WW Cloud IT Infrastructure Market Grew 14% in 4Q14 at $8 Billion – IDC

Top 5 vendors: HP, Dell, EMC, Cisco and IBM

This is a Press Release edited by StorageNewsletter.com on April 24, 2015 at 3:01 pmAccording to International Data Corporation‘s (IDC) Worldwide Quarterly Cloud IT Infrastructure Tracker, total cloud IT infrastructure spending (server, disk storage, and Ethernet switch) grew by 14.4% year over year to $8.0 billion in the fourth quarter of 2014 (4Q14), accounting for approximately 30% of all IT infrastructure spend, up from about 27% one year ago.

Private cloud infrastructure spending grew by 18.3% year over year to $2.9 billion, while public cloud infrastructure spending grew to $5.0 billion, 12.3% higher than one year ago.

For the full year 2014, cloud IT infrastructure spending totaled $26.4 billion, up 18.7% year over year from $22.3 billion; private cloud spending was just under $10.0B, up 20.7% year over year, while public cloud spending was $16.5B, up 17.5% year over year.

“The transition to cloud-oriented infrastructure and data platform architectures within enterprises’ datacenters continues to accelerate, yet the expansion of public cloud infrastructure in service providers’ datacenters around the world is an even larger driver of IT spending,” observed Richard Villars, VP, datacenter and cloud research, IDC. “A key driver of this acceleration is organizations’ development and use of new Internet of Things services that require levels of agility and scale that only cloud solutions can deliver.“

For this second quarterly release of cloud IT market results, IDC has expanded its worldwide coverage to include detail for 8 regions: AsiaPac (ex. Japan), Canada, Central & Eastern Europe, Japan, Latin America, Middle East and Africa, USA, and Western Europe. In 4Q14, USA had the highest share of overall cloud IT infrastructure spending with 64%, followed by AsiaPac (ex. Japan) with 17% and Western Europe with 12%. Western Europe had the highest growth in cloud IT infrastructure spending with 30% year over year growth.

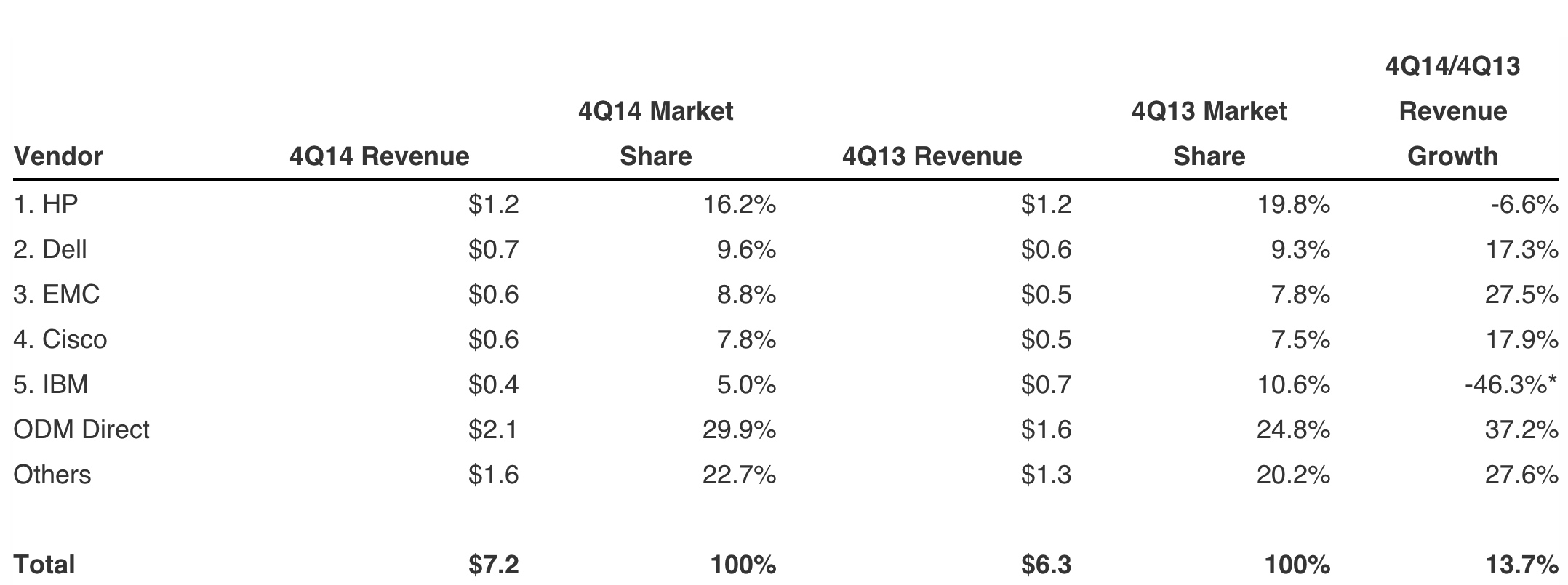

Top 5 Corporate Family, WW Cloud IT Infrastructure Vendor Revenue, 4Q14

(revenue in $ billion)

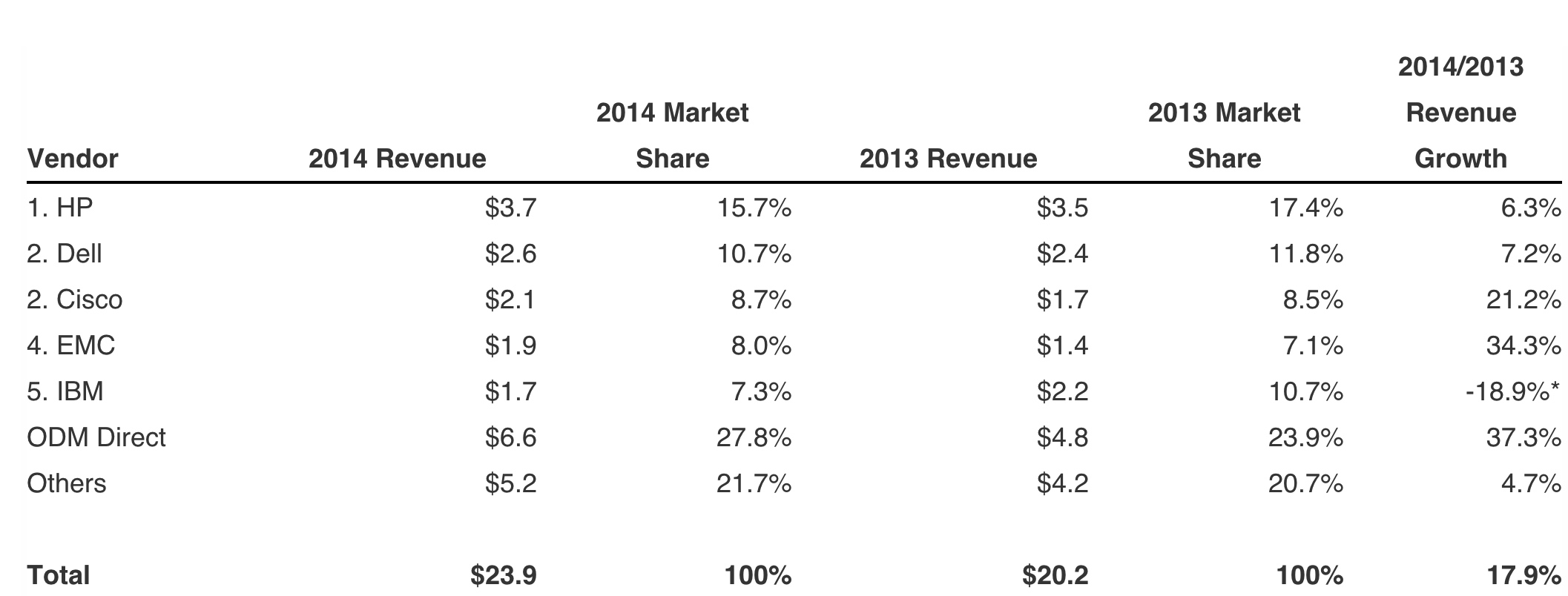

Top 5 Corporate Family, WW Cloud IT Infrastructure Vendor Revenue, Year 2014

(revenue in $ billion)

(Source: IDC’s Worldwide Quarterly Cloud IT Infrastructure Tracker, April 2015)

*IBM’s divestiture of its x86 business to Lenovo on October 1, 2014 has a negative impact on year over year comparisons for 2014.

Taxonomy Notes:

IDC defines cloud services more formally through a checklist of key attributes that an offering must manifest to end users of the service. Public cloud services are shared among unrelated enterprises and consumers; open to a largely unrestricted universe of potential users; and designed for a market, not a single enterprise. The public cloud market includes variety of services designed to extend or, in some cases, replace IT infrastructure deployed in corporate datacenters. It also includes content services delivered by a group of suppliers IDC calls Value Added Content Providers (VACP). Private cloud services are shared within a single enterprise or an extended enterprise with restrictions on access and level of resource dedication and defined/controlled by the enterprise (and beyond the control available in public cloud offerings); can be onsite or offsite; and can be managed by a third-party or in-house staff. In private cloud that is managed by in-house staff, ‘vendors (cloud service providers)’ are equivalent to the IT departments/shared service departments within enterprises/groups. In this utilization model, where standardized services are jointly used within the enterprise/group, business departments, offices, and employees are the ‘service users.’

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter