Brocade: Fiscal 2Q15 Financial Results

SAN product revenue decreasing: 11% Q/Q, 2% Y/Y

This is a Press Release edited by StorageNewsletter.com on May 22, 2015 at 3:04 pm| (in $ million) | 2Q14 | 2Q15 | 6 mo. 14 | 6 mo. 15 |

| Revenue | 536.9 | 546.6 | 1,101 | 1,123 |

| Growth | 2% | 2% | ||

| Net income (loss) | (13.7) | 77.0 | 67.2 | 164.3 |

Brocade Communications Systems, Inc. reported financial results for its second fiscal quarter ended May 2, 2015.

The company reported second quarter revenue of $547 million, up 2% year over year and down 5% sequentially.

The company reported GAAP diluted Earnings Per Share (EPS) of $0.18, up from a loss of $0.03 per share in Q2 2014 and down from $0.20 in Q1 2015.

The Q2 2014 GAAP loss was due to a non-cash goodwill impairment charge associated with the strategic repositioning of the Brocade ADX product family.

Non-GAAP diluted EPS was $0.22 for Q2 2015, up from $0.19 in Q2 2014 and down from $0.27 in Q1 2015.

“We grew our IP networking revenue year over year and closed the acquisitions of Connectem and the SteelApp assets, expanding our strong portfolio of virtual IP networking services,” said Lloyd Carney, CEO. “These next-gen software-based technologies, together with our hardware products, allow us to build more strategic solutions for our customers and underscore our vision for the New IP.”

Highlights

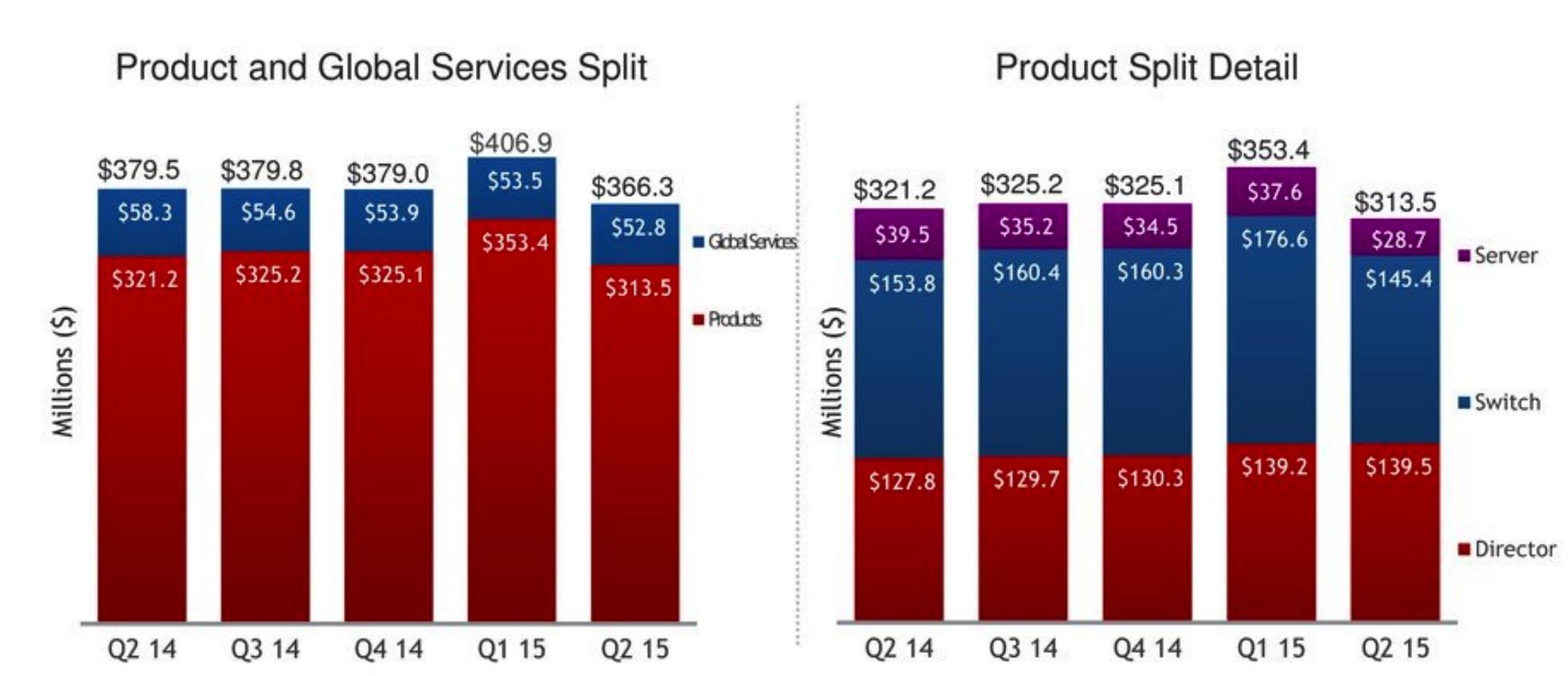

- SAN product revenue was $314 million, down 2% year over year. The decline was primarily the result of softer storage demand and operational issues at certain OEM partners. The sequential revenue decline of 11% was at the low end of the company’s outlook for the quarter and consistent with the last two years, where the fiscal second quarters have seen sequential revenue declines of 10% to 12%.

- IP networking product revenue was $145 million, up 19% year over year. The growth was primarily due to higher sales of routers (up 40%) and Ethernet switches (up 8%), as well as higher software networking revenue, which now includes SteelApp revenue from the date of closing of the acquisition in early March. The increased sales year over year were primarily due to service provider and U.S. federal customers. Sequentially, IP Networking revenue increased 9% due to higher routing and switching sales, as well as higher software networking revenue.

- Global Services revenue was $88 million, down 7% year over year primarily due to the additional week of support revenue recognized in Q2 2014, which was a 14-week fiscal quarter for Brocade. Global services revenue was down 2% sequentially due to the timing of certain large support renewal orders.

- During the quarter, Brocade completed the previously announced acquisitions of Connectem Inc., a pioneer in the LTE virtual evolved packet core market, and the SteelApp assets from Riverbed Technology, Inc.

Consistent with the company’s philosophy of returning cash to shareholders, the board of directors has declared a quarterly cash dividend of $0.045 per share of the company’s common stock, a 29% increase from the prior dividend of $0.035 per share. The dividend payment will be made on July 2, 2015, to stockholders of record at the close of market on June 10, 2015.

Comments

For next quarter, Brocade expects a continuing decrease of SAN revenue, between 2% and 6% sequentially, and global sales at $540-$560 million.

Abstracts of the earnings call transcript:

Lloyd Carney, CEO:

"While SAN revenue was at the low end of our outlook for Q2 2015, growth in IP Networking revenue across our key markets was strong and above our long-term model of 8% to 12% growth.

"Q1 2015 was one of the strongest quarters in Brocade history for SAN revenue, yet sales in Q2 were seasonally softer and at the low end of our expectations. The SAN decline was primarily the result of softer storage demand and partner-specific issues that impacted the low-end switch and server blade revenue. We hope to recapture some of that opportunity over time. Aside from normal seasonality in Q3, we see several catalysts in the second half of the fiscal year.

"We opened a state-of-the-art development center in Bangalore, India in April."

Dan Fairfax, CFO:

"Our SAN product revenue was $314 million in the quarter, down 2% Y/Y as switch and server sales were down 6% and 27% Y/Y, respectively, partially offset by higher director sales, which were up 9% Y/Y. Combining fiscal Q1 and Q2, first-half fiscal year 2015 director sales were up 3% Y/Y, and first half fiscal year 2015 switch sales were up 1% Y/Y. First-half fiscal year 2015 server sales were down 5% Y/Y."

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter