SSD Shipments Top 42 Million in 2Q17, NAND Output Up 6% Q/Q to 41EB

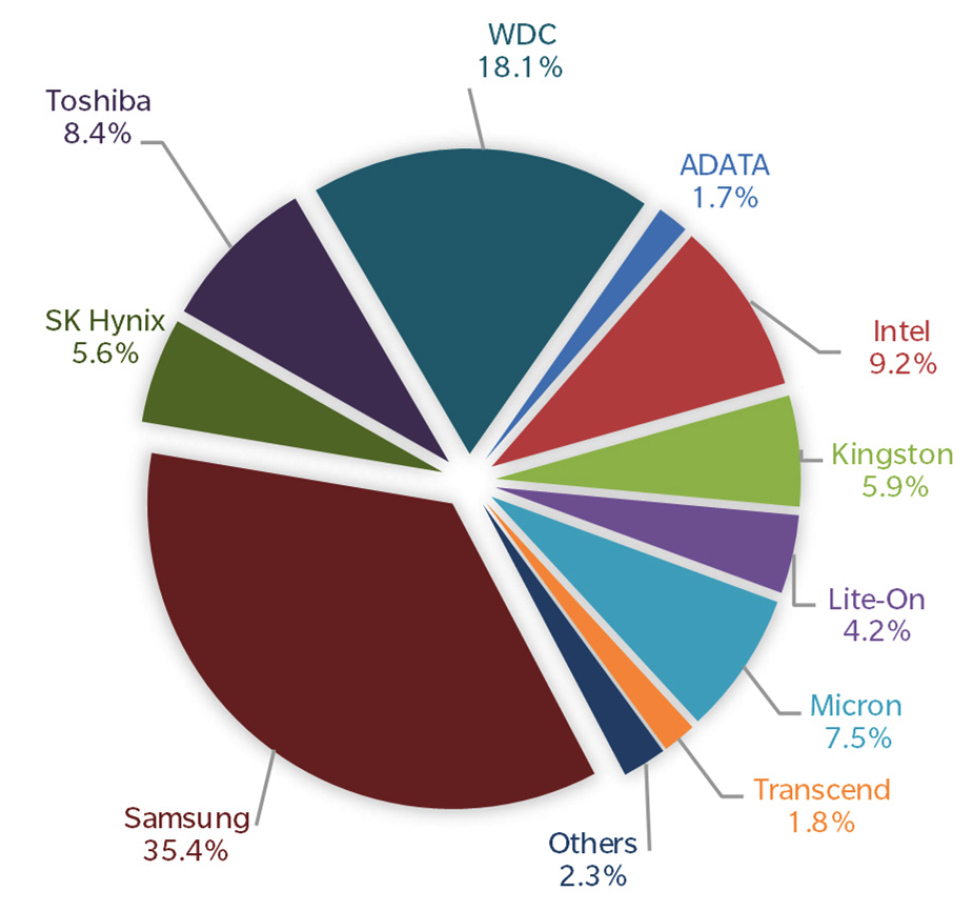

Top four makers in units: Samsung (35%), WDC (18%), Intel (9%), Toshiba (8%)

This is a Press Release edited by StorageNewsletter.com on August 22, 2017 at 3:47 pmHere is an abstract of a report, NAND/SSD Information Service 2CQ17 Quarterly Update, written on August 17, 2017, by analysts from Trendfocus, Inc.

SSD Shipments Top 42 Million – NAND Grows 6% Q/Q

Healthy growth in most SSD segments, especially client modules

- Total SSD shipments increased 5.8% from 1CQ17 to top 42 million units.

- A large decline in client drive form factor (DFF) SSDs offset the 44.4% sequential rise in client modules to result in a total client SSD increase of 3.1%, to 35.935 million units.

- Exabytes increased slightly by 2.7%, driven by the higher mix of enterprise SSDs, which offset lower client SSD exabytes – a continued function of the higher pricing environment and by an effort by companies to target the enterprise segment more aggressively.

- Enterprise SATA SSDs saw a healthy unit increase, totaling 4.521 million units, helping overall enterprise SSD units reach 6.153 million units shipped, an increase of 25.2% over 1CQ17.

- SAS and PCIe SSDs also increased in both unit shipments and exabytes shipped, with PCIe leading in units shipped, while SAS led in exabytes shipped.

- NAND output grew 6.3% sequentially to 41.10EB in 2CQ17.

- 3D NAND shipments rose to 43% of bits shipped for the quarter.

- SSDs continue to account for the largest share of NAND shipments in 2CQ17.

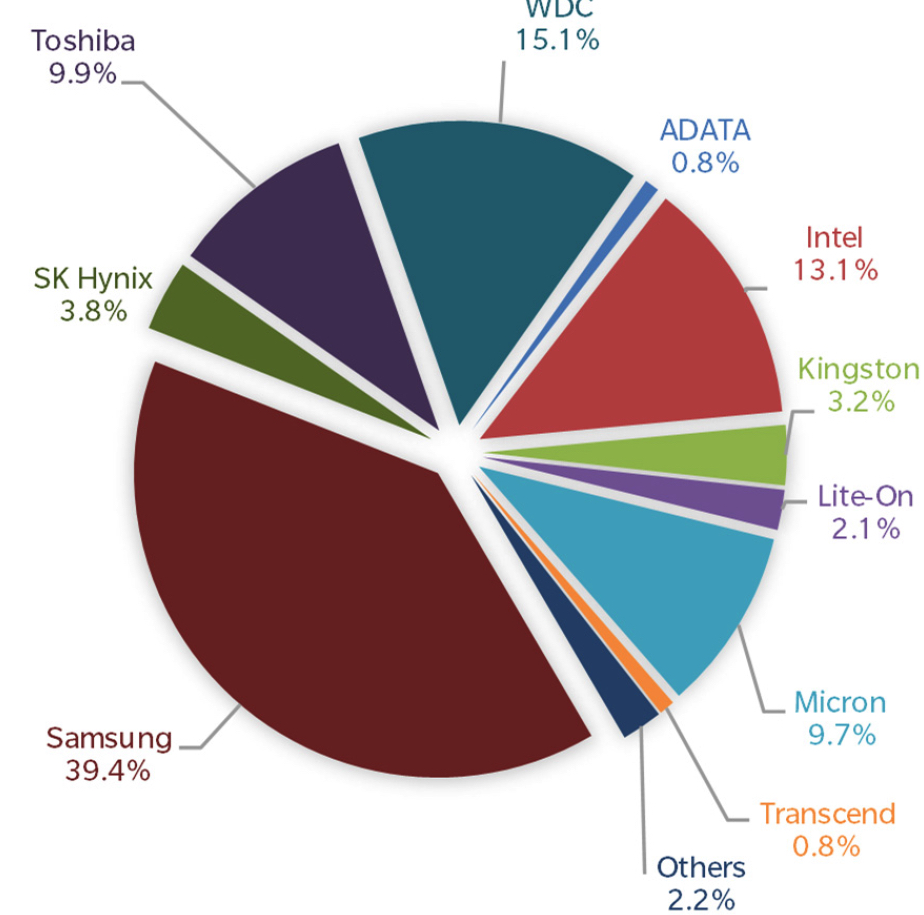

2CQ17 Total SSD Supplier Market Share, by Supplier, Units (Million), Exabytes

2CQ17 Total SSD Market: 42.088 Million Units

2CQ17 Total SSD Market: 15.156EB

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter