All M&As in 2014

Top ones are ...

By Jean Jacques Maleval | January 5, 2015 at 3:03 pmSince more than a decade we analyze the merger and acquisition trends in the worldwide storage industry, which has allowed us the proper perspective from which to gauge the evolution over time.

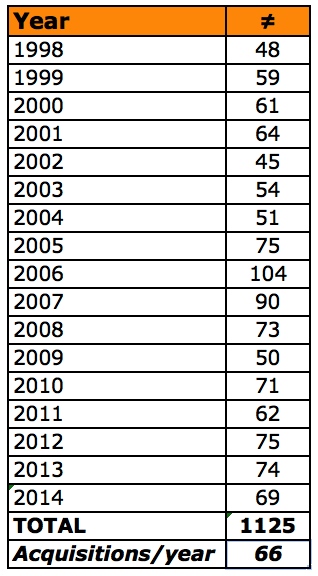

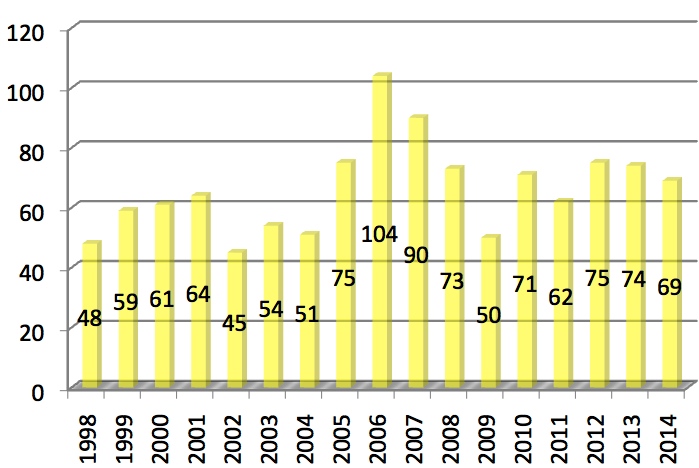

NUMBER OF ACQUISITIONS SINCE 1998 IN WW STORAGE INDUSTRY

(Source: StorageNewsletter.com)

In 2006, there was a record of 104 M&As. Since 2012, the number of deals decreased yearly to reach 69 in 2014 compared to 74 in 2013, but a little more than 66, the average per year since 1998.

On these 69 M&As last year, the price of only 16 deals was revealed by the buyers, meaning that it was relatively low for the 53 other ones as the amount was not impacting seriously their financial results.

Furthermore there were only two acquisitions at more than $1 billion: Riverbed by Thoma Bravo for $3.6 billion and Fusion-io by SanDisk for $1.1 billion. All the other ones are under half billion dollar.

Last year there was an enormous acquisition, LSI being bought by Avago Technologies for as much as $6.6 billion, more than the total known amount spent for all acquisitions in 2014, $6.3 billion.

In conclusion, there was not an intense activity in 2014 with average price going down. Why? The main buyers are generally big storage firms but most of them didn’t have excellent financial results and prefer to keep their cash.

Historically, EMC historically is the most voracious in the industry with 78 acquisitions since 1994, but is much quieter these past years. It acquired a record 23 companies in 2007 only, just two in 2011, three in 2012 and 2013, and six small start-ups last year, as usual to get new technologies that its own R&D was not able to design.

Like in 2013, other storage giants were even quieter. No deal at all realized by Dell, HP, IBM, Micron and Symantec, only one by HDS, NetApp, SanDisk, Samsung, Seagate and WD.

With these 78 deals, EMC is largely in front of Seagate (including Seagate Software) with a total of 30 acquisitions, Iron Mountain 29, Veritas Software added to Symantec 25, IBM and WD 19, LSI and Dell 17, Xyratex 16, HP 15. Only 14 for NetApp.

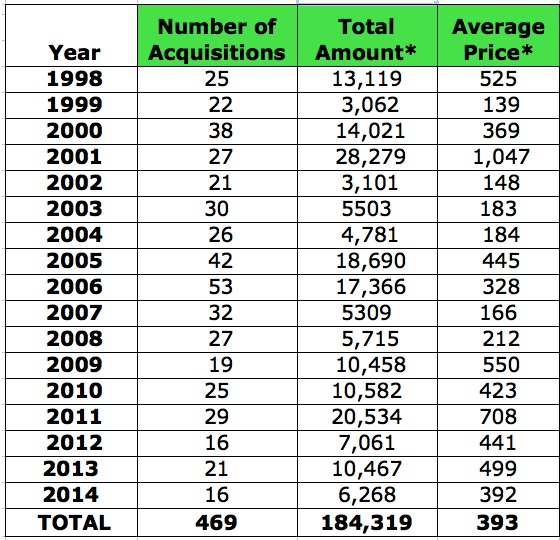

TOTAL AMOUNT OF ACQUISITIONS SINCE 1998

(here we include only the acquisitions when the price is known)

* in $ million

(Source: StorageNewsletter.com)

Looking at the total amount spent by the buyers – one more when the price of the acquisition has been revealed -, it was $6.3 billion in 2014 for an average of $392 million per deal, a small figure as it’s about the same as the average since 1998 and decreasing 21% from 2013 .

One year ago we predicted a more productive 2014 year but finally the number of acquisitions was lower than in 2012 and 2013. And now our bet is around 60 to 70 this year. The consolidation in the industry will continue because some publicly-traded companies are in bad shape and there are too many storage start-ups trying to survive with the only goal, to be acquired or die.

Furthermore a trend is not going to stop: storage giants invent about nothing in new killing storage technologies and prefer to buy them by acquiring start-ups. It’s less expansive than investing in their own R&D.

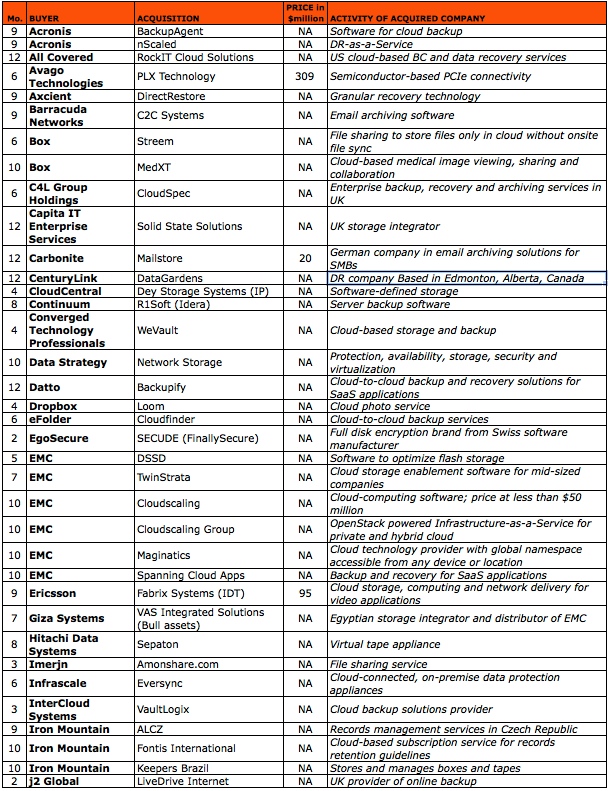

We will probably continue to see several M&As in the cloud market as usual (21 in 2014), around software (11), channel (9), and especially SSD (8) where there are too many companies even it’s a booming activity.

MORE THAN $1 BILLION M&As IN HISTORY OF STORAGE INDUSTRY

(only two in 2014)

2001: Compaq by HP, $25,000 million

2005: Veritas by Symantec, $11,000 million

2011: Autonomy by HP, $10,300 million

1998: Digital Equipment by Compaq, $9,600 million

2009: Sun by Oracle, $7,400 million

2013: LSI by Avago technologies, $6.600 million

2011: Hitachi GST by WD, $4,300 million

2005: StorageTek by Sun, $4,100 million

2000: Sterling Software by CA, $4,000 million

2000: Seagate by Suez Acquisition, $4,000 million

2006: Agere by LSI, $4,000 million

2014: Riverbed by Thoma Bravo, $3,600 million

2008: Foundry Networks by Brocade, $2,600 million

2012: Elpida by Micron Technology, $2,500 million

2012: Quest Software by Dell, $2,400 million

2010: 3par by HP, $2,350 million

2010: Isilon by EMC, $2,250 million

2009: Data Domain by EMC, $2,200 million

2006: RSA by EMC, $2,100 million

2002: IBM HDD by Hitachi, $2,050 million

2000: Cobalt Networks by Sun, $2,000 million

2004: Kroll by Marsh & McLennan Companies, $1,900 million

2006: Maxtor by Seagate, $1,900 million

2000: Ancor Communications by QLogic, $1,700 million

1998: Seagate Software by Veritas, $1,600 million

2006: FileNet by IBM, $1,600 million

2006: msystems by SanDisk, $1,500 million

2007: EqualLogic by Dell, $1,400 million

2011: Samsung HDD by Seagate, $1,375 million

2000: Quantum HDD by Maxtor, $1,300 million

2003: Legato by EMC, $1,300 million

2010: Numonyx by Micron, $1,270 million

1996: Cheyenne by CA, $1,200 million

2010: Division 5 Technology by Max Stiegemeier (GCF), $1,200 million

1999: Data General by EMC, $1,100 million

2014: Fusion-io by SanDisk, $1,100 million

1995: Conner Peripherals by Seagate, $1,040 million

(Source: StorageNewsletter.com)

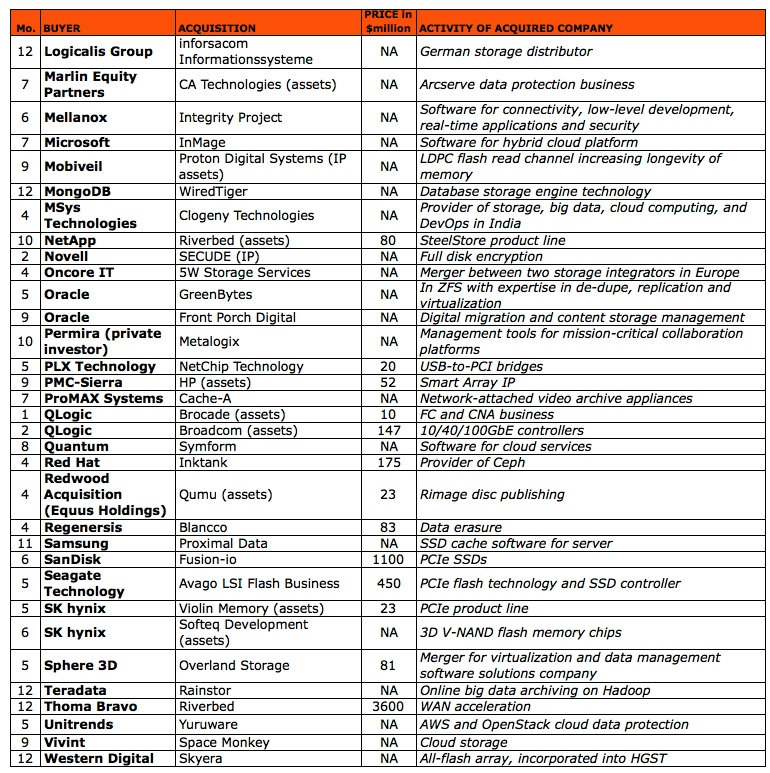

WHO BOUGHT WHOM IN 2014

(Source: StorageNewsletter.com)

WHO BOUGHT WHOM IN 2014 (continued)

(Source: StorageNewsletter.com)

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter