WW NAS/Unified Storage Market – IDC

EMC leads in revenue, Netgear in units shipped

This is a Press Release edited by StorageNewsletter.com on November 12, 2013 at 3:09 pmDespite turbulence in global economies and tight IT budgets, the NAS/unified storage market grew 19.7% in 2012 (compared with 32.5% in 2011), according to Market Share Analysis: Network-Attached Storage and Unified Storage, Worldwide, 2012 – Gartner, 29 May 2013, ID:G00251056, written by analyst John Monroe.

No.1 EMC extended its share of the market’s revenue, reflecting continuing movement toward unified storage by major SAN vendors.

Key Findings

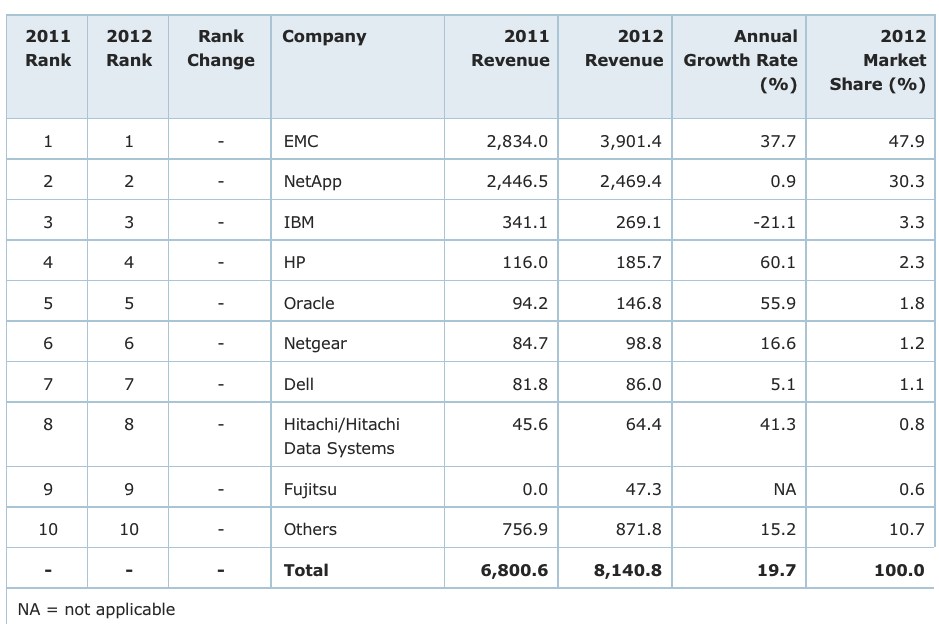

- EMC and NetApp retained almost 80% of the market. They were separated by more than $2 billion in revenue from IBM and HP, their next two largest competitors.

- No.1 EMC grew its overall network-attached storage (NAS)/unified storage share to 47.9% (up from 41.7% in 2011), while No.2 NetApp’s overall NAS/unified storage share dropped to 30.3% (down from 36% in 2011).

- In the overall NAS/unified storage share ranking, the positions of the nine named vendors remained unchanged in 2012 (in order of share rank: EMC, NetApp, IBM, HP, Oracle, Netgear, Dell, Hitachi/Hitachi Data Systems and Fujitsu).

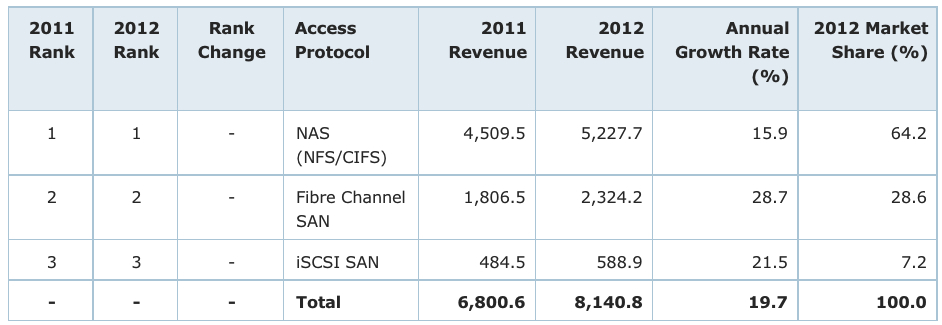

- For the fifth consecutive year, iSCSI SAN revenue and FC SAN revenue continued to gain proportionate share in the overall NAS/unified market.

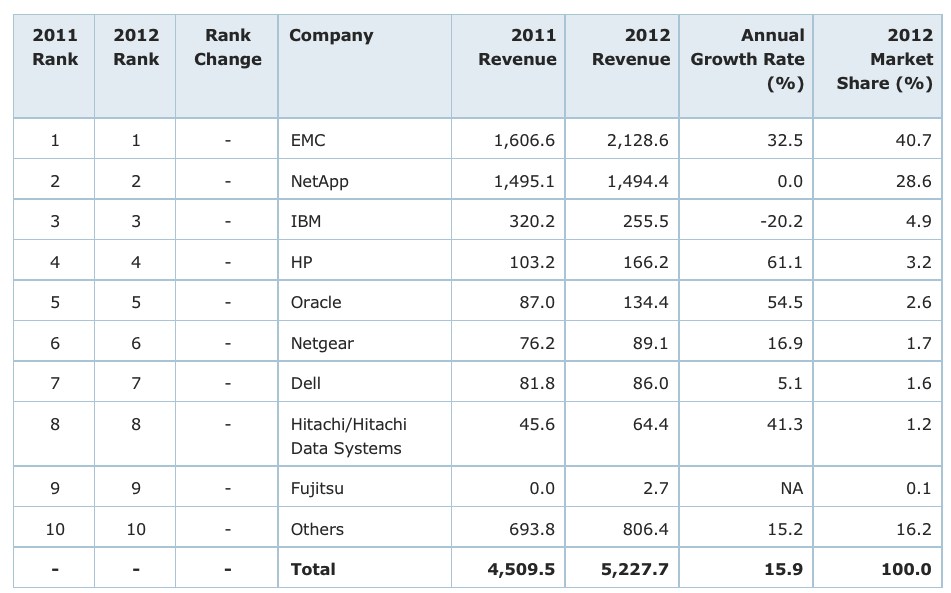

- The pure NAS market continues to grow at a much faster rate (15.9%) than the overall external controller-based (ECB) block-access market (2.3%), in large part due to the expanding NAS support of growing vertical applications and virtualization.

Market Share Data

The overall NAS/unified storage market, illustrated in Table 1 and Table 2, includes NAS products that exclusively offer NAS protocols, such as NFS and CIFS, as well as unified storage that offers both NAS protocols and block storage protocols, such as FC and iSCSI, from the same system.

For the pure NAS storage market, illustrated in Table 3, Gartner excludes systems that offer block storage protocols. For example, EMC’s VNX is included entirely in Table 2, whereas only the estimated NAS portion of VNX is included in Table 3.

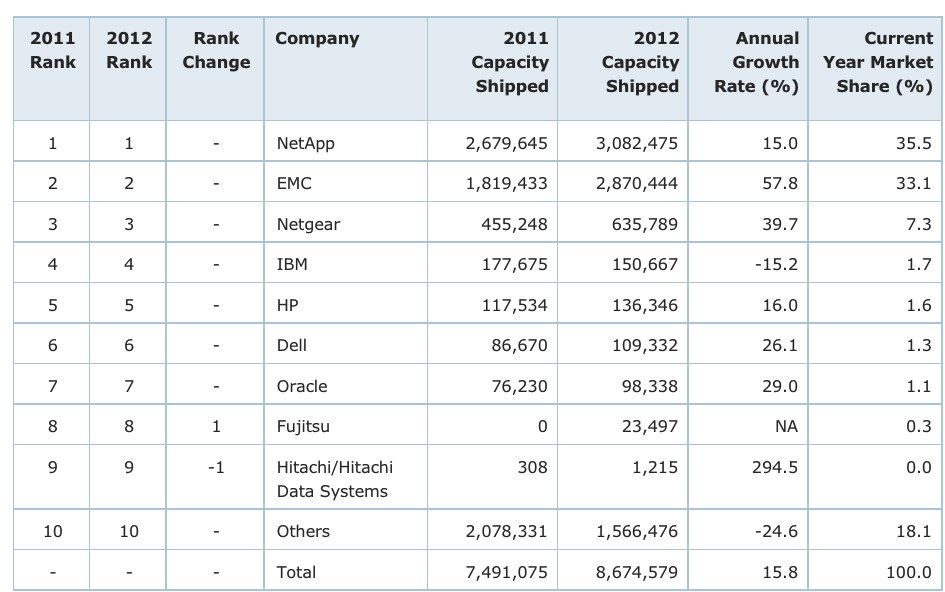

Table 4 and Table 5 depict units and raw capacities shipped. The low-end markets, as exemplified by Netgear, consume the majority of units shipped but have a relatively small portion of the revenue and petabytes delivered.

The following notes are relevant to Table 2 through Table 5:

- EMC numbers include Iomega’s historical numbers, Data Domain’s numbers from 3Q09, and Isilon’s revenue from 4Q10.

- Hitachi/HDS’ numbers in 2011 include BlueArc’s numbers from 4Q11.

- Due to a shrinking of the number of named vendors in this report, the Others category has been re-estimated for 2008 through 2011. Clients should refer to prior years’ NAS market share reports for historical shares of smaller vendors, most of which have now been consumed by larger companies.

Table 1. Total NAS/Unified Storage Revenue by Access Protocol ($ million)

Source: Gartner (May 2013)

Table 2. Total NAS/Unified Storage Vendors by Revenue ($ million)

Source: Gartner (May 2013)

Table 3. NAS Vendor Revenue, Excluding Block-Access Protocols ($ million)

Source: Gartner (May 2013)

Table 4. Total NAS/Unified Storage Vendors by Raw Capacity Shipped (TB)

Source: Gartner (May 2013)

Table 5. Total NAS/Unified Storage Vendors by Unit Shipments

Source: Gartner (May 2013)

Overall Market Segment Performance Analysis

Market conditions were challenging, but the total NAS/unified storage market grew by 19.7% in 2012, driven by the increasing SAN contribution to the unified storage market and EMC’s continuing excellence in sales execution.

Unified Storage Sales Continue to Accelerate

The concept of unified storage is no longer driven only by NAS vendors and products; SAN vendors have started to add NAS capabilities on their SAN storage arrays with a unified management interface as well (and some vendors, such as Hitachi/HDS, have added object storage access). As a result, the unified storage market has grown much faster than in the past.

In fact, the FC SAN portion of the NAS/unified storage market increased by 82.3% to account for 27% of the market in 2011. Although this trend continued in 2012, the growth rate was diminished at 28.7%, but FC SAN share grew to 28.6% from 26.6%. We expect the NAS/SAN convergence will focus on the midrange storage array arena, and we expect the combined share of iSCSI SAN and FC SAN systems will continue to increase in coming years, as it has done for the last five years.

With BlueArc and Pillar Data being acquired by HDS and Oracle, respectively, the NAS/unified storage market is now devoid of an emerging innovative enterprise player with significant revenue. Netgear, along with the largest vendors (Buffalo and QNAP) in the Others category in Table 2 and Table 3, are all essentially playing in the low-end NAS markets, with limited (or no) expansion beyond the small office/home office networking space into small and midsize business and other higher-range markets.

Huawei in recent quarters has shown significant enterprise growth and will emerge from the Others category and become one of the named, separately tracked vendors in Gartner’s ECB market statistics beginning in 2Q13.

Raw Capacity Growth

The raw capacity growth rate at 15.8% was the lowest in recent years, largely due to tight budget constraints and the necessity of deploying greater storage efficiencies throughout the infrastructure. However, Gartner still expects that capacity growth will continue unabated in the 35%-to-45% range, and it may yet exceed 50% in future years.

Top Vendors Analyzed

For the past decade, NetApp and EMC have dominated the NAS/unified storage market, and their lion’s share of this space continues to grow. Combined EMC and NetApp shares expanded from 43.1% in 2008 to 78.2% in 2012.

NetApp lost considerable market share to EMC in 2011 and 2012. In 2008, 2009 and 2010, NetApp held 41.6%, 39.3% and 40.2% market shares, but its share fell to 36% in 2011 and to 30.3% in 2012. Meanwhile, EMC’s share grew from 11.5% in 2008 to 47.9% in 2012.

Much of EMC’s growth has been due to the Isilon acquisition at the end of 2010 (EMC’s sales force was able to place Isilon’s scale-out NAS systems in a much wider variety of global vertical industries, especially financial services, universities/research, media/entertainment, government and healthcare); to continuing growth in the company’s Data Domain backup business; and to the company’s VNX unified storage replacing not only the previous-generation Celerra NAS business but also its CLARiiON SAN business, transferring a significant portion of its existing midrange SAN business to the unified storage category. We expect VNX will replace all of its separate NAS and SAN arrays with unified platforms during 2013.

Much of NetApp’s share loss has been due to the delayed and ineffective launch of its next-generation OS Clustered Data Ontap 8.1 (which is now beginning to gain crucial customer acceptance); to the debt ceiling gridlock in June 2011, which froze many government organizations’ budgets (this likely impacted NetApp more than its competitors); to the company’s continuing overreliance on a limited number of large accounts; and to the company’s relatively slow penetration, compared with its competitors, of regions outside of the United States and Western Europe.

Although deficient as a disk-to-disk appliance and too expensive for expansive archiving, from the technology platform perspective, NetApp’s Data Ontap platform – as delivered under NetApp’s own brand or under other OEM brands – remains the most widely deployed in the NAS/unified storage arenas. NetApp (along with Oracle and its ZFS Storage appliance) also stands out by providing a single OS platform for both NAS and SAN support and both primary and backup/archive usage, whereas EMC and other storage vendors have to resort to multiple OS platforms to compete at the same level. On the other hand, EMC and other vendors could argue that each of their platforms is more optimized for certain workload characteristics and may do a better job than NetApp’s “one platform fits all” approach. The key continues to lie in the management layer – in the ways in which those various platforms can be tightly integrated and managed by a common, intuitive tool. EMC’s Unisphere has been a good initial step with positive user feedback, but all vendors with various storage platforms will face continuing challenges in the common management area.

Other Notable Vendors

Below the top two vendors, the distant third is IBM, which earned a 3.3% share (down from 5% in 2011), with a 21.1% revenue decline, largely due to its transitions from ECB disk storage solutions sourced from NetApp to ECB disk storage solutions based on IBM intellectual property; also, IBM’s SONAS was unable to keep up with the scale-out NAS market growth.

The No. 4 vendor, HP, rebranded its NAS offerings as StoreEasy. These systems, based on Windows Server 2012, became increasingly appealing to the entry and midrange NAS market in 2012, resulting in a 60.1% increase in revenue and a share gain of 0.6%.

Oracle, the No. 5 vendor, increased its share from 1.4% to 1.8% and grew its NAS revenue by 55.9%. The company’s R&D investments in its Sun ZFS Storage Appliance in conjunction with the formation of a dedicated sales force is producing increased market traction in the general-purpose NAS market supporting Oracle software and as a backup appliance that has been optimized for Oracle’s engineered systems, such as the Exadata Database Machine.

No. 6 Netgear‘s share remained flat at 1.2%, but its revenue increased by 16.6%, reflecting a need for increased storage in low-end NAS markets (Netgear’s raw capacity shipped increased by 39.7%).

The market gains achieved by No. 7 Dell‘s Fluid File System NAS platforms were offset by declines in its Windows Server-based PowerVault NAS offering, resulting in a slight decline in share (from 1.2% to 1.1%).

Featuring enterprise scalability, No. 8 Hitachi/HDS‘ NAS Platform (HNAS) minor market share gain (from 0.7% to 0.8%) came from the increasing deployment of this platform as a gateway for the high-end Hitachi VSP or as an integrated component of the HUS100 Family and HUSVM.

No. 9 Fujitsu had no NAS revenue in 2011 but shipped $47.3 million in NAS gateway devices in 2012; these devices gave its customers the ability to deliver both file- and block-level storage services with Fujitsu’s Eternus SAN storage systems. Although HP’s, Oracle’s and Netgear’s revenue increased in terms of percentage growth, their combined revenue volume remains only a small fraction of the revenue reported by EMC and NetApp.

The Others category, comprising smaller vendors, has declined precipitously in revenue share, from 28.2% in 2008 to only 10.7% in 2012.

Mergers and Acquisitions

Unlike 2011, there were no mergers and acquisitions in the NAS/unified storage space during 2012, but Gartner believes there will be considerable merger and acquisition activity in this market arena during the next five years.

Future NAS and SAN Consolidation and Disruptive Trends

The storage hegemony of the eight largest global suppliers – Dell, EMC, Fujitsu, Hitachi/Hitachi Data Systems, HP, IBM, NetApp and Oracle – is already being threatened on multiple fronts by creative technology disruptions provided by such emerging vendors as Fusion-io, Nimble, Pure Storage, Tegile, Tintri, Violin Memory and a host of others.

As the amount of unstructured data increases at an exponential rate, the associated costs to store this data on traditional ECB disk storage platforms for analysis and retention is becoming prohibitive. To address this unsustainable situation, scale-out storage systems based on industry standard multicore Intel Architecture (IA) microprocessors and open-source software – from collaborative organizations, such as Open Stack, that are able to support petabytes of data under a single name space – are poised to present a real and present threat to all vendors in the NAS and object storage markets. Software vendors without an installed hardware base to protect, such as Red Hat, Nexenta and CloudByte, provide storage system software and professional support that enable users to construct storage nodes based on commodity industry standard IA servers with direct-attached disks supporting petabytes of (in most cases) scale-out storage. Hadoop implementations that support big data applications often use the Hadoop Distributed File System and commodity IA servers with direct-attached disks to keep performance competitively high and costs low.

Larger vendors are also enabling future disruptions. Refining or strengthening this increasingly visible market trend is the growing maturity of Windows Server OSs, which now deliver significant native parallel I/O capability, along with other efficiency, clustering and availability features.

More embedded standard software functionality in evolving scale-out architectures will also enable less care and feeding by system administrators, further reducing fixed and variable costs. In fact, Gartner believes that, by 2016, storage system functional enhancements will double storage administrator productivity on a petabytes-per-full-time-equivalent basis.

A corollary or contradiction to the threat of creative technology disruptions from smaller companies is the ongoing trend of mergers, acquisitions and consolidation, which tends to preserve the “Big Eight” server/storage hegemony. Although we have seen a plethora of new vendor activity in developing software-defined, scale-out storage products, we still believe that the general trend of “all giants, no dwarfs” will prevail.

Although this trend toward consolidation may serve to curtail the impact of creative technology disruptions, we still believe that, by 2016, the multiple potential values provided by servers masquerading as storage arrays will be an obvious force to be reckoned with for all vendors in all storage markets.

Read also:

Top 2011 NAS Vendors: EMC in Sales, Netgear in Units

According to Gartner

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter