Cloud Represented 32% of Total EMEA Storage Capacity in 4Q14 – IDC

52% growth Y/Y

This is a Press Release edited by StorageNewsletter.com on May 1, 2015 at 3:10 pmAccording to the newly introduced EMEA data portion of the International Data Corporation‘s Worldwide Quarterly Cloud Infrastructure Tracker, IT infrastructure spending (server, disk storage, and Ethernet switch) for public and private cloud in Europe, the Middle East, and Africa (EMEA) grew by 27% to reach $1.1 billion in revenue in 4Q14 and totaled around $4.1 billion for the whole year, with 28% growth over 2013.

The cloud-related share of total EMEA infrastructure expenditure on server, disk storage, and Ethernet switch grew by 3 percentage points to exceed 17% in 2014.

In terms of storage capacity, cloud represented around 32% of total EMEA capacity in 4Q14, with 52% growth over the same period a year before.

For the scope of this tracker, IDC has tracked the following vendors: Cisco, Dell, EMC, Fujitsu, Hitachi, HP, IBM, Lenovo, NetApp, the major ODM vendors, and others.

IDC expects this market to reach a value of $10.8 billion by 2019, or 39% of the total market expenditure, representing one of the areas of tremendous growth for the European infrastructure sector, compared to the expectation of a stagnant, if not declining, traditional market.

Western Europe

Western Europe accounted for about 82% of the EMEA cloud business in 2014 and saw its cloud investment soar from 15% of the datacenter infrastructure spending in 2013 to 19% in 2014 and, in fact, bringing to growth an otherwise stagnant IT infrastructure market. Public cloud in particular, though accounting for only around 8% of total investments, registered the highest year-over-year growth rate (35%). On a quarterly basis, 4Q14 registered 29% growth in cloud investments, just short of $1 billion, versus a total market growth of 3%.

“The Western European market for cloud hardware was the fastest growing among the major regions at the end of 2014, and we believe it is still far from maturity,” said Giorgio Nebuloni, associate director IDC European cloud practice. “Though in public cloud environments the region is lagging the U.S. and China – where the largest Web players have their roots -in 2014 it went through a phase of considerable datacenter investments as U.S. multinationals like AWS, Facebook, Google, Microsoft, and Salesforce expanded presence to serve customers with regionally located datacenters, and native service providers fought back with investments of their own.”

CEMA

The emerging markets of Central and Eastern Europe, Middle East and Africa, captured 18% of EMEA cloud investments in 2014. Despite that the fact that the value in CEE was near double that of MEA, the latter is growing at a faster double-digit rate, in comparison to 2013.

Cloud infrastructure spending in the region is estimated to be 12% from the total addressable server, storage and networking hardware market. Public cloud is still below half of this share.

“Many businesses are reluctant to make the move to public cloud,” said Mohamed Hefny, senior research analyst, systems and infrastructure solutions, IDC CEMA. “They opt alternatively for private cloud deployment off-premises, taking advantage of the relative maturity of local hosters.“

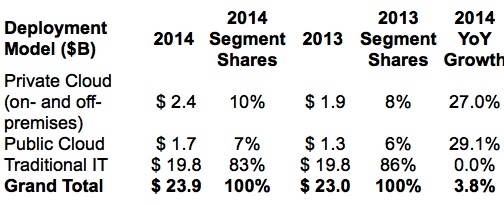

EMEA Cloud IT Infrastructure Value, Calendar Year 2014

(in $ billion)

(Source: IDC Worldwide Quarterly cloud IT Infrastructure Tracker, April 2015)

Taxonomy Notes:

IDC defines cloud services more formally through a checklist of key attributes that an offering must manifest to end users of the service. Public cloud services are shared among unrelated enterprises and consumers; open to a largely unrestricted universe of potential users; and designed for a market, not a single enterprise. The public cloud market includes variety of services designed to extend or, in some cases, replace IT infrastructure deployed in corporate datacenters. It also includes content services delivered by a group of suppliers IDC calls Value Added Content Providers (VACP). Private cloud services are shared within a single enterprise or an extended enterprise with restrictions on access and level of resource dedication and defined/controlled by the enterprise (and beyond the control available in public cloud offerings); can be onsite or offsite; and can be managed by a third-party or in-house staff. In private cloud that is managed by in-house staff, ‘vendors (cloud service providers)’ are equivalent to the IT departments/shared service departments within enterprises/groups. In this utilization model, where standardized services are jointly used within the enterprise/group, business departments, offices, and employees are the “service users”.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter