Storage Start-Ups in 2013

$1.3 billion invested in 57 companies following 58 financial rounds

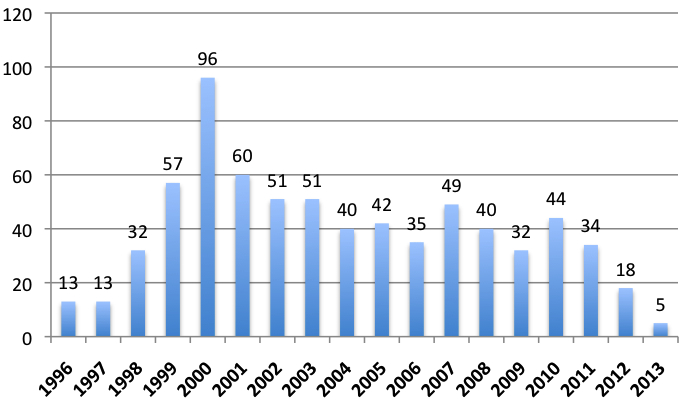

By Jean Jacques Maleval | January 8, 2014 at 2:57 pmIn 2013 we counted 58 investment rounds initiated by 57 storage start-ups, a small number.

It was 77 in 2012 and 66 in 2011, the record being 78 in 2005. This decrease last year is not really bad news for storage, still one of the most dynamic sectors in the IT industry, continuing to be appreciated by VCs that dream of what got some of them following the acquisitions of firms like 3par, Data Domain and Isilon few years ago at more than $2 billion, or few successful IPOs.

But the investors in these latter three start-ups were lucky as generally most of them have to invest in several new ventures to finally win the jackpot.

NUMBER OF FINANCIAL ROUNDS SINCE 2003

(Source: StorageNewsletter.com)

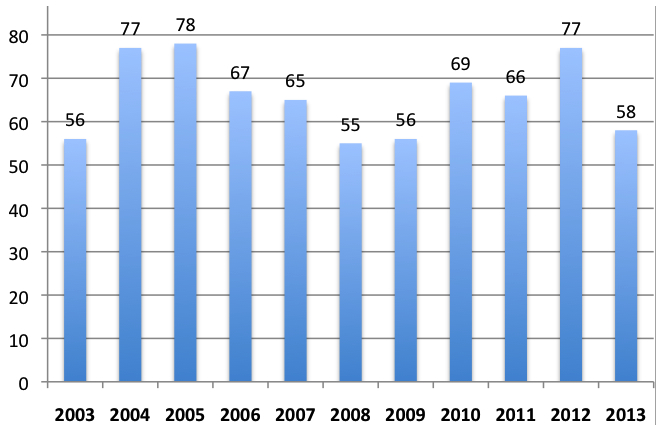

Fewer New Start-Ups

More worrying is the reduced number of start-ups founded since the heydeys of 2000 when 96 new entities sprang up in a single year. We were only able to turn up 5 new firms launched last year vs. 18 in 2012 and 34 in 2011, while these figures will go up as more of them, operating in stealth mode, come to light.

NUMBER OF STORAGE START-UPS LAUNCHED EACH YEAR SINCE 1996

(when the born year is known)

(Source: StorageNewsletter.com)

How Much Do They Raise?

21 firms raised more than $20 million in 2013 (27 in 2012 and 16 in 2011). Pure Storage tops the list with with $150 million. Last year the record was $125 million for Box.net. Cloud and SSD were really exciting the investors last year.

LARGEST FINANCIAL ROUNDS IN 2013

(at more than $40 million)

| COMPANY | $ MILLION |

| Pure Storage |

150 |

| Box | 100 |

| Corsair Components |

75 |

| SimpliVity | 58 |

| Cleversafe* | 55* |

| Skyera |

51.6 |

| Actifio | 50 |

| Primary Data |

50 |

| Crocus Technology |

45 |

| Virident Systems |

40 |

* Correction: Line added on January 9, 2014

(Source: StorageNewsletter.com)

If we take into account here the total funding of start-ups, all rounds aggregated, Pillar Data was historically the most financed company, with about $544 million from Larry Ellison, CEO of Oracle that finally acquires the storage subsystem provider. After that comes Box with $404.5 million, Dropbox with $257 million, Pure Storage with $245 million, and BlueArc (acquired by HDS) with $224 million.

No More Record Year in Financial Funding

2013 was not another record year in the global amount received by storage start-ups considering here only the sums revealed by the companies: $1.291 billion invested. It was $1,432 million in 2012. It’s the first time this amount is going down since 2009. But the average amount per round continues to increase, also since 2009, this time by as much as 20% year to year. In brief investors put more money in less start-ups and consequently in less rounds.

These past eleven years, VCs have put $17.2 billion in storage start-ups. This amount is much higher than the total figure in the table below ($10,738 billion adding all rounds) because, for several firms, we got the total invested but not the details per round.

On average, a company got historically $39.7 million in total funding, the average per round being $14.3 million.

| ? OF ROUNDS | TOTAL INVESTED* |

AVERAGE PER ROUND* |

|

| 2003 |

56 | $736 | $13.1 |

| 2004 | 77 | $980 | $12.7 |

| 2005 |

78 | $995 | $12.8 |

| 2006 |

67 | $817 | $12.2 |

| 2007 |

65 | $744 | $11.4 |

| 2008 |

55 | $724 | $13.2 |

| 2009 |

56 | $576 | $10.3 |

| 2010 |

69 | $861 | $12.5 |

| 2011 |

66 | $1,224 | $18.5 |

| 2012 | 77 | $1,432 | $18.6 |

| 2013 | 58 | $1,291 | $22.3 |

| TOTAL |

724 |

$10,378 | $14.3 |

* in $ million

(Source: StorageNewsletter.com)

Where From?

It will come as a surprise to no one that storage start-ups are for the most part (around three-fourths of the total) headquartered in the U.S., even if occasionally the actual founders hail from another country originally (typically India or Israel). Far behind are UK, France, Canada and Israel. Apart America and Europe, the two other continents, Asia and Oceania, are not well represented at all.

WHICH COUNTRY DO THEY COME FROM?

(out of 409 active start-ups)

| COUNTRY |

Number |

% |

| USA | 298 | 73% |

| UK | 18 | 5% |

| France | 17 | 4% |

| Canada | 12 | 3% |

| Israel | 9 | 3% |

| Others | 55 | 12% |

| TOTAL | 409 | 100% |

(Source: StorageNewsletter.com)

Where Are They Going?

The last thing we looked at was what becomes of all these storage start-ups after we identify and count them. The conclusion is not really reassuring, a reminder that investment in these sorts of companies is in fact highly risky. And that’s just taking those we know about.

On all start-ups identified, only 3% eventually go public, and thus allow investors more than just to recoup their original stake. The same is generally true for the 27% that find buyers, although the asking price is not always greater than the total of all sunk investments. It is, in any case, the emergency exit that most companies are seeking, certainly more than the increasingly elusive IPO. Meanwhile, another 18% just vanish off the map – doors closed.

50% all start-ups of them remain in a holding pattern, still a start-up, still nursing the secret hope of an offer from a storage giant seeking to fill-in a missing technology.

WHAT HAPPENED TO THEM SINCE 1978

(out of a total 794 start-ups)

| Became public | 26 | 3% |

| Sold | 221 | 27% |

| Closed | 147 | 18% |

| Remaining start-ups | 400 | 50% |

(Source: StorageNewsletter.com)

11 start-ups did find buyers in 2013 and 21 in 2012, the biggest deal last year being Virident acquired by Western Digital for $685 million. In 2012 it was XtremIO by EMC for $430 million, both of them around SSDs.

There were three IPOs in 2013: Violin Memory now in trouble, Nimble Storage and Barracuda Networks. No one was filed with success in 2012. But this figure last year is not so low and proves that the stock exchange finds some interest in storage when we learned that for all activities in USA (not only IT), there was no more than 82 IPOs in 2013 for total amount of $11.2 billion or an average of $137 million, according to Thomson Reuters & National Venture Capital Association. Average for the three new public storage firms was $135 million.

Few start-ups are going to file for IPO this year. Box is not far to become public. Pure Storage wants do do it. Coraid could be also on the list as well as Tintri in 2015.

IPOs IN STORAGE INDUSTRY

| Company | IPO year | Amount raised* | Total funding* |

| Silicon Storage Technology | 1995 | 15 | NA |

| StorageNetworks | 2000 | 260 | 205 |

| BakBone | 2000 | NA | NA |

| McData | 2000 | 350 | NA |

| STEC | 2000 | 65 | NA |

| FalconStor** | 2001 | NA | 33 |

| Xyratex | 2004 | 48 | NA |

| Rackable Systems | 2005 | 75 | 21 |

| CommVault | 2006 | 161 | 75 |

| Double-Take | 2006 | 55 | 70 |

| Isilon | 2006 | 108 | 69 |

| Riverbed | 2006 | 86 | 38 |

| 3PAR | 2007 | 95 | 183 |

| Compellent | 2007 | 85 | 53 |

| Data Domain | 2007 | 111 | 41 |

| Mellanox | 2007 | 102 | 89 |

| Netezza | 2007 | 124 | 68 |

| Voltaire | 2007 | 47 | 75 |

| Rackspace Hostings | 2008 | 145 | NA |

| OCZ Technology | 2010 | 101 | NA |

| Carbonite | 2011 | 62.5 | 67 |

| Fusion-io | 2011 | 223 | 111.5 |

| JCY International | 2011 | 238 | NA |

| Parade Technologies | 2011 | 34 | 21.5 |

| Violin Memory | 2013 | 162 | 186 |

| Nimble Storage | 2013 | 168 | 98.7 |

| Barracuda Networks | 2013 | 75 | 40 |

| Average of known figures | 120 | 81.3 |

* in $ million

** became public via a merger with Network Peripherals

(Source: StorageNewsletter.com)

START-UPS ACQUIRED IN 2013

| ACQUIRED START-UP | BUYER | TOTAL FUNDING | PRICE* |

| Arkeia Software (Carlsbad, CA) | Western Digital | 10 | NA |

| GridIron Systems (Sunnyvale, CA) | Violin Memory | >20 | NA |

| NexGen Storage (Louisville, CO) | Fusion-io | 12 | 119 |

| Nexsan (Thousand Oaks, CA) | Imation | 40 | 120 |

| PHD Virtual Technologies (Philadelphia, PA) | Unitrends | >4 | NA |

| Synerway (Gif-syr-Yvette, France) | Noël Minard et Yann Rolland,groupe Resad | 3.5 | NA |

| Tonian Systems (Cambrige, MA) | Primaty Data (merger) | >6 | NA |

| VeloBit (Lincoln, MA) | Western Digital | NA | NA |

| Virident Systems (Milpitas, CA) | Western Digital | 116 | 685 |

| Virsto Software (Sunnyvale, CA) | VMware | 24 | NA |

| WhipTail Technologies (Whippany, NJ) |

Cisco Systems | >41 | 415 |

*in $ million

(Source: StorageNewsletter.com)

NEW START-UPS (known thus far) BORN IN 2012 …

| Company | Activity and comments |

| Akonia Holographics (Longmont, CO) | holography, disc and drive, founded by former people from InPhase Technologies |

| BlueData Software (Mountain View, CA) |

big data platform; in stealth mode |

| CacheIO (Mason, NH) | SSD array and cache |

| Cobalt Iron (Lawrence, KS) | enterprise local and cloud backup |

| DataGravity (Nashua, NH) | launched by EqualLogic veterans; in stealth mode |

| DEY Storage Systems (San Mateo, CA) |

software defined storage: virtualized storage OS on standard hardware for datacenter scale customers |

| Folio Photonics (Cleveland, OH) |

optical disc holding 1TB or 2TB, spun-off from the Center for Layered Polymeric Systems |

| Hedvig (Santa Clara, CA) | in stealth mode, in software-defined storage system for cloud |

| hVault (Boulder, CO) | holographic disc storage system based on InPhase Technologies’ patents |

| Inktank (Sunnyvale, CA) | professional services and support subscriptions around Ceph |

| Koofr (Ljubljana, Slovenia) |

customizable hybrid cloud storage interface |

| Peaxy (San Jose, CA) | storage and management software |

| PernixData (San Jose, CA) | flash virtualization software; series A in 2012 |

| ProphetStor Data Services (Milpitas, CA) | Scale-out federation and distributed SAN; founded by former FalconStor and ITRI executives |

| Qumulo (Seattle, WA) | in stealth mode; seed funding of $2.3 million and series A $24.5 million in 2012 |

| Reduxio (Tel Aviv, Israel) | software reducing data on SSD/HDD arrays |

| SageCloud (Boston, MA) | storage system for cold storage |

| Starboard Storage Systems (Broomfield, CO) | Unified Hybrid Storage (SSD and HDD); born after the closing of RELDATA; series B in 2012; closed in 2013 |

(Source: StorageNewsletter.com)

… AND IN 2013

| Company | Activity and comments |

| Datrium Storage | alternative to virtualized storage, in stealth mode |

| Parsec Labs (Minneapolis, MN) |

storage virtualization for NAS |

| Primary Data | merged with Tonian Systems in 2013; in stealth mode; $50 million in 2013 in series B |

| Seeq (Seattle, WA) | big data technologies to manufacturing and operational industrial process data |

| SoftNAS (Houston, TX) | cloud storage OS; private equity funding in 2013 |

(Source: StorageNewsletter.com)

ALL FINANCIAL ROUNDS IN 2013

| NAME (HQ) | BORN IN | 2013 FUNDING | TOTAL FUNDING | ACTIVITY/COMMENTS |

| Actifio (Weston, MA) | 2009 | 50 | 107.5 | solution for data protection, DR and BC; two rounds in 2010, $8 and then $16 million |

| AlephCloud Systems (Sunnyvale, CA) | 2011 | 7.5 | 9.5 | managing content privacy and provenance in public clouds |

| Atlantis Computing (Mountain View, CA) | 20 | 35 | Virtual Desktop Infrastructure (VDI), storage and performance optimization solutions with de-dupe | |

| Axcient (Mountain View, CA) |

2007 | 17.6 | 51.1 | local backup on an appliance and online backup with DR; raises $7 million and $10.6 million in 2013 |

| BackupAgent (Delft, The Netherlands) |

2005 | 2 | NA | online backup solution; investment from the Solid Ventures capital fund; also in Poland; Sars is chief commercial officer; first round in 2007 |

| Bitcasa (Cincinnati, OH) | 2011 | 11 | 20 | infinite online backup storage for desktop PCs |

| BlueData Software (Mountain View, CA) | 2012 | 15 | 19 | big data platform; in stealth mode |

| Box (Palo Alto, CA) | 2005 | 100 | 404.5 | online storage on the Web; partners with Dell; two rounds in 2011: $48 million and $81 million |

| Cleversafe (Chicago, IL)** | 2005 | 55 | >100 | storage grid |

| CloudByte (San Mateo, CA) | 2010 | 4 | 6.1 | storage controller to manage physical or virtual storage; engineering team based in Bangalore, India |

| Cloudfind (Beehive Yard, UK) Bath, UK) |

2011 | 0.8 | 1.1 | algorithms that automatically tag information and documents from across cloud storage providers |

| CloudPhysics (Mountain View, CA) |

2011 | 10 | NA | datacenter analytics services for virtualized infrastructures |

| Cloudscaling (San Mateo, CA) |

2006 | 10 | NA | OpenStack-powered cloud infrastructure system |

| CloudVelocity (Santa Clara, CA) |

2010 | 13 | 18 | hybrid cloud platform with server, networking, security and storage integration with AWS; formerly Denali Systems |

| Clustrix (San Francisco, CA) |

2006 | 16.5 | 46.5 | scale-out SQL database engineered for the cloud; founded by former Isilon executives |

| Coho Data (Sunnyvale, CA) | 2011 | 25 | 35 | formerly Convergent.io; founded by XenSource veterans; in hybrid system with software-defined storage networking |

| Connected Data (Santa Clara, CA) |

2001 | 6 | 6 | Transporter to communicate and share files in a peer-to-peer fashion with computers and other Transporter devices located anywhere in the world |

| Corsair Components (San Franciso, CA) |

1994 | 75 | NA | PC components including memory, SSD, flash keys |

| Crocus Technology (Grenoble, France) | 2004 | 45 | 116.2 | MRAM |

| DataGravity (Nashua, NH) | 2012 | 30 | 42 | launched by EqualLogic veterans; in stealth mode |

| Datto (Norwalk, CT) | 2007 | 25 | 25 | hardware- and cloud-based on- and off-site backup, DR and BC solutions |

| Diablo Technologies (Ottawa, ONT) | 2003 | 7.5 | 55.5 | software and hardware architecture with non-volatile memory for solid state storage for enterprise |

| Druva Software (Pune, India) | 2007 | 25 | 42 | continuous data availability and de-dupe backup software for laptops |

| Egnyte (Mountain View, CA) | 2007 | 29.5 | 64.5 | cloud storage (online file server) |

| EverSpin Technologies (Chandler, AZ) | 2008 | 15 | 20 | MRAM; with roots in Freescale Semiconductor; $20 million in Series A financing and intellectual property from Freescale |

| GreenBytes (Providence, RI) |

2007 | 7 | NA | VDI/desktop virtualization |

| Hedvig (Santa Clara, CA) | 2012 | 10 | 12.5 | in stealth mode, in software-defined storage system for cloud |

| Hightail (Campbell, CA) | 2004 | 34 | 83 | online file sharing |

| HybridCluster (Bristol, UK) | 2008 | 1 | storage, replication and web clustering software; a SETsquared company | |

| Infinio (Cambridge, MA) | 2011 | 12 | 24 | software improving storage performance of virtualized environment |

| Maginatics (Mountain View, CA) |

2010 | 17 | 27 | software to overlay cloud storage with general-purpose distributed file system accessible by mobile devices |

| MapR Technologies (San Jose, CA)) |

2009 | 30 | 59 | Distribution for Apache Hadoop for data protection and business continuity; R&D in India; three rounds |

| Nexenta Systems (Santa Clara, CA) |

2005 | 24 | 54 | software storage OS based on Linux and ZFS |

| NextIO (Austin, TX) | 2003 | 8.8 | 74.8 | PCIe I/O virtualization solution; closed doors in 2013 |

| Panzura (San Jose, CA) | 2008 | 25 | 58 | flash-based NAS |

| PernixData (San Jose, CA) | 2012 | 20 | 27 | flash virtualization software; series A in 2012 |

| PHD Virtual Technologies (Philadelphia, PA) | 2006 | 4 | NA | backup and recovery for virtual machines: acquired VirtualSharp Software in 2013; acquired by Unitrends in 2013 |

| Piston Cloud Computing (San Francisco, CA) | 2011 | 8 | 12.5 | enterprise OpenStack software |

| Pivot3 (Austin, TX) | 2003 | 14 | 114.5 | RAID Across Independent Gigabit Ethernet (RAIGE) for video surveillance |

| Primary Data | 2013 | 50 | NA | merged with Tonian Systems in 2013; in stealth mode, $50 million in 2013 in series B |

| Proton Digital Systems (San Jose, CA) |

2011 | 2 | NA | flash read channel |

| Proximal Data (San Diego, CA) |

2011 | 2 | 5 | virtual cache software for unified I/O caching across multiple VMs |

| Pure Storage (Mountain View, CA) |

2009 | 150 | 245 | all-flash storage arrays; on track for IPO in 2013 |

| QuorumLabs (San Jose, CA) | 2008 | 21 | 31 | BC appliance; spun out of Themis Computer in 2008 |

| Radian Memory Systems (Calabasas, CA) | 2011 | 0.7 | NA | products that will transform the use of storage memory in enterprise and cloud computing environments; in stealth mode; R&D in Russia |

| Reduxio (Tel Aviv, Israel) | 2012 | 12 | 12 | software reducing data on SSD/HDD arrayse |

| RunCore Innovation Technology (Changsha, China) |

2007 | 10 | NA | rugged SSDs |

| SageCloud (Boston, MA) | 2012 | 10 | NA | storage system for cold storage |

| Scality (Paris, France)*** | 2010 | 22 | 35 | massively scalable storage platform; spin-off from Bizanga; R&D in Paris; formerly BizangaStore |

| Seeq (Seattle, WA) | 2013 | 6 | 6 | big data technologies to manufacturing and operational industrial process data |

| SimpliVity (Westborough, MA) |

2009 | 58 | 101 | 2U box platform to manage virtualized infrastructure; formerly Ecological Solution; two rounds in 2012, $6 million and $18 million?; third one same year series B at $25 million |

| Skyera (San Jose, CA) | 2010 | 51.6 | 57.6 | all-SSD systems; formerly StorCoud |

| SolidFire (Boulder, CO) | 2010 | 31 | 68 | all-SSD storage system; two rounds in 2011: $11 million and $25 million |

| Spanning Cloud Apps (Austin, TX) | 2010 | 6 | 9 | SaaS data protection for Google Apps |

| SwiftStack (San Francisco, CA) |

2011 | 6.1 | 7.6 | software-defined storage for object storage; $1.5 million in seed funding and $6.1 million in Series A in 2013 |

| Tegile Systems (Newark, CA) | 2009 | 35 | NA | multi-protocol SSD/HDD array with de-dupe for primary storage |

| Virident Systems (Milpitas, CA) |

2006 | 40 | 116 | enterprise PCIe SSD; also in Bangalore, India: second round in 2010; Seagate puts $40 million in the company in 2013; sold to Western Digital in 2013 |

| Zadara Storage (Irvine, CA) | 2011 | 3 | 10 | software defined storage as a service for public and private clouds (NAS and SAN); also in Nesher, Israel |

| Zerto (Boston, MA) | 2009 | 13 | 34.2 | hypervisor-based replication for enterprise; also in Herzliya, Israel |

| Zetta.net (Sunnyvale, CA) | 2007 | 8 | 39.5 | cloud storage solution for enterprises |

Note: Funding in $ million

** Correction: Line added on January 9, 2014

*** Correction: Line added on November 12, 2014

(Source: StorageNewsletter.com)

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter