Seagate: Fiscal 4Q15 Financial Results

About all figures down in challenging period

This is a Press Release edited by StorageNewsletter.com on August 3, 2015 at 3:09 pm| (in $ million) | 4Q14 | 4Q15 | FY14 | FY15 |

| Revenue | 3,301 | 2,927 | 13,724 | 13,739 |

| Growth | -11% | 0% | ||

| Net income (loss) | 320 | 138 | 1,570 | 1,742 |

Seagate Technology plc reported financial results for the quarter and fiscal year ended July 3, 2015.

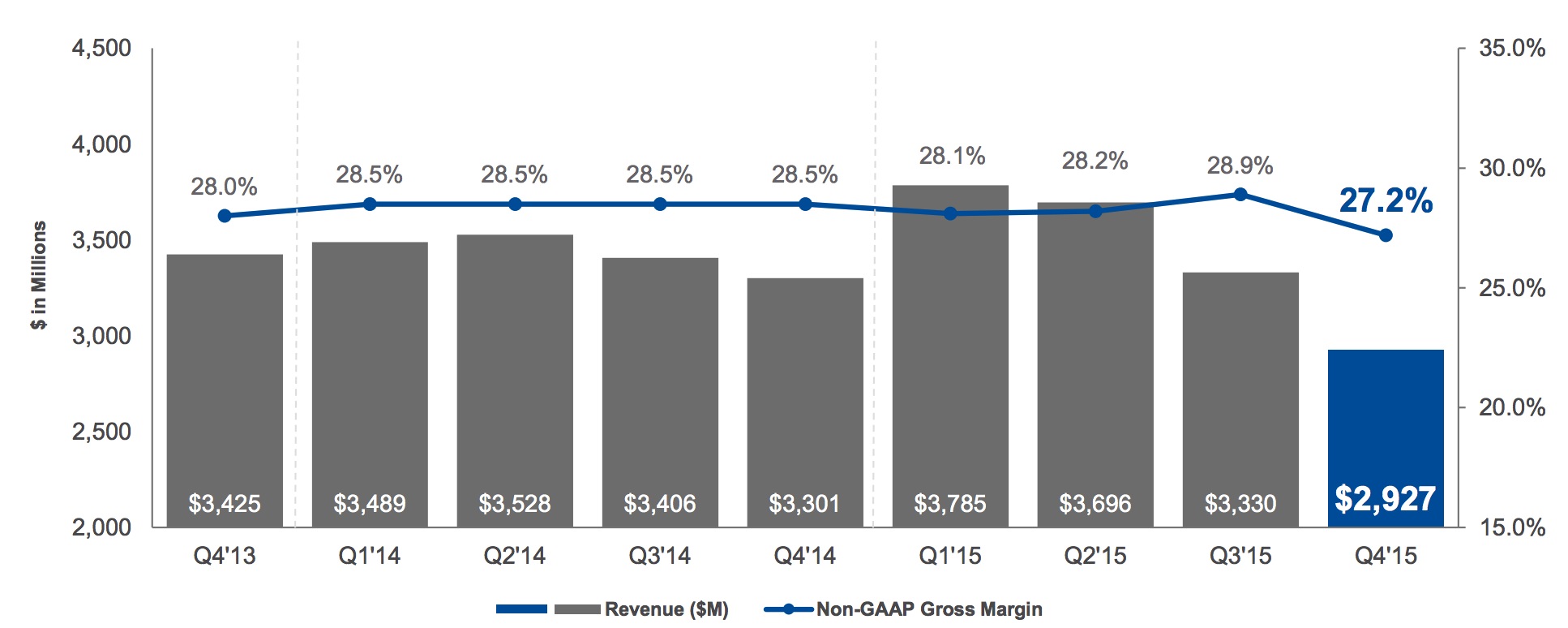

For the fourth quarter, the company reported revenue of $2.9 billion, gross margin of 26.5%, net income of $138 million and diluted earnings per share of $0.43.

On a non-GAAP basis, which excludes the net impact of certain items, Seagate reported gross margin of 27.2%, net income of $250 million and diluted earnings per share of $0.77.

During the fourth quarter, the company generated $228 million in operating cash flow and returned $351 million to shareholders in the form of dividends and share redemptions.

For the fiscal year ended July 3, 2015, the company reported revenue of $13.7 billion, gross margin of 27.7%, net income of $1.7 billion and diluted earnings per share of $5.26. On a non-GAAP basis, Seagate reported gross margin of 28.1%, net income of $1.5 billion and diluted earnings per share of $4.57.

In fiscal year 2015, the company generated approximately $2.6 billion in operating cash flow and returned $1.8 billion to shareholders in the form of dividends and share redemptions. The company also raised $1.2 billion in investment grade debt in fiscal 2015, extending its weighted average maturity to approximately 9 years and decreasing its weighted average interest to 4.8%. Cash, cash equivalents, restricted cash, and short-term investments totaled approximately $2.5 billion at the end of the fiscal year. There were 315 million ordinary shares issued and outstanding as of the end of the fiscal year.

“Over the last few years, Seagate has refined our financial model and global supply chain to allow us to continuously deliver significant value to shareholders and adapt effectively to short-term fluctuations in our business and geographic markets,” said Steve Luczo, chairman and CEO. “While shifting information technology market dynamics have been challenging to accurately predict, we achieved many of our financial goals in fiscal 2015 and remain confident in our long-term growth prospects driven by data growth, cloud and hyperscale deployments and data analytics. Our product portfolio is very well positioned in the traditional storage marketplace, our pipeline of innovation is strong, and our strategic investments in cloud systems and solutions and flash technology are expanding our opportunities with new and existing customers.”

The board of directors has approved a quarterly cash dividend of $0.54 per share, which will be payable on August 25, 2015 to shareholders of record as of the close of business on August 11, 2015. The payment of any future quarterly dividends will be at the discretion of the Board and will be dependent upon Seagate’s financial position, results of operations, available cash, cash flow, capital requirements and other factors deemed relevant by the board.

Comments

2Q15 was a catastrophic period for the HDD industry with shipments decreasing 11.6% quarterly according to Trendfocus. Consequently, WD and now Seagate here recorded bad financial results. It's apparently worst for Toshiba HDD business.

Steve Luczo, Seagate's chairman, president and CEO, commented:" Revenue challenges from macroeconomic pressures and PC systems demand have been persistent factors that have offset continued growth in other areas of our business."

Future is not bright even if HDD TAM is supposed to increase from 110 million to 125 million units in 3CQ15. "For the September quarter, we are forecasting for a relatively flat business environment, as we continue to shape our top line revenue opportunities that preserve our business profitability and enable us to continue to invest in advancing our storage technology portfolio offerings. For the September quarter, we are planning for revenue of approximately $2.9 billion to $3.1 billion, and we anticipate margins to be relatively flat, taking into account the anticipated seasonal mix and a lean production schedule," he added.

About all the Seagate's figures are decreasing during the quarter:

- revenue

- net income

- gross margin

- number of HDDs shipped (enterprise, notebook, desktop, branded)

- average price per HDD

- exabytes shipped

The only positive figures are:

- average capacity per drive sold

- high capacity nearline HDDs shipped

- CE HDDs sold

No figures were revealed for the flash business (controllers, SSDs) probably continuing to record small revenue and far to compensate the decreasing HDD activity, like for WD.

To read the earnings call transcript

Seagate's revenue and Non-GAAP Gross Margin

Seagate's HDDs from 4FQ13 to 4FQ15

(units in million)

| Fiscal period | Enterprise | Desktop | Notebook | CE | Branded | Total | ASP* | Exabytes | Average |

| HDDs | Shipped | GB/Drive | |||||||

| 4Q13 | 8.2 | 18.6 | 16.1 | 6.1 | 4.8 | 53.9 | $63 | 45.9 | 852 |

| 1Q14 | 8.1 | 19.1 | 17.2 | 6.2 | 5.1 | 55.7 | $62 | 48.9 | 878 |

| 2Q14 | 7.8 | 19.2 | 16.9 | 6.7 | 6.2 | 56.6 | $62 | 52.2 | 922 |

| 3Q14 | 7.7 | 19.8 | 16.4 | 5.4 | 5.9 | 56.2 | $61 | 50.8 | 920 |

| 4Q14 | 7.4 | 18.4 | 16.8 | 5.1 | 4.8 | 52.5 | $60 | 49.6 | 945 |

| 1Q15 | 8.8 | 18.7 | 20.2 | 6.0 | 5.7 | 59.5 | $60 | 59.9 | 1,007 |

| 2Q15 | 9.1 | 16.0 | 19.7 | 6.1 | 6.0 | 56.9 | $61 | 61.3 | 1,077 |

| 3Q15 | 9.1 | 14.3 | 16.8 | 4.8 | 5.1 | 50.1 | $62 | 55.2 | 1,102 |

| 4Q15 | 8.2 | 11.9 | 14.6 | 5.8 | 4.7 | 45.3 | $60 | 52.0 | 1,148 |

Seagate vs.WD for 4FQ15

(revenue and net income in $ million, units in million)

| Seagate | WD | % in favor of WD |

|

| Revenue | 2,927 | 3,191 | 6% |

| Net income | 138 | 220 | 32% |

| Notebook | 14.6 | 15.5 | 12% |

| Desktop | 11.9 | 11.6 | -6% |

| Branded | 4.7 | 5.2 | 20% |

| CE | 5.8 | 9.1 | 79% |

| Enterprise | 8.2 | 7.2 | -18% |

| Total HDDs | 45.3 | 48.5 | 9% |

| Market share | 41.0% | 43.9% | 9% |

| Average GB/drive | 1,148 | 1,159 | 2% |

| EB shipped | 52.0 | 56.2 | 11% |

| ASP | $60 | $60 | 0% |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter