72% of SMBs to Outlay Additional Investments in BC in Next 12-24 Months

IDC white paper sponsored by Carbonite

This is a Press Release edited by StorageNewsletter.com on May 7, 2015 at 2:46 pmThis white paper, The Growth Opportunity for SMB Cloud and Hybrid Business Continuity (BC), has been published on April 2015 by IDC Corp.‘s analysts Raymond Boggs, Christopher Chute and Laura DuBoisan and sponsored by Carbonite, Inc.

Executive summary

To mitigate the economic risk of downtime, SMBs are seeking cost-effective BC solutions that are both feature rich and complexity free. According to IDC’s 2015 SMB BC Study, 81% of SMBs using BC solutions are considering improvements to their current strategy. Legacy approaches are unable to meet today’s SMB requirements, and a full 35% of SMBs do not have a BC solution in place at all today. Thus, 72% of SMBs worldwide expect to outlay additional investments in BC in the next 12-24 months.

These investments in new and/or improved BC solutions by over 78 million SMBs worldwide have fueled double-digit growth for enterprise-grade cloud and hybrid BC. IDC forecasts that SMB IT spending will approach $590 billion overall in 2015, presenting a material and underserved opportunity for cloud and hybrid BC service providers. Unlike their enterprise counterparts, SMBs find that an investment in cloud-based BC can mean the difference between thriving, surviving, and becoming obsolete in today’s hypercompetitive business climate.

The worldwide market opportunity for SMB BC, both cloud and on-premise, will reach $915.6 million in 2015 and grow to $2.1 billion in spending by 2018, representing a 31.4% CAGR.

Further key findings include:

- Over 80% of SMBs have experienced downtime in the past, with unplanned downtime costs conservatively ranging from $82,200 to $256,000 for a single event.

- Approximately 76% of SMBs cite downtime as the single biggest driver for adopting BC solutions, with leading threats coming from hardware, security, corruption, and natural disasters.

- SMBs around the world continue to shift investments from on-premise to public and hybrid cloud to achieve robust, complexity-free, and cost-effective BC.

SMB drivers and requirements for BC

SMBs’ operational IT challenges stem from unabated data growth, budgetary constraints, and a need to reduce costs and increase efficiency. At the strategic level, IT organizations must respond to changing and new business demands while mitigating risk. Similar to larger enterprises, SMBs increasingly seek to utilize cloud computing, data analytics, mobility, and social communications to drive innovation. This places a further reliance on information and systems to run today’s SMB business. This reliance increases the strategic importance of BC so that the SMB can keep its operations and organizational process online and available – and avoid costly downtime.

Unlike enterprises, SMBs must use BC solutions that are enterprise grade and:

- Holistic, providing a range of BC services, from data protection and recovery to archiving/data retention to replication and availability

- Simple, eliminating infrastructure and operational complexity

- Cost effective, offering reduced capex and an economically viable fit with a typical SMB BC budget

- Cloud enabled, meeting public and/or hybrid cloud deployment requirements and offering offsite data protection and DR and a predictable opex model

SMB shift from on-premise to cloud services

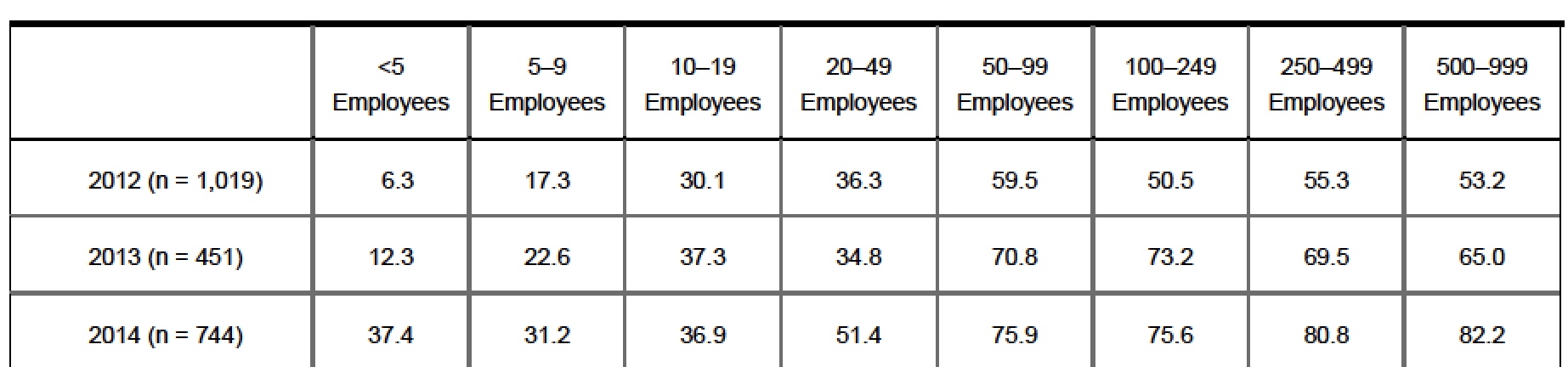

There are over 78 million SMBs worldwide today, and SMB IT spending will rise to nearly $590 billion globally in 2015. A significant contributor to this spending is the ongoing adoption of cloud services. IDC has also seen a major increase in the share of SMBs using cloud services (see Table 1). cloud use is now the rule rather than the exception in the United States. Today, the majority of SMBs with over 20 employees are using cloud computing. In regions outside the United States, the trend is similar, although adoption levels vary by the geographic location in which the SMB operates.

U.S. SMB cloud Adoption Rates by company Size, 2012-2014

(Mean %)

Q. Does your company currently use any software/services

delivered via online/ cloud computing?

(Source: IDC’s SMB Surveys, 2012, 2013, and 2014)

With this ongoing adoption of cloud services by SMBs comes a shift in investment from on-premise software to cloud services. This shift includes use cases such as collaboration, email, payroll processing, HR applications, and customer relationship management. IDC research confirms that a growing share of small businesses are using various cloud resources to sharpen their competitive position and improve back-office functions like email, accounts receivable management, HR applications, or sales force enablement. SharePoint and other collaborative platforms are increasing traction in the midmarket as an Office 365 cloud delivery model reduces barriers to deployment, usage, and maintenance.

As more primary workloads are deployed in public or hybrid cloud, a natural outcome is to move BC to the cloud as well. Thus, there is a growing shift away from on-premise BC strategies, which are often costly, complex, and resource intensive, to hybrid or public cloud approaches.

Current state of SMB BC

In March 2015, IDC completed a worldwide SMB BC Study to identify the current state of SMB BC and DR and uncover the different approaches that are being adopted by firms to address their continually evolving data protection, recovery, and availability needs. The study found that SMBs today rely on a range of BC solutions, although 81% of current BC users plan to enhance existing capabilities in the next 12-24 months.

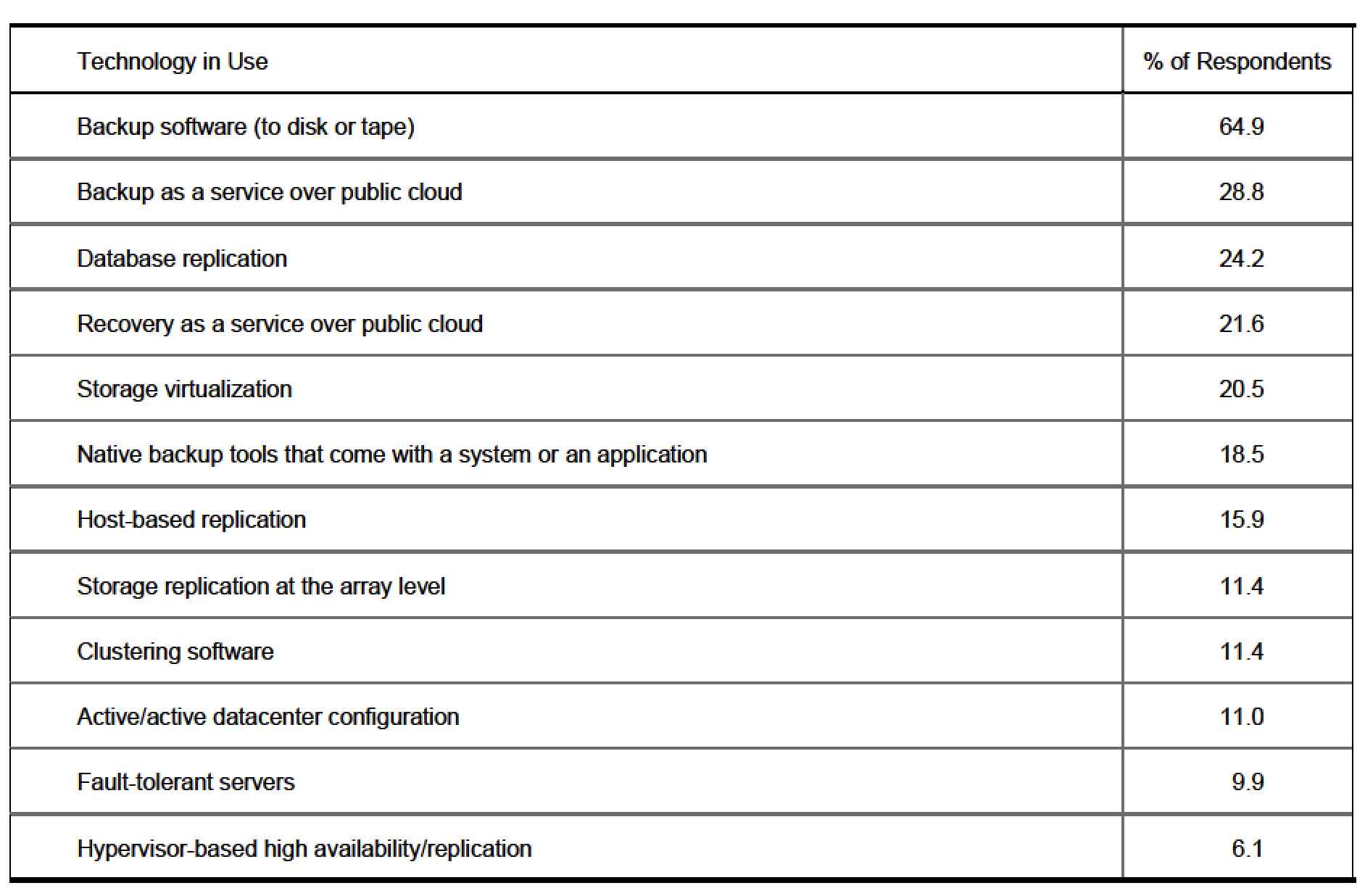

Table below shows the diverse set of solutions that SMBs turn to for backup, DR, and BC. Cornerstone BC technologies include backup, replication, and cloud services. Nearly 65% of SMBs use backup to tape or disk, about 58% rely on a replication approach, and almost 30% use backup to the cloud. This data also highlights that an SMB typically has three to four different BC solutions in place, commonly using different solutions for different applications.

The leading BC approach is on-premise backup, which is in use by nearly 65% of SMBs. This backup includes both disk and tape as targets, although SMBs are increasingly employing disk in lieu of tape for faster backup and recovery operations. Leading vendors and products for backup among SMBs include HP (Data Protector), Dell (AppAssure), and Symantec (Backup Exec). The single biggest challenge with traditional on-premise backup is the overhead associated with managing the infrastructure, troubleshooting failed backups, and meeting increasingly stringent SLAs on recovery.

Backup typically requires care and feeding by technical personnel to ensure backup jobs are run as planned and completed successfully and recovery is achieved when needed. SMBs often rely on partners or external IT consultants to help manage these processes. The backup infrastructure, including backup software, hardware, and configurations, need to be maintained. And to have an effective BC and recovery strategy, backup data must be kept offsite. This leaves an SMB with the choice of either removable media such as tape or remote replication of backup data to another datacenter. Both choices present challenges for an SMB. Removable media requires human intervention. The portable nature of tapes and carrying them offsite can drive tape collection fees and/or increase the risk of data compromise. On the other hand, remote replication of backup data requires an SMB to have a secondary datacenter or server room to replicate data to, with redundant IT infrastructure at the second site.

The second leading approach adopted by SMBs for BC is data replication, including snapshots, clones, and/or synchronous/asynchronous replication to serve as a source for failover and/or recovery. Today, more than half of SMBs use data replication and tend to favor host- and/or application-level replication capabilities. Leading host/application-level replication suppliers include Symantec (Veritas Volume Replicator or Storage Foundation) and Dell (Quest Software). The advantages of replication include not only failover/failback services but also faster recovery times. And if replication is used in concert with snapshots or clones, a more granular recovery point can also be achieved. However, an on-premise replication strategy often brings an investment in infrastructure and resources. The cost, complexity, and/or needed remote site often stymie the effective use of replication by SMBs.

BC Technology in Use by SMBs

Q. Which technologies are used/planned to be used to achieve BC at your company?

n = 735

(Source: IDC’s SMB BC Study, 2015)

New approaches to SMB and Hybrid BC

Increasingly, SMBs are leveraging a new approach – a cloud or hybrid BC strategy. Today, backup-as-a-service and recovery-as-a-service approaches are in use by 29% and 21% of SMBs, respectively. These cloud-enabled methods provide peace of mind for an SMB, ensuring data and systems are protected, available, and recoverable while eliminating the need for on-premise resources, including hardware, perpetual software licenses, or personnel to manage backup or replication jobs. Similarly, reliance on third-party consultants to tune or manage on-premise infrastructure may be reduced. SMBs are increasingly adopting public or hybrid cloud BC to address the limitations of legacy approaches.

They are selecting solutions that:

- Fit the SMB budget. According to IDC’s 2015 BC Study, the majority of SMBs report an annual IT budget of up to $20,000 and those who invest will allocate up to 14% of their budget to BC, representing an annual spend of $2,800. Additional expenses include hardware and software maintenance and server and storage capital costs as well as resources, either on-staff personnel or consultants to manage the operations. cloud services, priced on a subscription basis, eliminate many of the incremental costs associated with an on-premise BC approach.

- Reduce complexity. A typical SMB uses three to four different BC products, with different solutions for specific applications, use cases, or locations. Not only is this expensive, but technical staff must manage operations for each solution. And on-premise BC solutions require performance tuning, troubleshooting, and monitoring for successful completion of jobs. In lieu of this complexity, SMBs seek out simple, easy-to-deploy BC services for protection, availability, recovery, and retention.

- Offer enterprise-grade features. Most SMBs require many of the same enterprise-grade features and functions as larger enterprises, but without the complexity. For mission-critical applications, they require faster RTO as 61% of SMBs are looking for an RTO of less than four hours. In addition, there is a need for not only data protection and availability but also archiving and data retention. As a result, SMBs require a range of BC capabilities, from backup and archive to replication. SMBs frequently lack a secondary datacenter. As a result, 34% of SMBs have no offsite approach and need an offsite service provider location for DR, which a hybrid or cloud service can offer.

SMB BC investment drivers

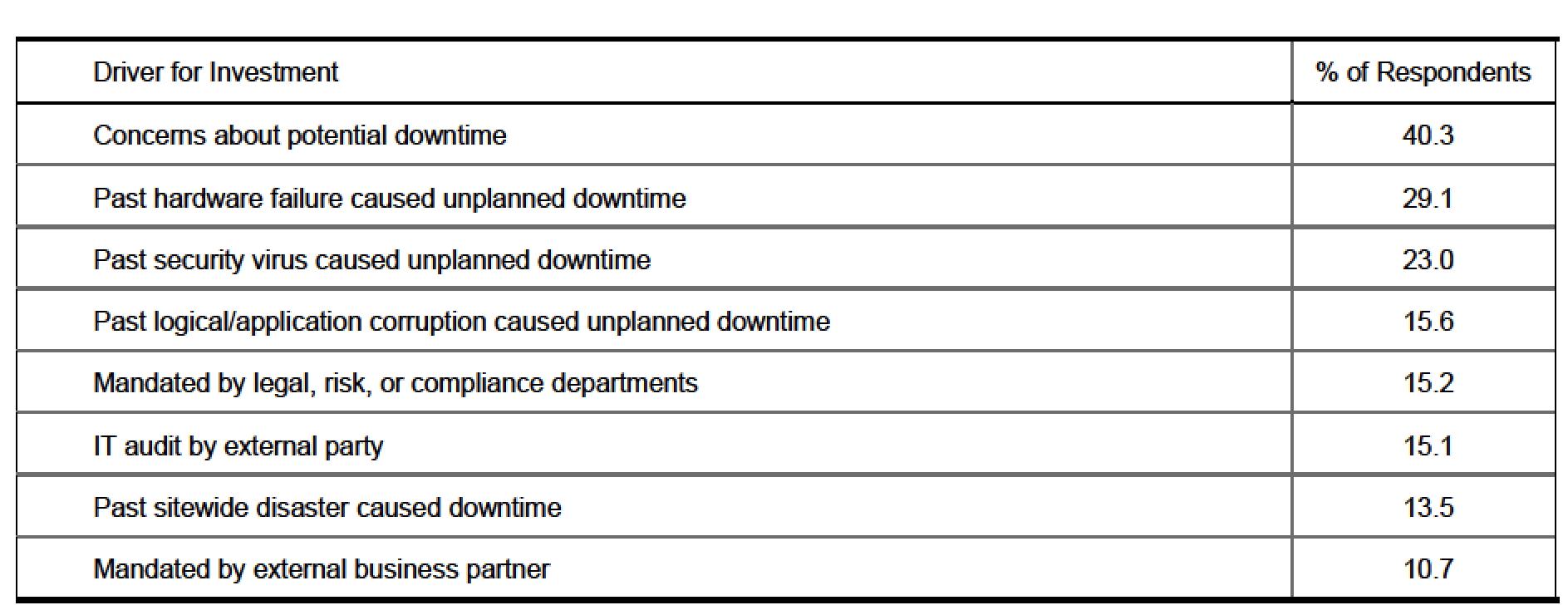

According to IDC’s 2015 SMB BC Study, 72% of SMBs expect to outlay additional investments in BC in the next 12-24 months. The driver for this investment is a material concern about the cost of downtime. 76% of SMBs cite downtime as the leading driver for investments in BC. Downtime can come from a range of events, from localized conditions, such as security incidents, hardware failures, or application corruption, to sitewide or even regional disasters, such as hurricanes, floods, power outages, and other acts of nature. Hardware failures and security events that result in downtime are the most pressing concerns for SMBs because of their higher rate of occurrence (see Table 3). While 40% of SMBs have concerns about downtime, over 80% have had past downtime events from a variety of local to sitewide conditions.

Drivers for SMB BC Investments

Q. For your firm’s most recent or planned BC investment,

what were or will be the two most significant reasons for the purchase?

n = 735

(Source: IDC’s SMB BC Study, 2015)

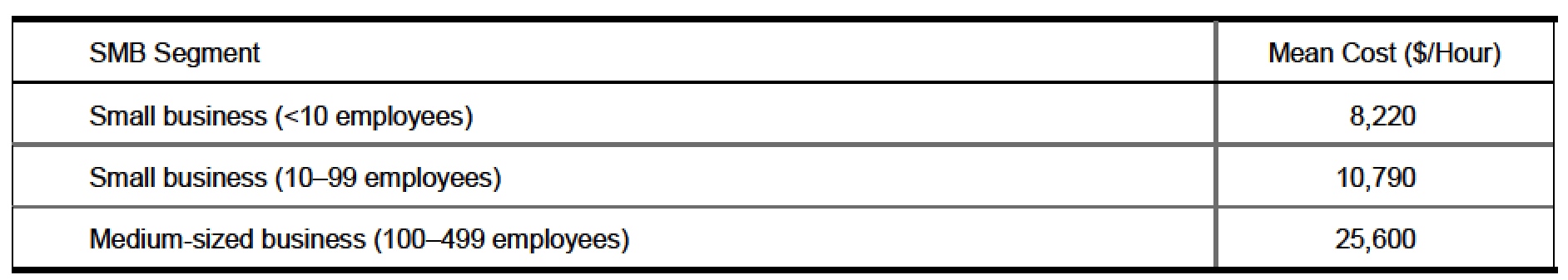

Unplanned downtime often has an economic impact on the SMB, but it can also harm the SMB’s reputation among customers, suppliers, and partners. The estimated cost of downtime per hour for an SMB ranges from an average of $8,220/hour to $25,600/hour (see table below). A typical unplanned downtime event spans hours, often as many as 24 hours. However, we assume a more conservative downtime event of 10 hours, which costs an SMB an average of $82,200 to $256,000. These costs can easily compromise an SMB’s sustainability and are an economic concern.

Mean Cost of Downtime per Hour Among SMBs

Q. What is the estimated cost of downtime per hour for your most mission-critical system?

n = 671

(Source: IDC’s SMB BC Study, 2015)

SMB BC priorities

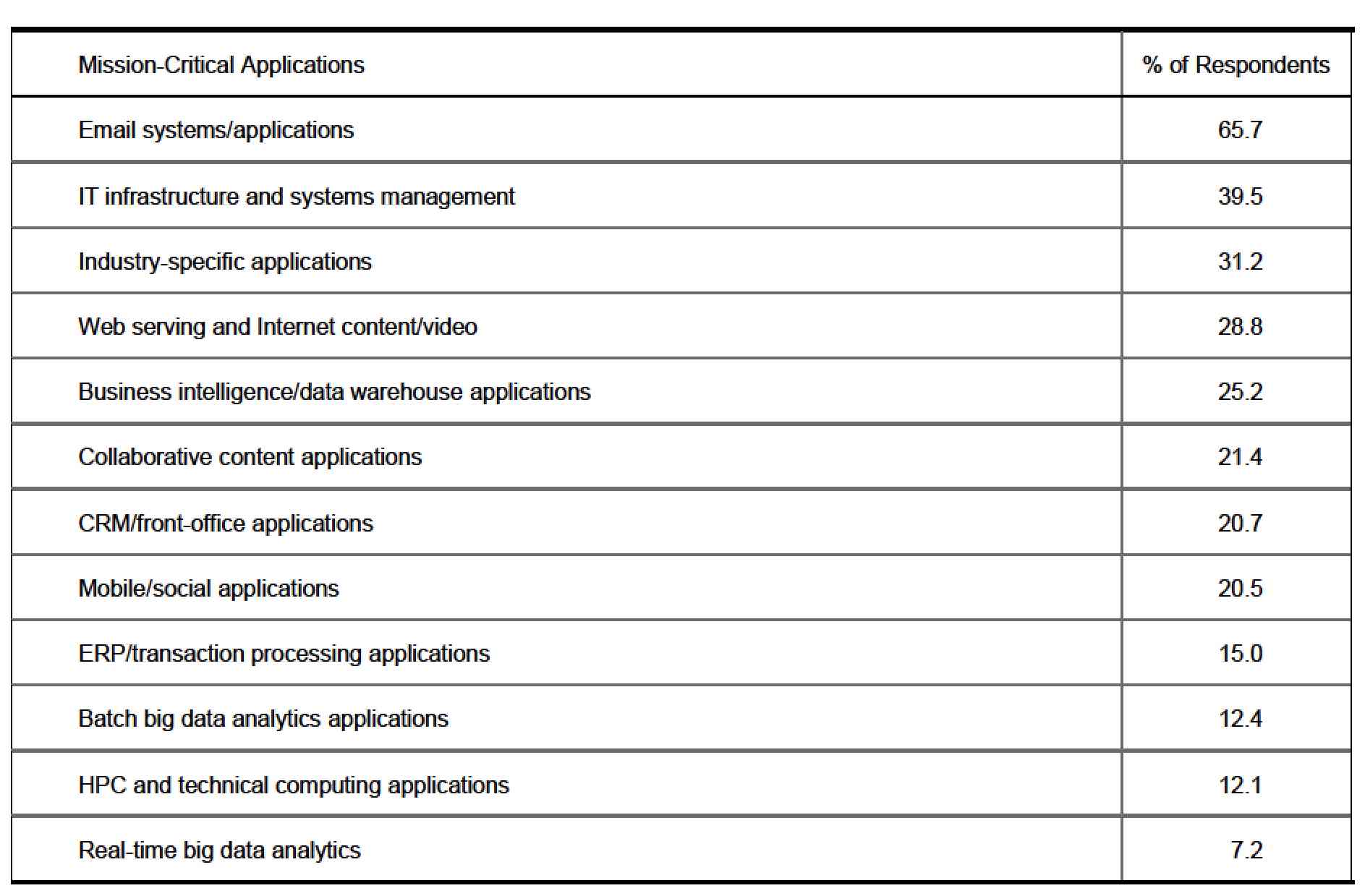

Cost of downtime is driving current and future SMB investment in BC. A near majority, or 44%, of SMBs indicate that mission-critical applications make up 10-20% of their total application portfolio. These applications include email, IT infrastructure and systems management, industry- or vertical-specific applications, Web serving/Internet content, and business intelligence/data warehouse systems (see table below). 61% of SMBs say that the typical RTO for these mission-critical applications needs to be four hours or less, although the reality is that the RTOs for these mission-critical applications are often much longer, depending on the approach in use.

Mission-Critical Applications Among SMBs

Q. Which of the following applications are your company’s most mission-critical systems?

n = 735

(Source: IDC’s SMB BC Study, 2015)

Furure outlook

The sheer number of SMBs worldwide (78 million) means the SMB segment presents a massive opportunity both in the United States and globally. These companies have signaled a need and intention to drive material spending on BC in the next 12-24 months. As mentioned previously, 72% of SMBs expect to outlay additional investments in BC over this time period, and those SMBs without a BC solution will make an investment in the same time period.

To capitalize on this opportunity, solution providers must support an ongoing shift by SMBs from on-premise to public and hybrid cloud BC. Service providers must offer economically viable, feature-rich BC solutions that reduce complexity and can be deployed in both hybrid and public cloud environments. SMBs indicate they have a range of applications they deem mission critical that require faster recovery times as well as an even larger range of workloads that require good enough recovery. Moreover, these SMBs also require functionality such as archiving and data retention. As a result, there is a significant opportunity for service providers that can offer these capabilities. The reality is that today, no single supplier can offer a holistic set of BC services targeted at the SMB. However, providers that can address this demand in the future will be well positioned to capitalize on the $2.1 billion SMB BC opportunity by 2018.

About IDC’S SMB BC Study

Cconducted in 2015, it surveyed more than 700 SMBs around the world about their current implementations of and future plans for BC. The study identified the approaches and technologies in use today as well as investment drivers and spending intentions. The SMBs surveyed represented firms with operations in the United States, Germany, Austria, Switzerland, AsiaPac, and Japan. For the purposes of the study, SMBs were defined as firms with fewer than 500 employees worldwide. Survey respondents were decision makers and/or evaluators of BC for their firm and held IT and/or executive-level positions for the company. For the purposes of developing sizing and forecasting the SMB BC market outlook, BC spending included investments in both on-premise software and off-premise cloud services across data protection and recovery, replication, and data retention.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter