2018 Digital Storage for Media and Entertainment Market – Coughlin Associates

From 2017 to 2023 TAM to increase by 1.9X from $4.5 billion to $8.5 billion

This is a Press Release edited by StorageNewsletter.com on August 28, 2018 at 2:31 pm  This report, 2018 Digital Storage for Media and Entertainment Report – Digital Storage for the Capture, Creation, Editing, Archiving and Distribution of Entertainment Content ($7,000), was written by Thomas Coughlin, Coughlin Associates.

This report, 2018 Digital Storage for Media and Entertainment Report – Digital Storage for the Capture, Creation, Editing, Archiving and Distribution of Entertainment Content ($7,000), was written by Thomas Coughlin, Coughlin Associates.

Executive Summary

This report ($7,000) is the sixteenth report on data storage and emerging applications and the fourteenth report on data storage in the entertainment and media market published by Coughlin Associates.

Data storage is a key element in the digital transformation of content creation, editing, distribution and reception. Data capacity and communication speed increases, changing form factors, lowered product prices and the growing familiarity with digital editing, digital intermediates and various forms of digital distribution are key components in the continued growth and development of entertainment.

Because of the large file sizes required for high resolution and multi-camera images there is increasing demand for high capacity storage devices as well as high performance storage. The entire content value chain of content creation, editing, archiving, distribution as well as consumer electronics content reception devices, provide an accelerating feed-forward mechanism. This drives growth in data storage for all entertainment content applications.

For many archiving and distribution applications where content is relatively static, low cost/high capacity SATA HDD storage, optical discs and tape-based storage libraries will predominate, with some flash memory used for caching and metadata. Hard disk drives as well as enterprise SSDs are also used in high performance storage applications where storage cost factors must be balanced with performance requirements.

For applications requiring rugged field use or fast playback response flash memory either as cards or SSDs are now standard fare.

Due to input from industry groups, SMPTE, HPA, EBU (and other media and entertainment workers) survey results and discussions with industry end users and equipment providers we have continued to adjust many of our models for current storage estimates as well as future growth in 2018. The 2018 report extends the updated capacity and storage cost model we developed in 2017. In addition, we have expanded the impact of solid state storage in our later projections based upon expected lower flash memory storage costs.

Key points of the report

• Creation, distribution and conversion of video content creates a huge demand driver for storage device and systems manufacturers

• As image resolution increases and as stereoscopic VR video becomes more common, storage requirements explode

• The development of 4K TV and other high-resolution venues in the home and in mobile devices will drive the demand for digital content (especially enabled by high HEVC (H.265) compression.

• HDD areal density increases are slower but flash memory growth has increased. This might cause more applications to use flash memory

• Activity to create capture and display devices for 8K X 4K content is occurring with planned implementation in common media systems by the next decade

• Active archiving will drive increased use of HDD storage for ‘archiving’ applications, supplementing tape for long term archives

• Optical storage developments for higher capacity write-once Blu-ray optical cartridges will create higher capacity discs and this may help slow the reduction in optical disc archiving

• Flash memory dominates cameras and is finding wider use in post production and content distribution systems

• From 2017 to 2023 entertainment and media digital storage TAM (without archiving and preservation) will increase by about 1.9X from $4.5 billion to $8.5 billion

• The growth in storage capacities will result in a total media and entertainment storage revenue growth of about 1.9X between 2017 and 2023 (from $6.9 billion to $12.8 billion)

• Overall annual storage capacity demand for non-archival applications is expected to increase over the period from 2017 to 2023 by 5.2X from 11.7EB to 60.3EB

• Between 2017 and 2023 we expect about a 3.5X increase in the required digital storage capacity used in the entertainment industry and about a 3.7X increase in storage capacity shipped per year (from 51.9EB to 191.9EB)

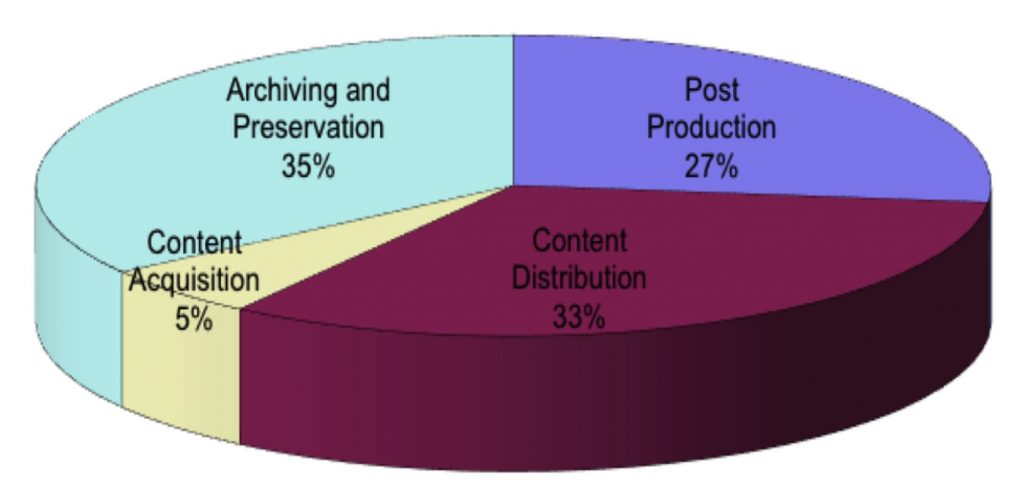

• In 2017 archiving and preservation is estimated to have been 35% of total storage revenue followed by content distribution (33%), post-production (27%) and content acquisition (5%)

• In 2023 the projected revenue distribution is 34% archiving and preservation, 33% content distribution, 26% post production and 7% content acquisition

• By 2023 we expect about 55% of archived content to be in near-line and object storage, up from 45% in 2017

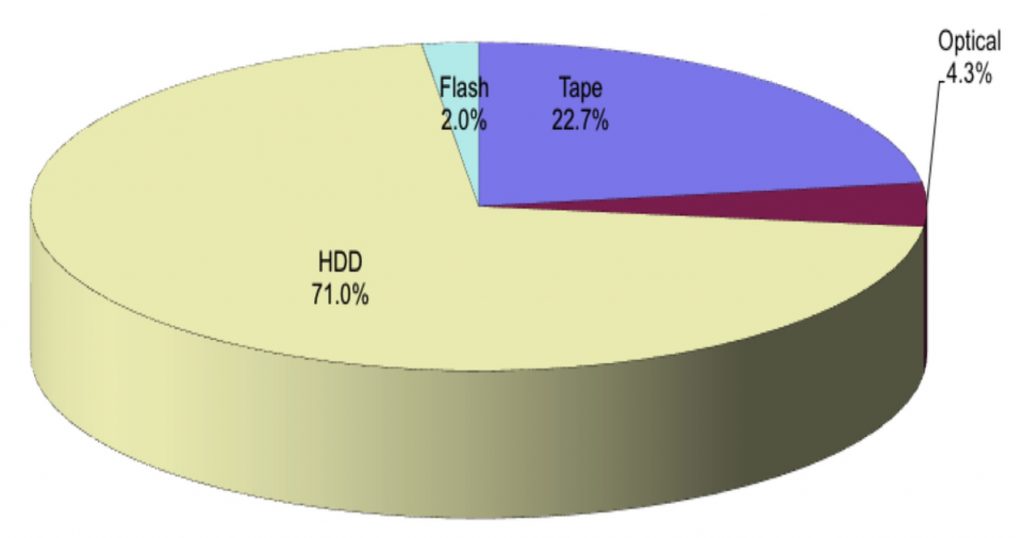

• in 2017 we estimate that 71% of the total storage media capacity shipped for all the digital entertainment content segments was in HDDs with digital tape at 22.7%, 4.3% optical discs and flash at 2.0%

• By 2023 tape has been reduced to 15.4%, HDDs shipped capacity is 75.5%, optical disc capacity is down to about 1.0% and flash capacity percentage is at 8.1%

• Media revenue is expected to increase about 1.6X from 2017 to 2023 ($1.8 billion to $2.9 billion).

• The single biggest application (by storage capacity) for digital storage in the next several years as well as one of the most challenging is the digital conversion of film, video tape and other analog formats

• Over 131EB of new digital storage will be used for digital archiving and content conversion and preservation by 2023

• Storage in remote ‘clouds’ is playing an important role in enabling collaborative workflows and in archiving

• Overall cloud storage capacity for media and entertainment is expected to grow about 13.3X between 2017 and 2023 (5.1EB to 68.2EB)

• Overall object storage capacity for media and entertainment is expected to grow about 4.9X between 2017 and 2023 (10.4EB to 51.6EB)

• Cloud storage revenue will be about $2.7 billion by 2023

• By our estimates, professional media and entertainment storage capacity represents about 4.5% of total shipped storage capacity in 2017. Professional media and entertainment uses about 13% of all tape capacity shipments, 8% of all HDD shipments and 2% of all flash memory shipments in 2017

• Digital cinema conversion complete in most countries with movement to 4K video wide-spread

• Silver halide film as a content distribution media will vanish before the end of the decade.

• AXF and other new standards may help format obsolescence

• Several petabytes of storage can be required for a complete

stereoscopic digital movie production at 4K resolution and there is

some production work as high as 8K

• By the next decade total video captured for a high end digital

production could be hundreds of petabytes, approaching 1EB

• Movement to IP based workflows will reduce total costs for content management, including storage

• Non-linear editing requires high performance storage devices. Over the forecast period lower network storage costs and higher performing low cost storage networks will result in faster growth of network storage than direct attached and local.

• ATA HDD arrays have become the dominant mode for readily retrievable fixed content storage, but flash memory will grow for this use as costs decline

• Magnetic tape will remain as an archival media although use in other applications is in decline, particularly content capture

• Flash memory is the clear majority storage media in professional video cameras with survey results showing about 56% utilization in the 2018 survey

• The continued need to storage for higher performance and high capacity workflows are driving strong storage growth in the projection periods – assuming no great negative economic trends.

Media and Entertainment market storage revenue share by segment in 2017

Market Share of M&E Storage Media by Storage Capacity Shipped in 2017

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter