F5 Networks Acquires NGINX for $670 Million

Building platform designed to deliver end-to-end applications services

This is a Press Release edited by StorageNewsletter.com on March 27, 2019 at 2:22 pmF5 Networks, Inc. and NGINX, Inc. announced a definitive agreement under which F5 will acquire all issued and outstanding shares of privately held NGINX for a total enterprise value of approximately $670 million, subject to certain adjustments.

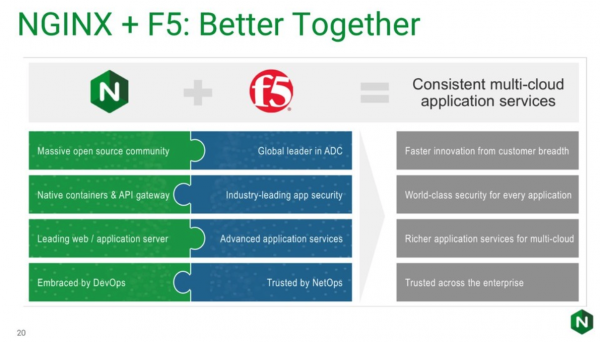

“F5’s acquisition of NGINX strengthens our growth trajectory by accelerating our software and multi-cloud transformation,” said François Locoh-Donou, president and CEO, F5. “By bringing F5’s world-class application security and rich application services portfolio for improving performance, availability, and management together with NGINX’s leading software application delivery and API management solutions, unparalleled credibility and brand recognition in the DevOps community, and massive open source user base, we bridge the divide between NetOps and DevOps with consistent application services across an enterprise’s multi-cloud environment.”

“We believe every organization can benefit from the agility and flexibility enabled by modern technologies without compromising on security, manageability, and reliability,” he continued. “The combined company will enable every customer – from the app developer to the network engineer to the security specialist – with the tools they need to ensure their apps are available and secure across every platform, from the enterprise data center to private and public clouds.”

F5 will enhance NGINX’s current offerings with F5 security solutions and will integrate F5 cloud-native innovations with NGINX’s software load balancing technology, accelerating F5’s time to market of application services for modern, containerized applications. F5 will also leverage its global sales force, channel infrastructure, and partner ecosystem to scale NGINX selling opportunities to the enterprise.

“NGINX and F5 share the same mission and vision. We both believe applications are at the heart of driving digital transformation. And we both believe that an end-to-end application infrastructure – one that spans from code to customer – is needed to deliver apps across a multi-cloud environment,” said Gus Robertson, CEO, NGINX. “I’m excited to continue this journey by adding the power of NGINX’s open source innovation to F5’s ADC leadership and enterprise reach. F5 gains depth with solutions designed for DevOps, while NGINX gains breadth with access to tens of thousands of customers and partners.”

NGINX’s thriving open source community was one of the most attractive elements of this combination, and F5 recognizes the trust that the user community has in NGINX’s technology. Open source is a core part of F5’s multi-cloud strategy and a driver for F5’s next phase of innovation. As such, F5 is committed to continued innovation and increasing investment in the NGINX open source project to empower NGINX’s widespread user communities. It expects the combination will accelerate its product integrations with open source projects and will enhance its technology partnerships with open source vendors.

Upon closing of the acquisition, F5 will maintain the NGINX brand. Gus Robertson, along with NGINX founders Igor Sysoev and Maxim Konovalov, will join F5 and will continue to lead NGINX. Robertson will join F5’s senior management team, reporting to François Locoh-Donou. F5 will maintain NGINX’s operations in San Francisco, CA, California and other locations globally.

Transaction Details

The acquisition of NGINX is expected to increase F5’s software revenue growth and increase the company’s software revenue mix in fiscal year 2019. It secures F5’s Horizon 2 (FY21 to FY22) objectives of mid-to-high single-digit revenue and double-digit non-GAAP earnings per share growth. Short-term, the firm expects that the acquisition and organic investment in new and emerging solutions will result in modest earnings dilution in FY19 and FY20.

F5 provided the following regarding its Horizon 1 (FY19 to FY20) outlook, following the completion of the NGINX acquisition:

| Analyst and Investor Meeting Horizon 1 (FY19-FY20) Outlook, March 2018 |

Post-NGINX Acquisition Horizon 1 (FY19-FY20) Guidance |

|

|---|---|---|

| Total Revenue Growth | Low-to-mid single-digit growth | Mid single-digit growth |

| Software1 Revenue Growth | 30%-35%+ growth | 35%-40%+ growth |

| Software1 as a % of Product Revenue | Mid 20s% | 25%-30% |

| Non-GAAP Gross Margin | ~85% | ~85% |

| Non-GAAP Operating Margin | 35%-37% | 33%-35% |

| Non-GAAP EPS | Mid-to-high single-digit growth | Low single-digit growth |

1 Software includes standalone Virtual Editions, including subscriptions and utility, and as a service offerings

F5 intends to fund the transaction through cash on its balance sheet. In conjunction with the transaction, the company is suspending its common stock share repurchase program. It will continue to evaluate market conditions and other factors including F5’s capital requirements in determining when and whether to continue such program and the levels of such program. The program does not require the purchase of any minimum number of shares and the program may be modified, suspended, or discontinued at any time.

The acquisition has been approved by the boards of directors of both F5 and NGINX and, following execution of the definitive agreement, received the requisite shareholder approval of NGINX. It is subject to regulatory approvals and other customary closing conditions and is expected to close in t2Q19.

Foros LLC acted as financial advisor and Wilson Sonsini Goodrich & Rosati provided legal counsel to F5 on this transaction. Qatalyst Partners served as financial advisor to NGINX.

Additional Information

- Letter to F5 Employees from CEO François Locoh-Donou Announcing NGINX Acquisition – F5 Newsroom Blog Post

- NGINX Joins F5 – Blog Post from NGINX CEO Gus Robertson

Comments

It's a surprise for the market as F5, a commercial enterprise company specialized in network infrastructures, and NGINX, an open source ISV dedicated in web and application services optimization, playing in two different market segments, have agreed to merge.

As you can read F5 confirms the definitive agreement between the two companies.

The only first synergy seems to be around load balancing in a clear different enterprise and market culture but both target infrastructure at a different levels so convergence between DevOps and NetOps makes sense.

Founded in 2011, NGINX has raised so far $103 million meaning that the $670 illlion of the acquisition represents a ratio of 6.5 globally on investment and, for 250+ employees, it is roughly $2.6 million more than 10 times a famous number of $250,000 per employee.

This acquisition is also the biggest one in F5 history (source Wikipedia):

- uRoam (SSL VPN vendor) for $25 million in 2003

- Magnifire WebSystems (web application firewall) for $29 million in 2004

- Swan Labs (WAN acceleration and web acceleration) for $43 million in 2005

- Acopia Networks (file virtualization) for 210 million in 2007

- DPI intellectual property from Crescendo Networks in 2011 (amount undisclosed)

- Traffix Systems (Diameter protocol switching technology) in 2012 (amount undisclosed)

- LineRate Systems in 2013 (high-performance, software-based Load Balancer for x86 systems with node.js datapath scripting)

- Versafe (anti-fraud, anti-phishing, and anti-malware solutions) for $87.7 million in 2013

- Defense.Net (cloud-based DDoS mitigation service) for $49.4 million in 2014

- CloudWeaver formerly Lyatiss (Application Defined Networking) in 2015 (amount undisclosed)

- NGINX (web server and application server vendor) for 670 million on March 11, 2019

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter