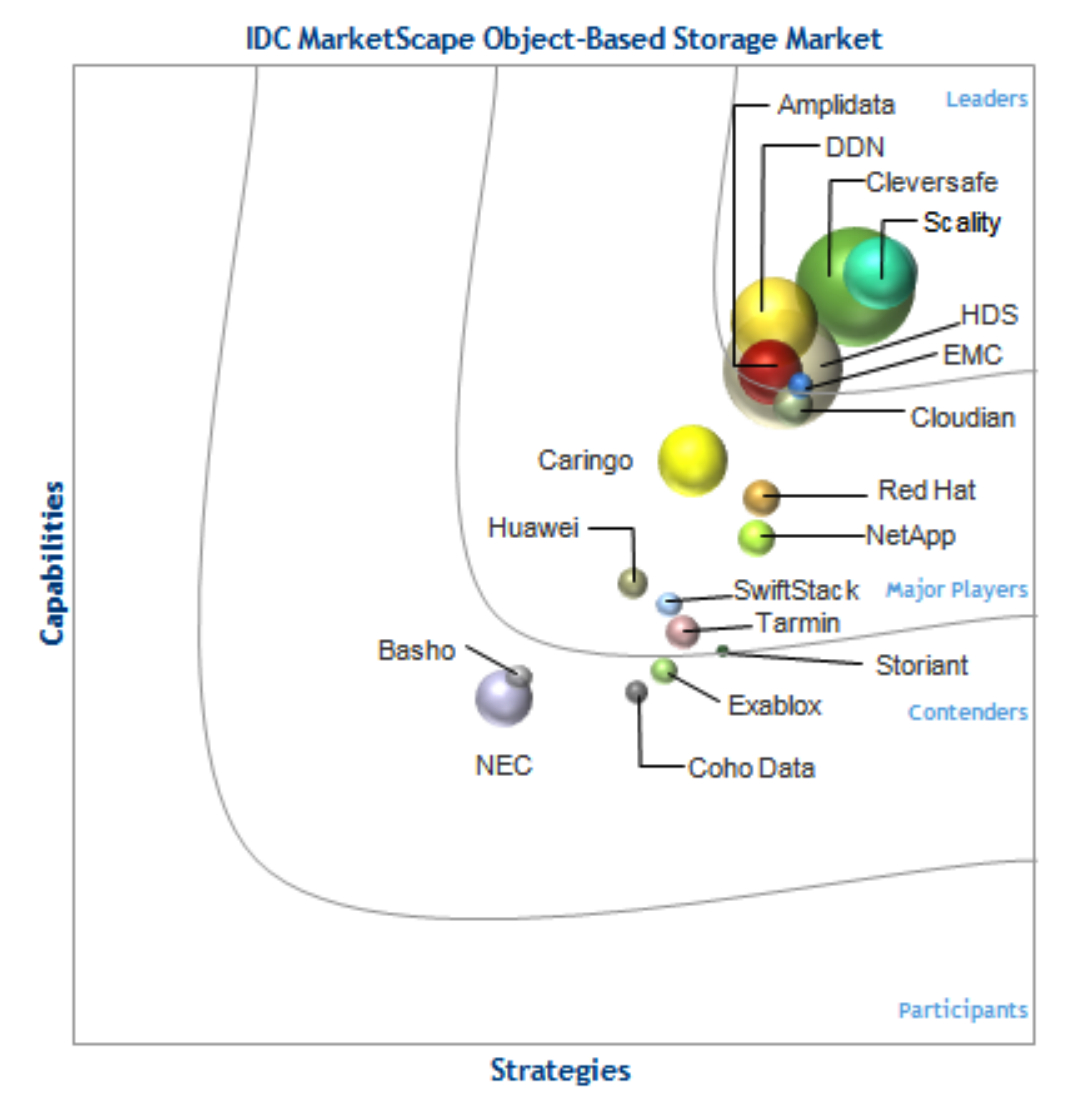

Leaders in Worldwide Object-Based Storage in 2014 – IDC

?1 Scality, ?2 Cleversafe, ?3 DDN

This is a Press Release edited by StorageNewsletter.com on January 6, 2015 at 3:11 pmInternational Data Corporation has published a report, IDC MarketScape: Worldwide Object-Based Storage 2014, Vendor Assessment (Doc #253055, December 2014), written by analyst Ashish Nadkarni

IDC Opinion

Object-based storage (OBS) platforms continue to perpetuate cloud and enterprise IT infrastructure. As businesses move toward petabyte-scale storage, OBS solutions are turning out to be the right choice for balancing scale, complexity, and costs.

By way of their core design principles, OBS platforms deliver unprecedented scale at reduced complexity and reduced costs over the long term. Early OBS platforms suffered from ‘necessity crisis,’ were too cumbersome to deploy and, in some cases, caused a platform lock-in because of their proprietary access mechanisms. In spite of their from-the-ground-up design, a departure from how traditional SAN and NAS arrays are deployed and, more importantly, a lack of standard interfaces made it difficult for IT organizations to deploy OBS solutions in the infrastructure.

Thanks to Amazon S3 and OpenStack Swift becoming de facto access interfaces, this situation has changed. This has in turn spurred further investments in making OBS solutions more ubiquitous. In 2013 and 2014, several new suppliers entered the market, while others announced partnerships and expanded their ecosystem, and notably, many of them came together to form an alliance (known as the Object Storage Alliance) to perpetuate object storage further into the enterprise.

An important trend that is catching on slowly is to deemphasize the ‘object storage’ component of the solution and instead focus on the use case or the problems solved by the solution – for vertical-specific situations or for more generic big data, social, cloud, and mobile workloads.

IDC estimates that in 2014, OBS solutions accounted for nearly 46% share of the file-and-OBS (FOBS) market in revenue and is forecast to be a $28.3 billion market in 2018. However, the total revenue from commercial OBS products as a percentage of the overall OBS market is quite small in 2013, and even with a forecast CAGR of over 27%, it will constitute a relatively small portion in 2017.

IDC assesses the present commercial OBS supplier (suppliers that deliver software-based OBS solutions as software or appliances much like other storage platforms) landscape. As this IDC MarketScape indicates, in 2014, the OBS market became more fragmented (IDC now counts more than 25 OBS suppliers, of which 18 are featured in this IDC MarketScape as ‘owner of IP’ suppliers). IDC analyzed the capabilities and business strategies of 18 OBS suppliers that it considers to be representative of the market.

Key findings include:

- The market has more or less adopted Amazon S3 and OpenStack Swift as the RESTful access mechanisms for object storage. Several suppliers are aligning themselves to OpenStack in an attempt to make their object storage compatible with Swift, Cinder, Manila, Glance, and Nova. They are also trying to preemptively ward off a threat from Ceph and Swift (the OpenStack OBS implementation). This has also led to a new breed of open source-based commercial variants of OBS platforms like Swift and Ceph (some of which are profiled in this IDC MarketScape).

- Leading suppliers (especially incumbent storage suppliers) are focusing on a broader portfolio and a bigger sales force to go after more buyers. Furthermore, many such suppliers have signaled a portfolio approach wherein object capabilities would be provided using multiple platforms – both legacy and next generation.

- Smaller suppliers (especially the newer entrants) that have more innovative solutions are getting additional funding to go after a diverse buyer base. Such suppliers therefore focus on specific verticals and/or use cases such as archiving, telecom providers, and managed service providers as they build out their business. They are also extending their reach using OEM partnerships and reseller relationships.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter