Box: Fiscal 4Q17 Financial Results

Record revenue for FY17, up 32% Y/Y, high but lower loss

This is a Press Release edited by StorageNewsletter.com on March 3, 2017 at 2:51 pm| (in $ million) | 4Q16 | 4Q17 | FY16 | FY17 |

| Revenue | 85.0 | 109.9 | 302.7 | 398.6 |

| Growth | 29% | 32% | ||

| Net income (loss) | (50.4) | (36.9) | (202.9) | (151.8) |

Box, Inc. announced financial results for the fiscal fourth quarter and full fiscal year 2017, which ended January 31, 2017.

“Fiscal 2017 was a milestone year for Box as we achieved record revenue with growth of 32% year-over-year and delivered on our commitment to generate positive free cash flow for the first time in the fourth quarter,” said Aaron Levie, co-founder and CEO. “Box is raising the bar in cloud content management. We’ve consistently delivered innovative new products, set the standard for security and compliance, and helped customers in every industry move to the cloud with confidence. We are driving towards a $1 billion long-term revenue target, and this year we plan to invest for scale while continuing to drive operating leverage.”

“We generated free cash flow of $10 million, improving more than $30 million year-over-year, and delivered the promise we made two years ago to achieve positive free cash flow by Q4 of our 2017 fiscal year,” said Dylan Smith, co-founder and CFO. “These results demonstrate the strength of our business model and our operating discipline as we work towards the goal of achieving positive free cash flow for the full year of fiscal 2018.“

Fiscal Fourth Quarter Financial Highlights

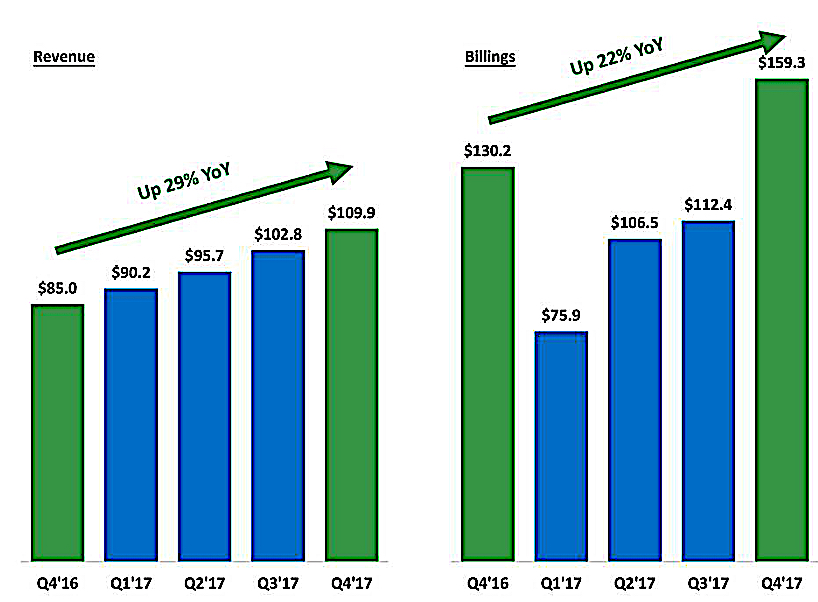

• Revenue was a record $109.9 million, an increase of 29% from the fourth quarter of fiscal 2016.

• Billings were $159.3 million, an increase of 22% from the fourth quarter of fiscal 2016.

• GAAP operating loss was $36.4 million, or 33% of revenue. This compares to GAAP operating loss of $49.6 million, or 58% of revenue, in the fourth quarter of fiscal 2016.

• Non-GAAP operating loss was $12.7 million, or 12% of revenue. This compares to a non-GAAP operating loss of $31.1 million, or 37% of revenue, in the fourth quarter of fiscal 2016.

• GAAP net loss per share, basic and diluted, was $0.28 on 129.8 million shares outstanding, compared to a GAAP net loss per share of $0.41 in the fourth quarter of fiscal 2016 on 123.3 million shares outstanding.

• Non-GAAP net loss per share, basic and diluted, was $0.10, compared to non-GAAP net loss per share of $0.26 in the fourth quarter of fiscal 2016.

• Net cash provided by operating activities totaled $14.7 million. This was a $9.9 million improvement compared to net cash provided by operating activities of $4.9 million in the fourth quarter of fiscal 2016.

• Free cash flow was $10.2 million, a $31.5 million improvement compared to negative $21.3 million, in the fourth quarter of fiscal 2016.

Fiscal Year 2017 Financial Highlights

• Revenue was a record $398.6 million, an increase of 32% from fiscal year 2016.

• Deferred revenue ended at $242.0 million, an increase of 30% from fiscal year 2016.

• Billings were $454.2 million, an increase of 23% from fiscal year 2016.

• GAAP operating loss was $150.7 million, or 38% of revenue. This compares to GAAP operating loss of $201.0 million, or 66% of revenue, in fiscal year 2016.

• Non-GAAP operating loss was $70.6 million, or 18% of revenue. This compares to non-GAAP operating loss of $134.3 million, or 44% of revenue, in fiscal year 2016.

• GAAP net loss per share, basic and diluted, was $1.19 on 127.5 million shares outstanding, compared to GAAP net loss per share of $1.67 in fiscal year 2016 on 121.2 million shares outstanding.

• Non-GAAP net loss per share, basic and diluted, $0.56 compared to non-GAAP net loss per share of $1.12 in fiscal year 2016.

• Net cash used in operating activities totaled $1.2 million. This was a $65.1 million improvement compared to net cash used in operating activities of $66.3 million in fiscal year 2016.

• Free cash flow was negative $24.8 million, compared to negative $116.3 million, in fiscal year 2016.

• Cash, cash equivalents, and restricted cash were $204.2 million as of January 31, 2017, of which $26.8 million was restricted.

Business Highlights since Last Earnings Release

• Grew paying customer base to over 71,000 businesses, including new or expanded deployments with leading enterprises such as Volkswagen Group of America, Discovery Communications, John Muir Health, and Spotify.

• Launched the new Box Notes web and desktop apps, driving real-time collaboration across teams with the security, governance and compliance required by large enterprises.

• Added Australia and Canada to Box’s data residency offering, Box Zones. Customers are now able to store data locally in seven countries across North America, Europe, Asia, and Australia.

• Expanded integration with Microsoft, including Office 365 supported on Android, round trip editing across the entire Office product suite, and improved Excel preview capabilities, making the Box and Office user experience even more seamless.

• Expanded Box and IBM integration with the availability of Box + IBM Cloud Connections, which enables users to store, share, access, and update their Box content within the IBM Connections environment.

• Enhanced the Box Platform developer experience to make it easier for developers to collaborate and manage their content in one place while tapping into the expertise of Box’s growing community.

• Launched a new Partner Portal, giving partners the ability to engage with Box directly and conduct day-to-day operations more effectively.

Q1 FY18 Guidance

Revenue is expected to be in the range of $114 million to $115 million. GAAP and non-GAAP basic and diluted earnings per share are expected to be in the range of ($0.33) to ($0.32) and ($0.15) to ($0.14), respectively. Weighted average basic and diluted shares outstanding are expected to be approximately 131 million.

Full Year FY18 Guidance

Revenue is expected to be in the range of $500 million to $504 million. GAAP and non-GAAP basic and diluted earnings per share are expected to be in the range of ($1.27) to ($1.23) and ($0.49) to ($0.45), respectively. Weighted average basic and diluted shares outstanding are expected to be approximately 134 million.

Comments

Abstracts of the earnings call transcript:

Aaron Levie, CEO:

"We also continue our streak of exceeding our guidance since we've gone public, and feel confident that the improvements we made in the business over the past year set us up well on the path to our long-term goal of $1 billion in revenue. This quarter, we grew our leadership in the market and now have over 71,000 paying customers.

"Our focus on enterprises drove major wins in Q4 with 64 deals over $100,000, a record 16 deals over $500,000 and a record eight deals over $1 million.

"We now have more than 700 Governance customers, up from over 500 customers last quarter. And roughly half of our governance deals in Q4 came from customers that are new to Box.

"KeySafe was an initial part of a $1 million plus deal this quarter.

"This quarter alone, more than 40% of Box's 58 billion API calls came from third-party applications."

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter