Western Digital: Fiscal 4Q18 Financial Results

Demand for HDDs and flash-based offerings remained strong

This is a Press Release edited by StorageNewsletter.com on July 27, 2018 at 2:21 pm| (in $ million) | 4Q17 | 4Q18 | FY17 | FY18 |

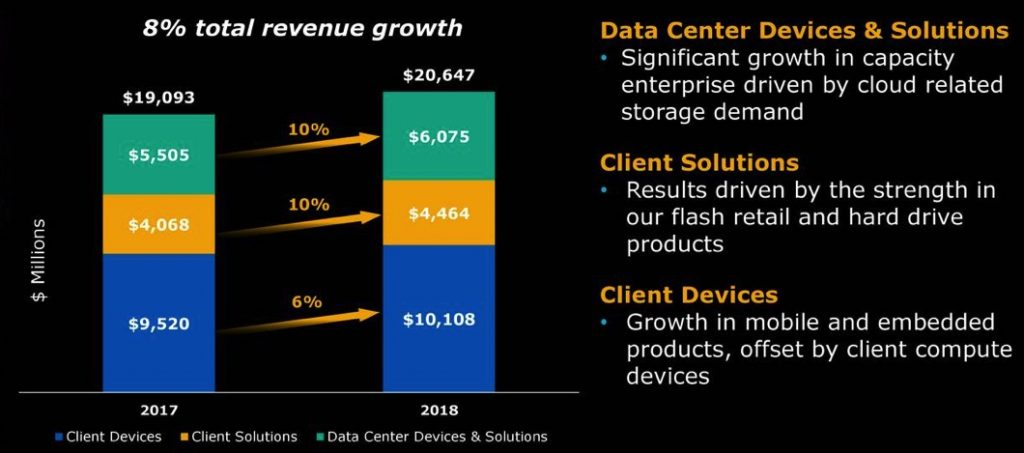

| Revenue | 4,842 | 5,117 | 19,093 | 20,647 |

| Growth | 6% | 8% | ||

| Net income (loss) | 280 | 756 | 397 | 675 |

Western Digital Corp. reported revenue of $5.1 billion for its fourth fiscal quarter ended June 29, 2018.

Operating income was $843 million with net income of $756 million, or $2.46 per share. Excluding certain non-GAAP adjustments, the company achieved non-GAAP operating income of $1.3 billion and non-GAAP net income of $1.1 billion, or $3.61 per share.

In the year-ago quarter, the company reported revenue of $4.8 billion, operating income of $652 million and net income of $280 million, or $0.93 per share. Non-GAAP operating income in the year-ago quarter was $1.2 billion and non-GAAP net income was $881 million, or $2.93 per share.

The company generated $863 million in cash from operations during the fourth fiscal quarter of 2018, ending with $5.1 billion of total cash, cash equivalents and available-for-sale securities.

On May 2, 2018, the company declared a cash dividend of $0.50 per share of its common stock, which was paid to shareholders on July 16, 2018.

For fiscal 2018, the company achieved record revenue of $20.6 billion, operating income of $3.6 billion and net income of $675 million, or $2.20 per share, compared to fiscal 2017 revenue of $19.1 billion, operating income of $2.0 billion and net income of $397 million, or $1.34 per share. On a non-GAAP basis, fiscal 2018 operating income was $5.4 billion and net income was $4.5 billion, or $14.73 per share, compared to fiscal 2017 operating income of $3.9 billion and net income of $2.7 billion, or $9.19 per share.

The company generated $4.2 billion in cash from operations during the fiscal year 2018 and returned $1.2 billion to shareholders through share repurchases and dividends.

“I am pleased with our financial performance as we report strong revenue, profitability and cash flow generation,” said Steve Milligan, CEO. “The Western Digital platform allows us to continue to deliver differentiated financial performance enabling us to effectively navigate dynamic market conditions. With a deepening customer engagement, and our growing exposure to secular growth areas such as mobility and cloud, we remain poised to deliver compelling long-term shareholder value.”

The board of directors has authorized a new $5 billion share repurchase program, replacing all prior programs.

“Western Digital’s products and solutions are a key enabler of the ongoing growth in the volume and value of data. Our differentiated performance has demonstrated the stability, reliability and resiliency of our business model,” said Milligan. “This new significant share repurchase authorization reflects ongoing confidence in the fundamentals of our business and its cash flow generation capabilities. We believe it is an excellent capital allocation opportunity to enhance long-term shareholder value.”

Comments

For FY18, WDC grew revenue at the high end of its long-term range of 4% to 8% as demand for hard drive and flash-based offerings remained strong.

Click to enlarge

For this June quarter, revenue for Data Center Devices and Solutions was $1.6 billion, an increase of 14% Y/Y. The growth continues to be driven by cloud-related storage. Client Devices revenue was $2.5 billion, an increase of 3% Y/Y. The company had significant growth in mobile and embedded products offset by client compute devices. Client Solutions revenue was $1 billion, an increase of 2% Y/Y driven by the strength of global brands sold through retail.

Demand from cloud customers drove continued adoption of high-capacity helium drives, particularly at the 12TB capacity. On a cumulative basis, since the launch of firm's helium platform, the manufacturer has shipped 30 million drives. It estimates that the overall exabyte growth in capacity enterprise was more than Y/Y growth for calendar 2018.

It sees that, in calendar 2018, industry bit growth will be at the high end of the long-term range. These factors, together with a softer demand environment in key sectors such as mobility, are causing flash pricing to decline in a rate faster than in past quarters. The flash industry has been in the midst of adjusting to these normalization trends, and the firm expects pricing pressure to continue through the remainder of calendar 2018. In this context and in response to the changing market environment, it reviews plans for flash with joint venture partner Toshiba Memory Corp. to moderate capital investments.

The transition to BiCS496-layer technology is underway, and for the full calendar year 2018, WDC expects its 3D flash bit output to constitute nearly 75% of its total captive bit supply.

The company expects revenue of $5.1 billion to $5.2 billion for next quarter, about the same figure recorded in 4FQ18.

Volume and HDD Share

(units in million)

| HDDs | Enterprise | Desktop | Notebook | CE | Branded | Total HDDs | HDD share | Exabyte Shipped |

Average GB/drive |

ASP |

| 2Q15 | 8.0 | 15.4 | 21.2 | 9.3 | 7.2 | 61.0 | 43.4% | 66.4 | 1,087 | $60 |

| 3Q15 | 7.5 | 13.5 | 18.8 | 8.6 | 6.1 | 54.5 | 43.6% | 61.3 | 1,123 | $61 |

| 4Q15 | 7.2 | 11.6 | 15.5 | 9.1 | 5.2 | 48.5 | 43.7% | 56.2 | 1,159 | $60 |

| 1Q16 | 7.2 | 11.7 | 15.8 | 11.5 | 5.6 | 51.7 | 43.6% | 63.5 | 1,228 | $60 |

| 2Q16 | 7.0 | 12.5 | 15.3 | 8.5 | 6.4 | 49.7 | 43.2% | 69.1 | 1,390 | $61 |

| 3Q16 | 6.4 | 10.7 | 13.6 | 7.3 | 5.2 | 43.1 | 43.2% | 63.7 | 1,443 | $60 |

| 4Q16 | 6.0 | 7.9 | 11.4 | 10.0 | 4.7 | 40.1 | 40.7% | 66.1 | 1,648 | $63 |

| 1Q17 | 6.5 | 9.0 | 14.6 | 12.3 | 5.2 | 47.5 | 41.9% | 80.0 | 1,684 | $61 |

| 2Q17 | 6.4 | 9.9 | 14.7 | 8.3 | 5.5 | 44.8 | 39.9% | 77.8 | 1,737 | $62 |

| 3Q17 | 5.8 | 9.4 | 11.3 | 7.7 | 4.9 | 39.1 | 39.6% | 74.2 | 1,898 | $63 |

| 4Q17 | 6.2 | 8.9 | 10.3 | 9.6 | 4.3 | 39.3 | 40.8% | 81.2 | 2,066 | $63 |

| 1Q18 | 6.1 | 9.5 | 11.4 | 10.3 | 4.9 | 42.2 | 40.5% | 87.4 | 2,071 | $61 |

| 2Q18 | 6.8 | 10.2 | 10.9 | 8.6 | 5.8 | 42.3 | 40.4% | 95.3 | 2,253 | $63 |

| 3Q18 | 7.6 | 7.9 | 9.7 | 6.1 | 5.1 | 36.4 | 38.8% | 100.3 | 2,755 | $72 |

| 4Q18 |

75 |

8.2 |

9.6 |

89 |

4.8 |

39.0 |

NA |

106.5 |

NA |

$70 |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter