564 Million HDDs Shipped in 2014 – Trendfocus

Up 2% from 2013, for total exabytes increasing 15%

This is a Press Release edited by StorageNewsletter.com on February 4, 2015 at 3:06 pmHere is an abstract of SDAS: HDD Information Service CQ4 ’14 Quarterly Update – January 30, 2015 – Executive Summary, by analysts of Trendfocus, Inc.

CQ4 ’14 HDD Shipments Fall to 141 Million – Nearline Market Remains Robust

Exabytes grow sequentially on higher mix, despite lower volumes; client and CE HDD sales decline Q-Q

Notes: Nearline HDDs are included in the enterprise segment. Adjustments to shipments and market shares may be made in the final Quarterly Update.

Seagate

Seagate unit sales pulled back 4% sequentially to 57 million with desktop and CE HDDs posting all of the decline during the quarter. Enterprise (traditional and nearline) sales impressed, as shipments climbed nearly 5% to 9.13 million in CQ4. Nearline (capacity) HDD sales remained solid, rising sequentially to 5.07 million while traditional (performance) enterprise shipments also increased over the same period to 4.06 million. Total branded shipments grew to 5.95 million (not shown in this summary). Seagate’s average HDD capacity for the quarter inched upward to 1.08TB, and despite lower unit shipments, exabytes shipped grew to 61.3 for the quarter.

Toshiba

Toshiba experienced the smallest quarterly change of the three HDD companies, as shipments eased less than 1% to 22.90 million in CQ4. Although enterprise and branded were the only two segments that posted higher numbers, it was almost enough to offset the declines in net client (desktop and mobile) and CE sales. Desktop and mobile HDD sales (which include the branded numbers) declined 2% and 1%, respectively while CE dropped nearly 4% for the quarter. Enterprise sales grew 17% to 1.83 million while branded HDD subtotal jumped up 12% due to strong holiday sales, reaching 3.82 million. Nearline HDD shipments accounted 25% or 0.46 million units of its total 1.83 million enterprise HDDs.

WDC

WDC’s (WD and HGST combined) shipments fell nearly 6% from quarter-to-quarter to 61.05 million in CQ4. Client sales posted the largest unit declines, and desktop and mobile HDD shipments dropped by roughly 1 and 2 million, respectively. CE HDD pulled back as game console HDD sales eased in CQ4. CE HDD unit shipments dropped to 9.30 million while branded sales climbed to 7.16 million. Enterprise sales grew to 8.03 million of which nearline (capacity) HDD shipments totaled 4.92 million. Average HDD capacity was an industry leading 1.09TB, and total exabytes equaled 66.4 million.

2014 HDD Shipments Grow 2.2% to 563.94 Million Game Console Refresh Fuels CE HDD Sales

All three HDD companies benefit from solid 2014 market demand – total exabytes increase 15% to 528.57

Number of HDDs Shipped Worldwide in 2013 and 2014

| Seagate | 2013 | 2014 | Y/Y growth | 2014 share |

| 3.5″ | 124.78 | 119.61 | -4.1% | 49.1% |

| 2.5″ | 97.11 | 104.29 | 7.4% | 32.6% |

| Total | 221.89 | 223.90 | 0.9% | 39.7% |

| Toshiba | ||||

| 3.5″ | 15.83 | 21.73 | 37.3% | 8.9% |

| 2.5″ | 67.81 | 68.36 | 0.8% | 21.4% |

| ≤1.8″ | 0.67 | 0.64 | -4.5% | 100.0% |

| Total | 84.31 | 90.73 | 7.6% | 16.1% |

| WDC | ||||

| 3.5″ | 106.13 | 102.36 | -3.6% | 42.0% |

| 2.5″ | 139.63 | 146.95 | 5.2% | 46.0% |

| Total | 245.76 | 249.31 | 1.4% | 44.2% |

| GLOBAL | ||||

| 3.5″ | 246.74 | 243.70 | -1.2% | |

| 2.5″ | 304.55 | 319.60 | 4.9% | |

| ≤1.8″ | 0.67 | 0.64 | -4.5% | |

| TOTAL | 551.96 | 563.94 | 2.2% |

Comments

Rotating and mechanical magnetic hard disk drives are not going to disappear in the next decade but the market will slowly decline.

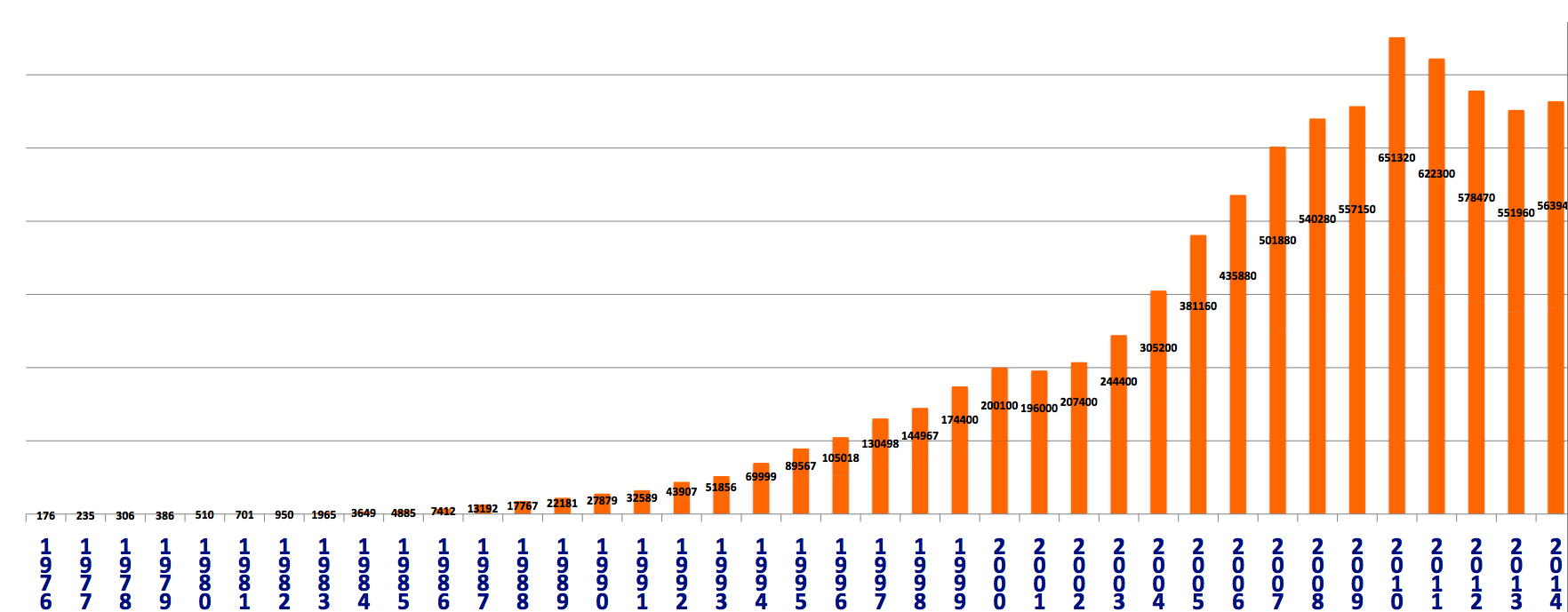

Historically, since 1976, the shipments of HDDs in the world always grew Y/Y (with only one exception in 2001 because of the economical crisis) and generally rapidly (see graphic below).

But from 2011 this trend has changed. It seems that it's definitively the end of the market growth for these devices in units shipped - with an exception in 2014 with a mere 2% growth - and more in revenue. About all devices into less than 2.5-inch form factor have disappeared. More recent flash units (SSD and keys), based on solid-state memories only and without any mechanical process, explain this change.

The historical yearly record of 651 million HDDs shipped in 2012 could be never beaten in a saturated market but shared by only three manufacturers.

Even total exabytes shipped on HDDs were flat from 1Q14 to 2Q14 at 120, and from 3Q14 to 4Q14 at 142-146, according to Trendfocus.

(Sources: Disk/Trend, IDC and Trendfocus, click to enlarge)

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter