CAGR of 14.1% for Revenues From Data Protection Software in SMEs Through 2028 – Fact.MR

Increase estimated at $750 million in 2018 over 2017

This is a Press Release edited by StorageNewsletter.com on November 2, 2018 at 2:35 pmThe data protection software market continues to observe bullish prospects, with a revenue increase estimated at over $750 million in 2018 over 2017, according to a recent Fact.MR study.

Managed services have traditionally reigned supreme in the data protection software market, meanwhile professional services have rapidly gained ground recently.

Click to enlarge

The study, Data Protection Software Market Forecast, Trend Analysis & Competition Tracking – Global Market Insights 2018 to 2028 (170 pages, $4,500), envisages professional services to pose a close competition to managed services in terms of revenue share, with the difference in 2018 estimated at just 1%.

Demand for managed services continues to remain at an all-time-high, with new providers emerging in the market as SMEs outsource their IT requirements to free up internal resources for focusing on critical activities.

However, professional services are now attracting established organizations and SMEs alike, owing to their proactivity in identifying sensitive data and assessing the same. Professional data protection services further aid in demonstrating compliance for data processing to maintain security, meanwhile facilitating establishment and maintaining of data inventory.

Sensing varied requirements from end-use verticals, data protection software developers have introduced diverse solutions to the market, ranging from backup and recovery to data compliance. While backup and recovery and DR have traditionally subjugated revenue share of worldwide data protection software solution sales, growth of data security and data compliance has witnessed rapid rise recently, and the status quo is expected to prevail in the forthcoming years.

“Several business are relying on the in-house cybersecurity professionals, while seeking the same by outsourcing to IT firms. The rate at which the cybercriminals are breaching the security systems is met by rising number of perks businesses, who are willing to spend more to acquire tech minds. Most of the compliance initiatives are undergird by national legislations, rooted in security concerns that revolve around solutions and services of data protection software. However, enterprises are focusing on the management, governing and ensuring compliance to overwhelm the amount of data being produced, particular in the face of worldwide legislations such as GDPR, instead of national regulations,” says a lead analyst at Fact.MR.

Revenues from sales of data protection software to SMEs have gained a significant uptick recently, as small business owners hold the risk of costly repercussions if data protection compliance is ignored. A CAGR of 14.1% has been foreseen for revenues from data protection software sales in SMEs through 2028. However, revenue share of large enterprises in the data protection software market continues to remain comparatively higher over the period of forecast. Business that manage the time for complying with regulations apropos of the data protection are expected to witness a robust and reliable establishment of contractual relationships, compliance processes, information security and data management.

Cloud-based deployment of data protection software is estimated to speed up, to account for nearly-equal revenue share of the data protection software market as that of on-premise deployment, despite latter’s supremacy. Cloud-based deployment of the data protection software, as the technology aids in ensuring data protection practices compliant with regulations. However, security issues continue to prevail in case of cloud-based data protection software deployments, which in turn underpins the preeminence of on-premise deployment.

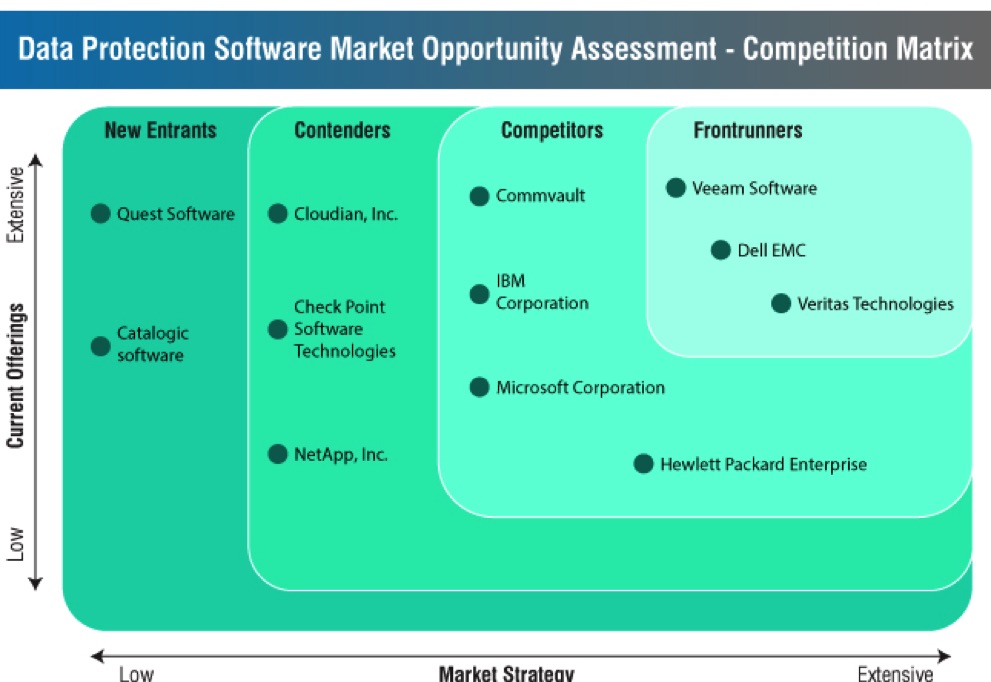

Key vendors in the data protection software market are focusing on global expansion, by installing new facilities or entering into partnership with software distributors or vendors. The primary objective behind such expansion strategies is to strengthen their support services associated with advanced data security solutions. Leading data protection software market vendors are also concentrating on application-specific advanced data protection suite offerings, to prevent data theft and data loss, thereby gaining customer loyalty and enhancing their business profiles.

Click to enlarge

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter