EMEA Cloud IT Infrastructure Revenue Grows 19.5% to $1.5 Billion in 3Q16 – IDC

Cloud storage represented 45% of total capacity.

This is a Press Release edited by StorageNewsletter.com on January 19, 2017 at 2:33 pmAccording to the International Data Corporation‘s Worldwide Quarterly Cloud Infrastructure Tracker, IT infrastructure spending (server, disk storage, and Ethernet switch) for public and private cloud in Europe, the Middle East, and Africa (EMEA) grew 19.5% year on year to reach $1.5 billion in revenue in the third quarter of 2016.

The cloud-related share of total EMEA infrastructure revenue from servers, disk storage, and Ethernet switches grew by 6 percentage points compared with last year to 24.9% in 3Q16. In terms of storage capacity, cloud represented around 44.8% of total EMEA capacity in 3Q16, with 8.6% growth over the same period a year before. Looking at the market in euros, EMEA in 3Q16 reported strong Y/Y user value growth (19.1%) in public and private cloud across servers, storage, and switches.

“IDC expects this market to reach a value of $10.9 billion by 2020, from the five-year forecast, or 35.4% of the total market expenditure. Fueled by increasing maturity and adoption rates of many new cloud-dependent technologies such as the Internet of Things, cloud continues to represent an area of tremendous growth for the European infrastructure sector,” said Kamil Gregor, research analyst, european infrastructure group, IDC.

For the scope of this tracker, IDC has tracked the following vendors: Cisco, Dell EMC, Fujitsu, Hitachi, HPE, IBM, Lenovo, NetApp, Oracle, the major ODM vendors, and others.

Regional Highlight

“In Western Europe, we are beginning to see not only specific solutions based on 3rd Platform and Innovation Accelerator technologies, but increasingly often innovative solutions that combine multiple technologies to harness unique value that none of the technologies could unlock alone,” said Gregor. “For example, several emerging industry clouds in the region combine data from the IoY edge devices with real-time and big data analytics in subverticals such as advanced building automation, manufacturing asset management, and predictive maintenance. Regulatory compliance is becoming an increasingly important inhibitor of cloud adoption in the region, mainly due to political volatility in the EU, both in 2016 and potentially continuing throughout 2017, and as we approach the end of a two-year transition period for the EU’s General Data Protection Regulation. Enterprises at the bleeding edge of innovation are looking into ways of mitigating these issues, for example by taking blockchain technology from the world of financial transactions and applying it to automation of policy compliance in complex cloud environments.”

Central and Eastern Europe, the Middle East, and Africa (CEMA) cloud infrastructure revenue grew by 17.8% year over year to $214.14 million in 3Q16, driven by investment in networking functionalities as Ethernet switch recorded the fastest growth. The Middle East and Africa (MEA) region saw the strongest growth in EMEA, with many organizations investing in private cloud to consolidate and optimize their resources as IT budgets come under pressure due to challenging economic conditions in the region.

“Private cloud deployments have been driving growth in the CEMA region as organizations that are consolidating their IT infrastructure seek greater flexibility, lower capex, and faster implementation over traditional IT infrastructure,” said Jiri Helebrand, research manager, systems and infrastructure solutions, IDC CEMA.

Cloud infrastructure spending in the CEMA region is estimated to be 19% of the total addressable server, storage, and networking hardware market, with public cloud accounting for about 47% of this share.

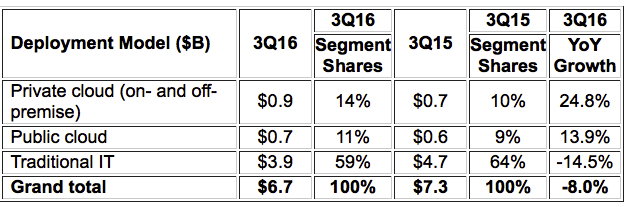

EMEA Cloud IT Infrastructure Value ( in $ billion)

Taxonomy notes

IDC defines cloud services more formally through a checklist of key attributes that an offering must manifest to end users of the service. Public cloud services are shared among unrelated enterprises and consumers; open to a largely unrestricted universe of potential users; and designed for a market, not a single enterprise. The public cloud market includes a variety of services designed to extend or, in some cases, replace IT infrastructure deployed in corporate datacenters. It also includes content services delivered by a group of suppliers that IDC calls value-added content providers (VACPs). Private cloud services are shared within a single enterprise or an extended enterprise with restrictions on the access and level of resource dedication and defined/controlled by the enterprise (and beyond the control available in public cloud offerings), can be onsite or offsite, and can be managed by a third-party or in-house staff. In private cloud that is managed by in-house staff, ‘vendors (cloud service providers)’ are equivalent to the IT departments/shared service departments within enterprises/groups. In this utilization model, where standardized services are jointly used within the enterprise/group, business departments, offices, and employees are the ‘service users.’

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter