpassed demand back in early 2018

March 28, 2019 | Press Release

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter