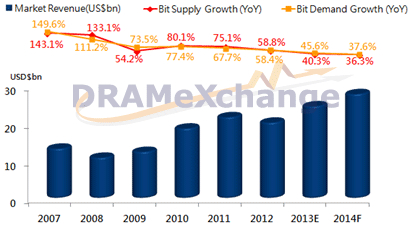

NAND Flash Revenue to Grow by 13% Y/Y to $28 Billion in 2014 – DRAMeXchange

SSD being key to momentum

This is a Press Release edited by StorageNewsletter.com on December 9, 2013 at 3:12 pmAccording to DRAMeXchange, a research division of TrendForce Corp., the price movements in the NAND flash market are expected to remain steady thanks to the industry’s stable supply and demand.

With the end-demand momentum being certain, TrendForce projects that the total NAND flash market value will grow by 13.3% Y/Y to $ 28 billion. This would mark the second straight year during which the NAND flash market displayed positive, double digit growth.

2007-2014F NAND Flash Market Value and Bit Growth

(Source: DRAMeXchange, November 2013)

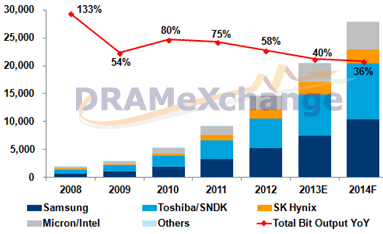

Looking at the supply side, given the amount of NAND flash capacity that has been allocated to DRAM following the fire accident at SK Hynix’s Wuxi plant, the 2013 NAND flash output has been revised downwards to 20,466 M 16GB equiv., a 40.3% Y/Y decrease.

For the entire year, the wafer production scale (12 inch equivalent) is only expected to be 12.4 million units, which represents a mere 3.2% increase from 2012 and suggests for a less severe oversupply situation in 4Q13 and 1H14.

With the total NAND flash capacity currently anticipated to return to pre-fire accident levels during 2H14 and various NAND flash manufacturers planning to increase capacity in the same period, TrendForce believes that the volatility in the NAND flash market will end up being relatively less severe in 1H14 compared to the previous years. This is expected to be the case even with the heightened supply of NAND flash products during the traditional off-peak quarters.

With regard to the manufacturing side, considering the anticipated rise in the 1xm-and-under technology migrations, more and more NAND flash manufacturers are expected to begin producing eMMC and SSD products using the 1xnm manufacturing process. The increased use of the manufacturing technology is currently expected to contribute to the furthered decline in manufacturing cost.

Looking at 3D-NAND flash, even though samples of the product are already being delivered to clients for testing, a considerable amount of time will still be needed for the product’s overall yield rate and efficiency to be improved. The earliest period during which 3D-NAND flash products can be mass produced, as such, is either 4Q14 or 2015.

Taking into account all of the aforementioned factors, it appears unlikely that the NAND flash vendors will change their usual strategy of sustaining profits through supply regulations.

For 2014, NAND flash output bit growth is forecast at only 36.3%, which represents a new low in five years.

2007-2014F NAND Flash Supply Dynamics

(Source: DRAMeXchange, November 2013)

TrendForce expects demand bit growth to be approximately 37.6% in 2014.

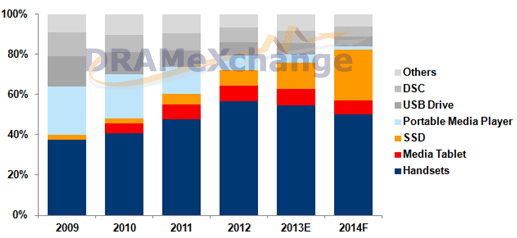

Looking at the memory card and UFD markets, the penetration rates of both USB 3.0 and SD3.0 have been rising thanks to the products’ lowered manufacturing costs. Due to the growing shipments of tablets and smartphones, applications of eMMC, eMCP, and SSD products also experienced continuous growth.

Looking towards next year, TrendForce believes the total smartphone shipments will break the one billion mark and arrive at 1.169 billion units.

For tablets (including those manufactured by white-box brands), shipments are estimated to rise by approximately 18% Y/Y to 219 million units.

Thanks to the overall momentum provided by the aforementioned products, 2014 eMMC shipment growth is estimated to reach up to 36%.

With the SSD format able to exert noticeable impact on the notebook and desktop industries, and with Intel and various NAND flash vendors pushing for the adoption of the M.2 SSD format, TrendForce believes that the prices of PC client SSDs will continue to rise.

As for the enterprise SSDs, due to the rise in cloud computing and the growing popularity of smartphone/tablet apps, the requirements for server and storage based functions have grown considerably. Data management centers and global server businesses are among the organizations that are gradually paying attention to enterprise SSDs as well as raising the number of relevant purchase orders.

Throughout the course of this year, Seagate and Western Digital have also strengthened their own industry level storage lines through in-house development or relevant acquisitions.

With the said developments in mind, TrendForce predicts that the SSD NAND flash consumption will rise from this year’s 13% to 25% in 2014. The growth is likely to be higher than the existing demand for other NAND flash products.

2007-2014F NAND Flash Demand Dynamics

(Source: DRAMeXchange, November 2013)

In the short and medium terms, TrendForce believes that the effects of the upcoming off-peak quarters will affect the NAND flash market and lead to a slight oversupply situation.

In the long run, NAND flash application will become increasingly more diverse.

In addition to the attachment type UFD and memory cards and system products such as smartphones and tablets, an increasing amount of attention are also being placed on industry-level storage systems. Along with the effects of the manufacturers’ supply regulations, we believe the end-demand for these multi-purpose products will enable NAND flash markets to grow at a more stable pace throughout 2014.

On the whole, the industry’s supply and demand is expected to remain healthy.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter