Avago Became Broadcom

With storage representing $673 million or 38% of global sales in last quarter

By Jean Jacques Maleval | March 8, 2016 at 3:27 pm$15 billion Avago Technologies Limited has decided to change its name into Broadcom Limited, a company in communications semiconductors acquired recently for as much as $37 billion. Hock E. Tan remains president and CEO of the new Broadcom.

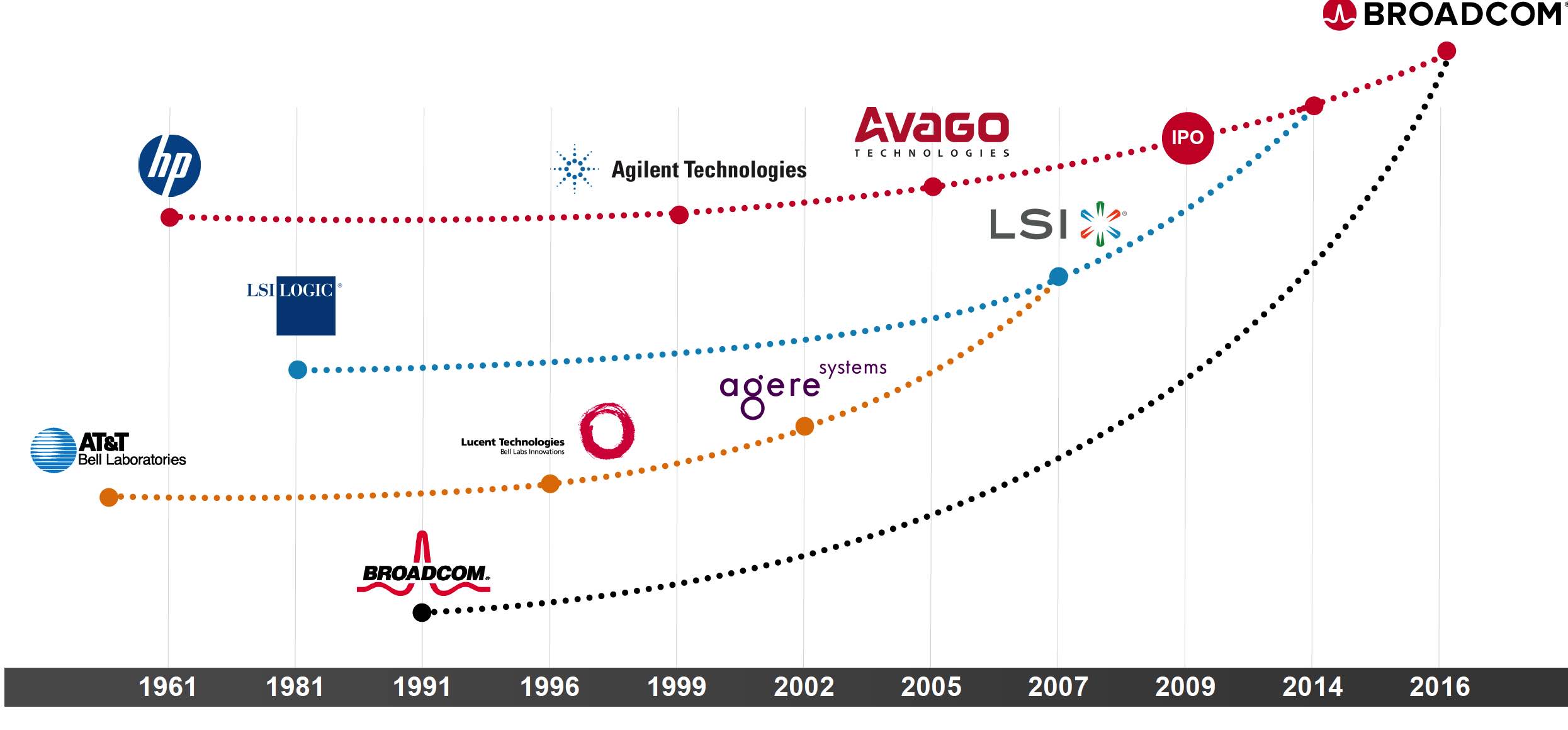

The Singapore-based chip manufacturer is involved in semiconductors for the wired, wireless, enterprise storage and industrial end markets. It also has another HQs in San Jose, CA. It was founded in 1961 as an electronics division of HP, then became part of Agilent, former semiconductor arm of HP, before taking it public.

Click to enlarge

Totally unknown in the storage industry, Avago began to invest in this field with the surprising acquisition of LSI in 2013 for as much as $6.6 billion, then PLX technology and Emulex. Part of LSI – PCIe flash technology and SSD controller – was sold to Seagate or $450 million.

Storage acquisitions of Broadcom/Avago

| Month of announcement | Year | Acquired company | Price in $ million | Business of acquired company |

| 2 | 2013 | LSI | 6,600 | Chips and controllers for storage and network |

| 6 | 2014 | PLX Technology | 309 | Semiconductor-based PCIe connectivity |

| 2 | 2015 | Emulex | 606 | Network connectivity, monitoring and management |

Broadcom is now a strong force in enterprise storage with total revenue of $2.18 billion – more than Dell – for fiscal year ended November 1, 2015, the form becoming number eleven in our Top 12 Storage Companies in 2015.

For the most recent 1FQ16 ended January 31, 2016, storage represented $673 million (or 38% of global sales) up 6% Q/Q and 39%Y/Y.

Commenting this results, Tan said: “During the quarter, we saw strong demand from enterprise and near-line HDDs. Our server and storage connectivity businesses also had a good quarter, led by seasonal growth from FC shipments, while our RAID and SAS business largely [sustained]. Going forward, composition of this segment will remain largely unchanged, however, we expect a somewhat different picture in the second quarter, with seasonal declines impacting both our HDD business and server storage. We expect second-quarter revenues from this segment to be approximately 17% of our total revenue from continuing operations. (…) We also expect a seasonal decline in enterprise storage [in 2FQ16], but something of a recovery in industrial.”

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter