WW Cloud IT Infrastructure Spend Grew 22% to $29 Billion in 2015 – IDC

Major vendors being HPE, Dell, Cisco, EMC, IBM and NetApp in order

This is a Press Release edited by StorageNewsletter.com on April 11, 2016 at 2:51 pmAccording to the International Data Corporation‘s Worldwide Quarterly Cloud IT Infrastructure Tracker, vendor revenue from sales of infrastructure products (server, storage, and Ethernet switch) for cloud IT, including public and private cloud, grew 21.9% year over year to $29.0 billion in 2015, with vendor revenue for 4Q15 growing 15.7% to $8.2 billion.

Compared to overall IT infrastructure spending, the share of cloud IT infrastructure sales climbed to 32.2% in 4Q15, up from 28.6% a year ago. Revenue from infrastructure sales to private cloud grew by 17.5% to $3.3 billion, and to public cloud by 14.6% to $4.9 billion. In comparison, revenue in the traditional (non-cloud) IT infrastructure segment decreased 2.7% year over year in the fourth quarter, with declines in all three technology segments (server, storage and Ethernet switch).

All three technology markets showed strong year-over-year growth in both private and public cloud segments, except for storage in the public cloud, which declined 4.0% in 4Q15 on a difficult compare with a very strong quarter in the prior year. Private cloud growth was led by Ethernet switch with 19.6% growth. In public cloud, Ethernet switch led the way with 56.9% year-on-year growth, while public cloud revenue from server grew 28.9% year on year in 4Q15. For the full year, server revenue in private cloud grew by 23.0% year on year, while Ethernet switch revenue in public cloud grew by 36.6% during the same period.

“The cloud IT infrastructure market continues to see strong double-digit growth with faster gains coming from public cloud infrastructure demand,” said Kuba Stolarski, research director for computing platforms, IDC. “End customers are modernizing their infrastructures along specific workload, performance, and TCO requirements, with a general tendency to move into 3rd Platform, next-gen technologies. Options on and off premises continue to expand, along with open platforms that enhance hybrid capabilities for a variety of use cases. Public cloud as-a-service offerings also continue to mature and grow in number, allowing customers to increasingly use sophisticated, mixed strategies for their deployment profiles. While the ice was broken a long time ago for public cloud services, the continued evolution of the enterprise IT customer means that public cloud acceptance and adoption will continue on a steady pace into the next decade.”

From a regional perspective, vendor revenue from cloud IT infrastructure sales grew fastest in Japan at 50.0% year over year in 4Q15, followed by AsiaPac (excluding Japan) at 38.7%, Western Europe at 30.5%, Canada at 23.5%, and the United States at 6.6%. Central and Eastern Europe declined 9.3% year over year as the region continues to go through political and economic turmoil, which impacts overall IT spending.

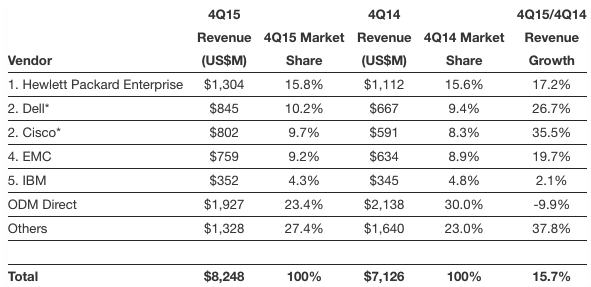

Top 5 Corporate Family, WW Cloud IT Infrastructure Vendor Revenue, 4Q15

(revenue in million, excludes double counting of storage and servers)

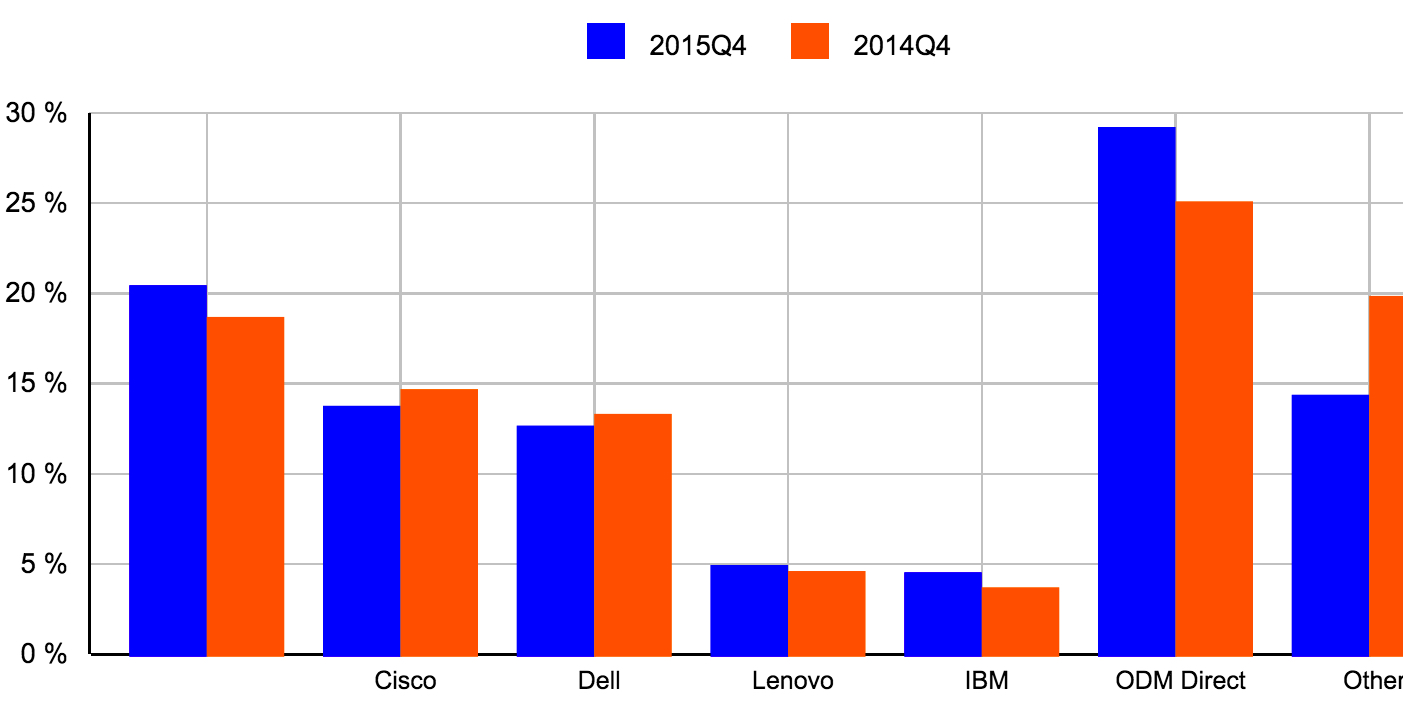

WW Cloud IT Infrastructure Top 5 Cloud Vendors Revenue, 4Q14 vs. 4Q15

(shares based on vendor revenue)

(Source: IDC’s Worldwide Quarterly Cloud IT Infrastructure Tracker, April 2016)

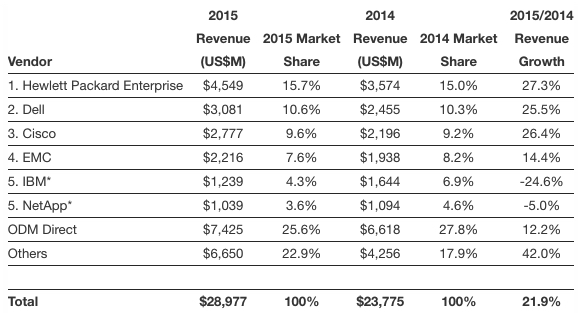

Top 5 Corporate Family, WW Cloud IT Infrastructure Vendor Revenue, 2015

(revenue in million, excludes double counting of storage and servers)

(Source: IDC’s Worldwide Quarterly Cloud IT Infrastructure Tracker, April 2016)

Note:

Dell and Cisco both ranked number 2 in 4Q15, and IBM and NetApp both ranked number 5 in 2015 in a statistical tie. IDC declares a statistical tie in the worldwide cloud IT infrastructure market when there is less than one% difference in the revenue share of two or more vendors.

Taxonomy Notes:

IDC defines cloud services more formally through a checklist of key attributes that an offering must manifest to end users of the service. Public cloud services are shared among unrelated enterprises and consumers; open to a largely unrestricted universe of potential users; and designed for a market, not a single enterprise. The public cloud market includes variety of services designed to extend or, in some cases, replace IT infrastructure deployed in corporate datacenters. It also includes content services delivered by a group of suppliers IDC calls Value Added Content Providers (VACP). Private cloud services are shared within a single enterprise or an extended enterprise with restrictions on access and level of resource dedication and defined/controlled by the enterprise (and beyond the control available in public cloud offerings); can be onsite or offsite; and can be managed by a third-party or in-house staff. In private cloud that is managed by in-house staff, ‘vendors (cloud service providers)’ are equivalent to the IT departments/shared service departments within enterprises/groups. In this utilization model, where standardized services are jointly used within the enterprise/group, business departments, offices, and employees are the ‘service users.’

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter