Nutanix: Fiscal 3Q18 Financial Results

One of WW fastest growing storage company but not able to be profitable

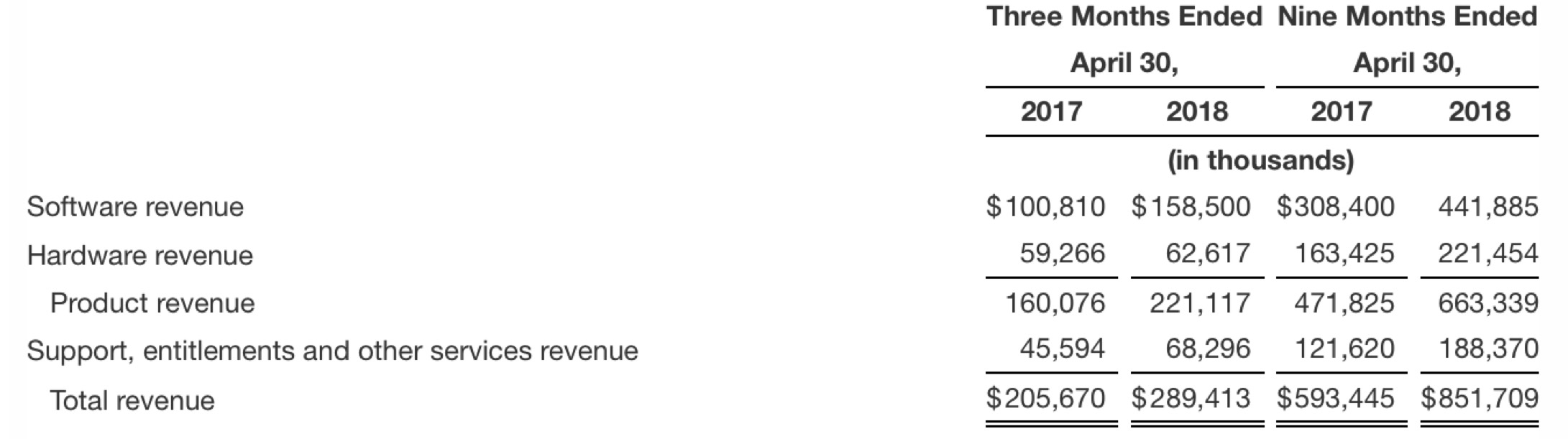

This is a Press Release edited by StorageNewsletter.com on May 28, 2018 at 2:14 pm| (in $ million) | 3Q17 | 3Q18 | 9 mo. 17 | 9 mo. 18 |

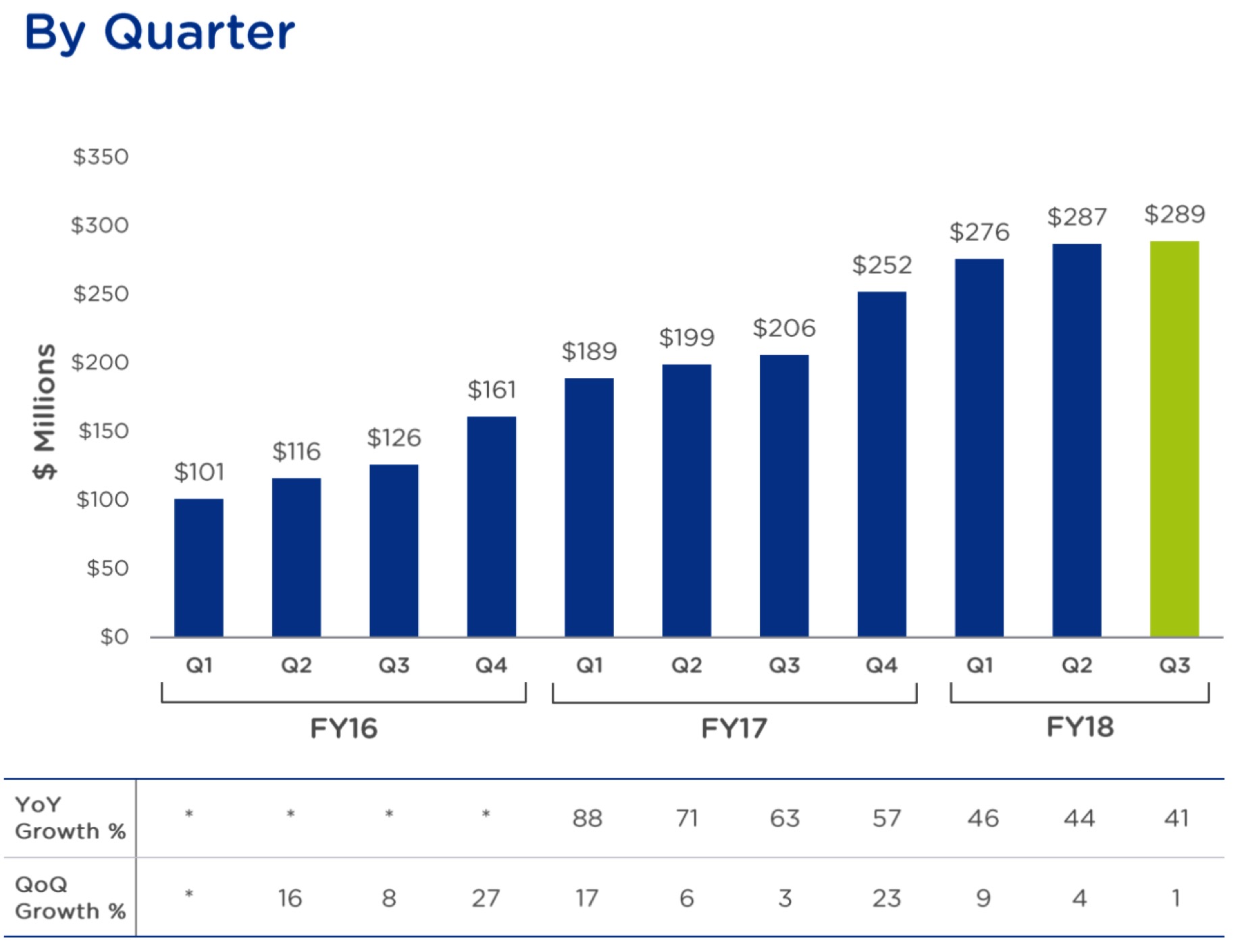

| Revenue | 205.7 | 289.4 | 593.4 | 851.7 |

| Growth | 41% | 44% | ||

| Net income (loss) | (96.8) | (85.7) | (313.5) | (209.8) |

Nutanix, Inc. announced financial results for its third quarter of fiscal 2018, ended April 30, 2018.

3FQ18 Financial Highlights

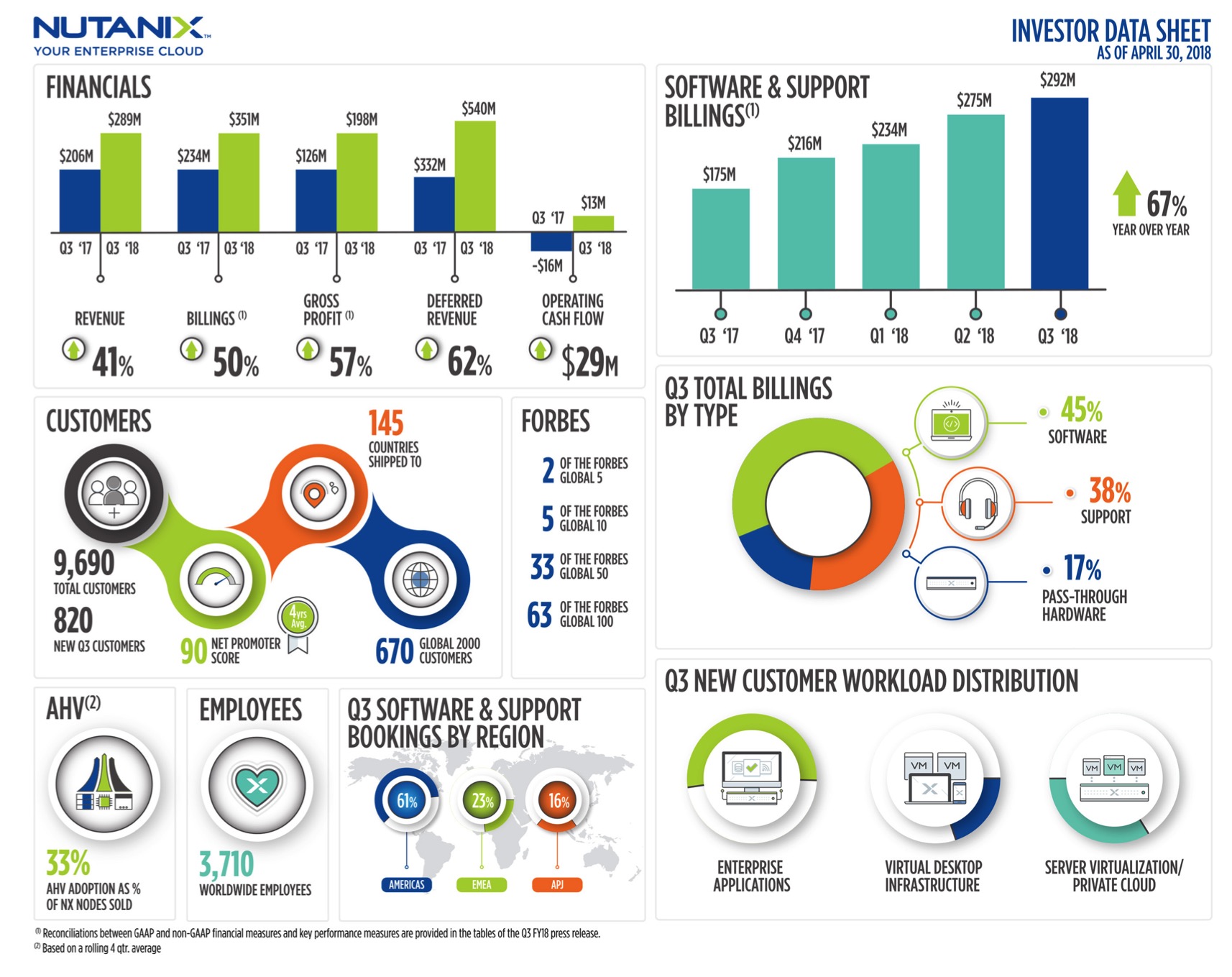

• Revenue: $289.4 million, growing 41% year-over-year from $205.7 million in 3FQ17, reflecting the elimination of approximately $52 million in pass-through hardware revenue in the quarter as the company executes its shift toward increasing software revenue*

• Billings: $351.2 million, growing 50% year-over-year from $234.1 million in 3FQ17

• Gross Profit: GAAP gross profit of $193.8 million, up 58% year-over-year from $122.5 million in the third quarter of fiscal 2017; Non-GAAP gross profit of $197.8 million, up 57% year-over-year from $125.9 million in 3FQ17

• Gross Margin: GAAP gross margin of 67.0%, up from 59.5% in 3FQ17; Non-GAAP gross margin of 68.4%, up from 61.2% in 3FQ17

• Net Loss: GAAP net loss of $85.7 million, compared to a GAAP net loss of $96.8 million 3FQ17; Non-GAAP net loss of $34.6 million, compared to a non-GAAP net loss of $45.7 million in 3FQ17

• Net Loss Per Share: GAAP net loss per share of $0.51, compared to a GAAP net loss per share of $0.67 in 3FQ17; Non-GAAP net loss per share of $0.21, compared to a non-GAAP net loss per share of $0.32 in 3FQ17

• Cash and Short-term Investments: $923.5 million, up 164% from 3FQ17, and up from $918 million in 2FQ18

• Deferred Revenue: $539.9 million, up 62% from 3FQ17

• Operating Cash Flow: $13.3 million, compared to $(16.0) million in 3FQ17

• Free Cash Flow: $(0.8) million, compared to $(29.2) million in 3FQ17

“Investment in our innovation engine is delivering strong results. At .NEXT, we introduced major new products that extend our unique consumer-grade value into security, networking, database operations, and multi-cloud markets,” said Dheeraj Pandey, chairman, founder and CEO. “Our continued industry-leading Net Promoter Score proves that a relentless focus on our customers drives our continued success.”

“Demand for our solutions remains strong as we saw 67% growth in software and support billings and 55% growth in software and support revenue. We had strong success in our hiring in the quarter that positions us to deliver on our future growth plans, as we outlined at our March Investor Day,” said Duston Williams, CFO. “The continued growth in our software and support billings and gross margin expansion in the quarter demonstrates we are successfully executing on our transition to a software-defined business model.“

Recent company Highlights

• Acquired Netsil, Inc.: Completed thi acquisition of a provider of application discovery and operations management that enables observability in modern distributed cloud environments.

• Executed on Transition to Software-Defined Business Model: Grew software and support billings by 67% year-over-year, including three software and support deals worth more than $5 million each. Pass-through hardware billings decreased to 17% of total billings in the quarter, down from 25% in the year-ago quarter.

• Improved AHV Penetration: Grew adoption of AHV, the company’s built-in hypervisor, to 33%, based on a four-quarter rolling average of nodes using AHV as a%age of NX nodes sold.

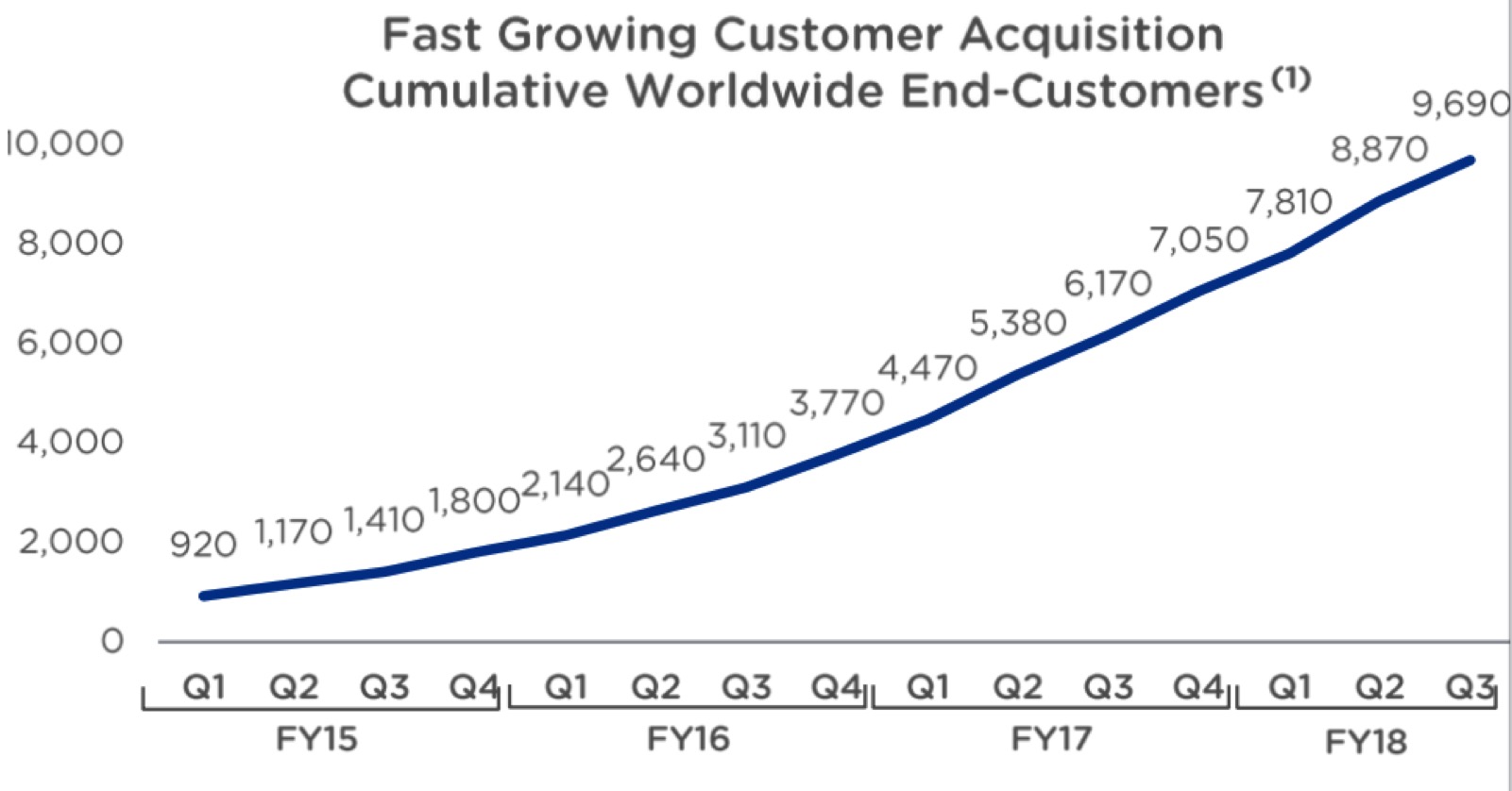

• Expanded Customer Base: Ended 3FQ18 with 9,690 end-customers, adding 820 new end-customers during the quarter and growing deals greater than $1 million by 28% year-over-year.

• Announced Three New Products for Multi-Cloud Environments:

- Flow, which completes its core infrastructure services offering and provides customers with a software-defined networking solution for the multi-cloud era. It solves customers’ security concerns through an application-centric focus combined with native VM microsegmentation that protects against internal and external threats.

- Era, which expands on the company’s platform services offering. Beginning with Copy Data Management (CDM), it empowers database administrators to clone, restore, and refresh their databases to any point in time leveraging a virtual time-machine. Copy Data Management, along with other planned offerings from Era, enables companies to address the complexity and cost of data sprawl with a sophisticated service that makes complex database operations simple.

- Beam, which introduces the company’s first software-as-a-service offering to the market. It enables IT managers to visualize, predict and manage cost, security, and regulations across multiple clouds. This offering helps application owners with the high costs of their cloud services and the lack of visibility and control of their service consumption.

• Increased Participation in 4th Annual .NEXT Conference: Nearly 5,000 attendees with 35+ customer speakers, 40+ partner sponsors, and keynote addresses from visionaries including Anthony Bourdain and TED talk speaker Dr. Brené Brown; partners including Jason Lochhead, CTO, infrastructure, Cyxtera; customers including Vijay Luthra, SVP, global head of technology infrastructure services, Northern Trust – Chicago, IL; and strategic alliances including Brian Stevens, CTO of Google Cloud. Additionally, the company hosted 20,000+ attendees at .NEXT events around the world over the past year.

• Hired New MD of operations in India: Hired Sankalp Saxena as SVP and MD of operations of its India subsidiary to lead its India operations and execute on the company’s growth strategy, including product innovation, talent acquisition, and brand building.

• Named as a Top Public Cloud company to Work For: Glassdoor and Battery Ventures ranked the firm one of the top 10 public cloud computing companies to work for in a recent report.

For next quarter of fiscal 2018, the company expects:

• Revenues between $295 and $300 million; assuming the elimination of approximately $95 million in pass-through hardware revenue* and an increased billings-to-revenue ratio of 1.25;

• Non-GAAP gross margin between 73% and 74%;

• Non-GAAP operating expenses between $250 and $260 million;

• Non-GAAP net loss per share between $0.20 and $0.22, using 171 million weighted shares outstanding.

*The elimination of hardware revenue is based on the estimated cost of hardware in transactions where customers purchase such hardware directly from contract manufacturers.

Comments

One of the fastest growing storage company in the word, Nutanix saw quarterly revenue climbing at $289 million, ahead of guidance of $275 million to $280 million, increasing 41% Y/Y but a mere 1% Q/Q, with net loss continuing at a high level, $86 million, down 11% Q/Q and up 37% Y/Y.

Revenue growth

This is the third quarter in transition towards a software-defined business model and was well managed.

Click to enlarge

$351 million was recorded in total billing in 3FQ18, +50% Y/Y, and $292 million in software and support billings, +67%.

Customers at the end of the quarter:

- * Total of 9,690, +57% Y/Y

- * 670 Global 2000 customers

- * 446 with lifetime bookings of $1-3 million

- * 80 with lifetime bookings of $3-5 million

- * 67 with lifetime bookings of more than $5 million

- * 73% of bookings from repeat customers

- * 73% of bookings from international customers

In this quarter, top four deals were in excess of $5 million each and three were software only. Of those deals, three were noteworthy for the customers decision to go all in with hypervisor Nutanix AHV. The third largest deal of the quarter with a Global 2000 retail customer with whom the company has more than $35 million in lifetime bookings. It was one of its 47 deals worth more than a $1 million in the quarter.

On a non-GAAP basis, Nutanix expect revenue between $295 million and $300 million or up 2% to 4%, assuming the elimination of approximately $95 million in pass-through hardware revenue.

"With this execution, we are well-positioned to reach our goal of $3 billion in billings for fiscal 2021," said the storage vendor.

According to CFO Duston Williams, "in Q3, we targeted to eliminate $45 million of pass-through hardware revenue, and I'm pleased to report that we exceeded our plan and eliminated $52 million of pass-through hardware revenue during the quarter. (...) During the quarter, we added over 60 new sales teams."

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter