Commvault: Fiscal 3Q18 Financial Results

Record revenue, up 7% Q/Q, with biggest loss since several years

This is a Press Release edited by StorageNewsletter.com on January 25, 2018 at 1:17 pm| (in $ million) | 3Q17 | 3Q18 | 9 mo. 17 | 9 mo. 18 |

| Revenue | 167.1 | 180.4 | 428.3 | 514.5 |

| Growth | 8% | 20% | ||

| Net income (loss) | 2.0 | (59.0) | (0.7) | (60.2) |

Commvault Systems, Inc. announced its financial results for the third quarter ended December 31, 2017.

N. Robert Hammer, chairman, president and CEO stated: “We achieved record quarterly revenue of $180.4 million highlighted by sequential software and products revenue growth of 13% driven by an increase in EMEA enterprise revenue transactions, a 19% year over year increase in deferred revenue and a 17% year over year increase in operating cash flows. We continue to make excellent progress with our subscription based pricing models, which represents approximately 20% of our year to date software revenue, more than double our historical run rate. We also successfully launched our Commvault HyperScale Appliance and Commvault HyperScale Software, which we believe are resonating with customers and partners and will begin to meaningfully impact our results in fiscal 2019. We are focused on executing a solid fiscal fourth quarter to build a stronger foundation for revenue and earnings growth in fiscal 2019. Finally, we remained opportunistic during the third fiscal quarter, repurchasing $80 million of our common stock.”

Total revenues for the third quarter of fiscal 2018 were $180.4 million, an increase of 8% year-over-year, and 7% sequentially. Software and products revenue was $81.4 million, an increase of 4% year-over-year, and 13% sequentially. Services revenue in the quarter was $98.9 million, an increase of 12% year-over-year and 3% sequentially.

On a GAAP basis, income from operations (EBIT) was $3.5 million for the third quarter compared to $3.8 million in the prior year. Non-GAAP EBIT was $22.0 million in the quarter compared to $23.7 million in the prior year.

For the third quarter of fiscal 2018, Commvault reported a GAAP net loss of $58.9 million, or $1.30 loss per diluted share. In the quarter, it recorded approximately $59.0 million of non-cash income tax charges related to the combined impact of the lower US corporate income tax rate on deferred tax assets and recording a valuation allowance against the remaining value of deferred tax assets. Non-GAAP net income for the quarter was $14.1 million, or $0.30 per diluted share. The firm measured itself to non-GAAP tax rates of 37% in fiscal 2017 and will continue to measure itself to a non-GAAP tax rate of 37% in fiscal 2018. Commvault is analyzing the longer term impacts of the recent U.S. income tax reform and currently expects that in fiscal 2019 it will reduce its non-GAAP tax rate to approximately 27% which should align with Commvault’s expected long-term cash tax rate.

Operating cash flow totaled $31.2 million for the third quarter of fiscal 2018 compared to $26.8 million in the prior year quarter.

Total cash and short-term investments were $445.5 million as of December 31, 2017 compared to $450.2 million as of March 31, 2017.

During the third quarter of fiscal 2018, the company repurchased approximately 1.5 million shares of its common stock totaling $80.1 million. On January 17, 2018, the board of directors extended the expiration date of the share repurchase program to March 31, 2019 and authorized a $100.0 million increase to the existing share repurchase program so that $133.7 million is now available. There have been no borrowings against the line of credit during fiscal 2018.

Recent Business Highlights:

• Commvault GO 2017, Commvault’s annual customer event, was held November 6-8, 2017 in Washington D.C., with an agenda that included more than 95 breakout, 30 mini theater and 25 structured lab speaking sessions, as well as industry-specific and other expert-led learning sessions. The conference, which grew from the previous year, offered business leaders an opportunity to explore how they can protect, manage and activate data to unlock new business opportunities and address some of today’s most pressing data challenges, with presentations by industry leaders, customers, and partners, including executives from Commvault, Google, Microsoft and Cisco. At the conference, Commvault announced a new analytics portfolio of applications, capabilities, solutions and services, all built on the Commvault Data Platform. The platform is designed to help customers have access to the right data and analytics in order to gain the insights needed to improve business outcomes.

• On November 7, 2017, announced a new partnership with Google Cloud to help enterprises leverage the range of cloud services available on one of the industry’s fastest growing cloud platforms, Google Cloud Platform. The partnership was highlighted at Commvault GO 2017 with a keynote delivered by Google executive Adam Massey on how this new relationship addresses the increasing need for data protection for fast growing multi-cloud, hybrid IT environments requiring flexibility, security, high data availability and business agility.

• On November 7, 2017, launched Commvault Endpoint Data Protection as a Service to simplify and streamline the backup and recovery of corporate data stored on laptops, desktops and other devices in one flexible, easy-to-use software as a service (SaaS) offering. Managed by Commvault in the cloud with 24/7 customer support, the service eliminates the need for in-house infrastructure installation and reduces application management resources.

• On October 25, 2017, was named a winner in the DR/BC solution category at NetworkWorld Asia’s 2017 Readers’ Choice/Rising Star Awards. The 12th Readers’ Choice Product Excellence Awards recognizes both established and new solution providers that have made the most impact on Asian end-user organizations. The vendor has been recognized for the best solution in getting organizations backup and continuously running after a disaster or downtime, based on votes from readers of NetworkWorld Asia, Asia Cloud Forum, Security Asia and Storage Asia.

• On October 24, 2017, announced ScaleProtect with Cisco UCS, a scale-out data protection solution combining Commvault HyperScale Software with UCS. ScaleProtect with UCS provides enterprises a single, integrated solution that delivers infrastructure simplicity, elasticity, resiliency, flexibility and scale for managing secondary data, while replacing legacy backup tools with a cloud-enabled data management solution. As the first solution launched as a Commvault HyperScale Software reference architecture, and is available to customers directly from Cisco’s Global Price List, making it easy for Cisco and it network of resellers to sell and deliver to the market.

• On October 17, 2017, launched Commvault HyperScale Appliance and Commvault HyperScale Software, two cloud-ready data infrastructure offerings that provide customers with on-premises simplicity, elasticity, resiliency, flexibility and scale for managing secondary data. HyperScale Technology brings scale-out infrastructure to the Commvault Data in support of true hybrid IT environments, and is positioned in the market to protect and securely move workloads across any type of infrastructure including public cloud, private cloud and on-premises. Initial program participants in the reference architecture software program include Fujitsu, Cisco, Lenovo, HPE, Super Micro Computer, Huawei and Dell-EMC.

Comments

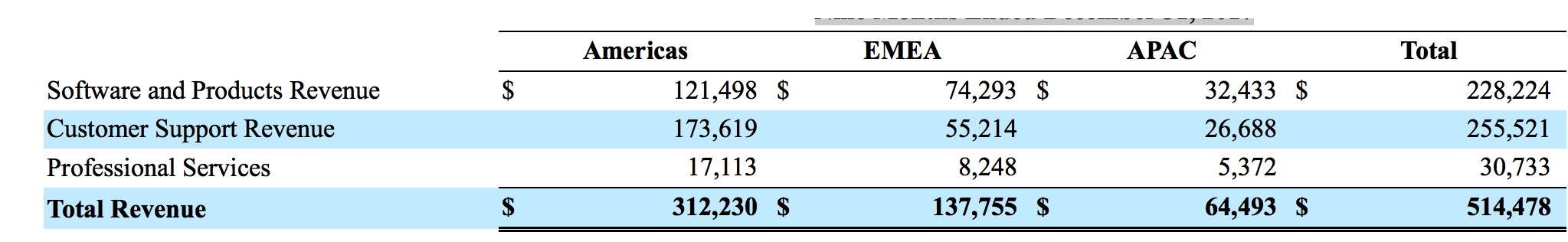

Nine Months Ended December 31, 2017

Click to enlarge

How the company explains such a big quarterly loss since many years, $59 million? CFO Brian Carolan answers: "The GAAP loss was driven by two large non-cash income tax charges. First, we recorded a $24 million reduction with the value of our deferred tax assets, which are future tax benefits as a result of lowering the US corporate income tax rate from 35% to 21%. Secondly, we recorded a $35 million deferred tax provision, inclusive of a valuation allowance against the remaining balance of deferred tax assets."

The revenue mix for the quarter was split between 45% for software and 55% for services.

Quarterly billings - total revenue plus the sequential change in deferred revenue - was approximately $192 million, up 13% over the prior year period and 12% sequentially.

Sales from enterprise deals - over $100,000 in software revenue in a given quarter - represented 57% of software revenue. Revenue from these transactions was up 4% Y/Y and 9% Q/Q. Average enterprise deal size increased 3% Y/Y to $268,000 during the quarter.

During the quarter approximately 56% of software license revenue was sold in a traditional per terabyte capacity basis. This is down from 68% in 3FQ17 and 59% in 2FQ18. Commvault anticipates that sales of traditional capacity based licenses will continue to decline as software license revenue shifts to standalone solution sets in its platform pricing model.

Americas, EMEA, and APAC represented 50%, 36%, and 14% of software sales respectively for the quarter. On a year-over-year growth basis, EMEA and APAC were up 12% and 5%, respectively, while Americas was down 2%.

The software company made good progress in managing data in the cloud, approaching 200PB, which is approximately 3x over the prior year.

It launched appliance in 3FQ18 and had good response from channel partners and customers. With a number of orders in hand, and it will begin to see an impact from appliance revenue in next quarter and expect to have meaningfully impact FY19.

Commvault saw good funnel build tied to its new resale agreement with Cisco for the enterprise. As a reminder, Cisco is reselling Commvault HyperScale Software combined with Cisco UCS hardware under the ScaleProtect with the UCS solution name. Impact on revenue is expected in 4FQ18 and in FY19.

As discussed before, the vendor is currently reliant on a steady flow of large six and seven figure deals, which come with additional risk due to their complexity and timing. While some deals from 2FQ18 closed during the quarter, several very large deals that get pushed from 2FQ18 did not close in 3FQ18 as expected and close rates were below historical levels. There is potential for some of those deals to close in 4FQ18.

The strategic initiatives launched last two quarters are designed to provide a more distribution leverage, to make it easier for the sales force and channel partners to sell solutions and to provide for a stronger mid-market revenue stream to complement enterprise revenues.

The firm is pleased with the progress made with the transition to subscription-based pricing models. The repeatable revenue stream is building somewhat faster than originally anticipated and had a slight dampening effect on in-period recognized software revenue. As such it currently believes Y/Y 4FQ18 software and product revenue will be approximately 10%.

Next three-month period revenue is estimated at $187 million (+4% Q/Q), reflecting continued move to subscription-based pricing and recent lower close rates from large seven-figure deals.

Current Street consensus for FY19 revenue is approximately $780 million.

Fiscal Q1 is usually company's most challenging quarter due to seasonality and the firm currently anticipates a sequential decline in both revenue and EBITD.

Commvault added 45 net employees during the quarter, ending with 2,841 people.

To read the earnings call transcript

| Fiscal period | Revenue | Y/Y growth | Net income (loss) |

| 1Q15 | 152.6 | 14% | 12.7 |

| 2Q15 | 151.1 | 7% | 6.5 |

| 3Q15 | 153.0 | -0% | 3.1 |

| 4Q15 | 150.7 | -4% | 3.4 |

| FY15 | 607.5 | 4% | 25.7 |

| 1Q16 | 139.1 | -9% | (1.3) |

| 2Q16 | 140.7 | -7% | (9.2) |

| 3Q16 | 155.7 | 2% | 4.9 |

| 4Q16 | 159.6 | 6% | 5.8 |

| FY16 | 595.1 | -2% | 0.1 |

| 1Q17 | 152.4 | 10% | (2.0) |

| 2Q17 | 159.3 | 13% | (0.6) |

| 3Q17 | 165.8 | 7% | (0.0) |

| 4Q17 | 172.9 | 8% | 3.2 |

| FY17 | 650.5 | 9% | 0.5 |

| 1Q18 | 166.0 | 9% | (0.3) |

| 2Q18 | 168.1 | 5% | (1.0) |

| 3Q18 | 180.4 | 8% | (59) |

Company changes figures for 3FQ17. It was $165.8 million in revenue and $0.0 loss, now $167.1 million and $2.0 million respectively are published. [We hate that. Editor]

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter